As soon as you receive a shipment of inventoried items, aACE processes the receipt of goods to make the items available for outgoing orders. However, the vendor's corresponding invoice will frequently be entered at a later date. To properly reflect the value of the inventory that has been received, but has not yet been entered as a payable, aACE can make a temporary entry to a liability account in the general ledger called Accrued Inventory.

Example of Accrued Inventory

Let's follow a transaction through the system to see how it affects inventory records and GL accounts.

Items Ordered

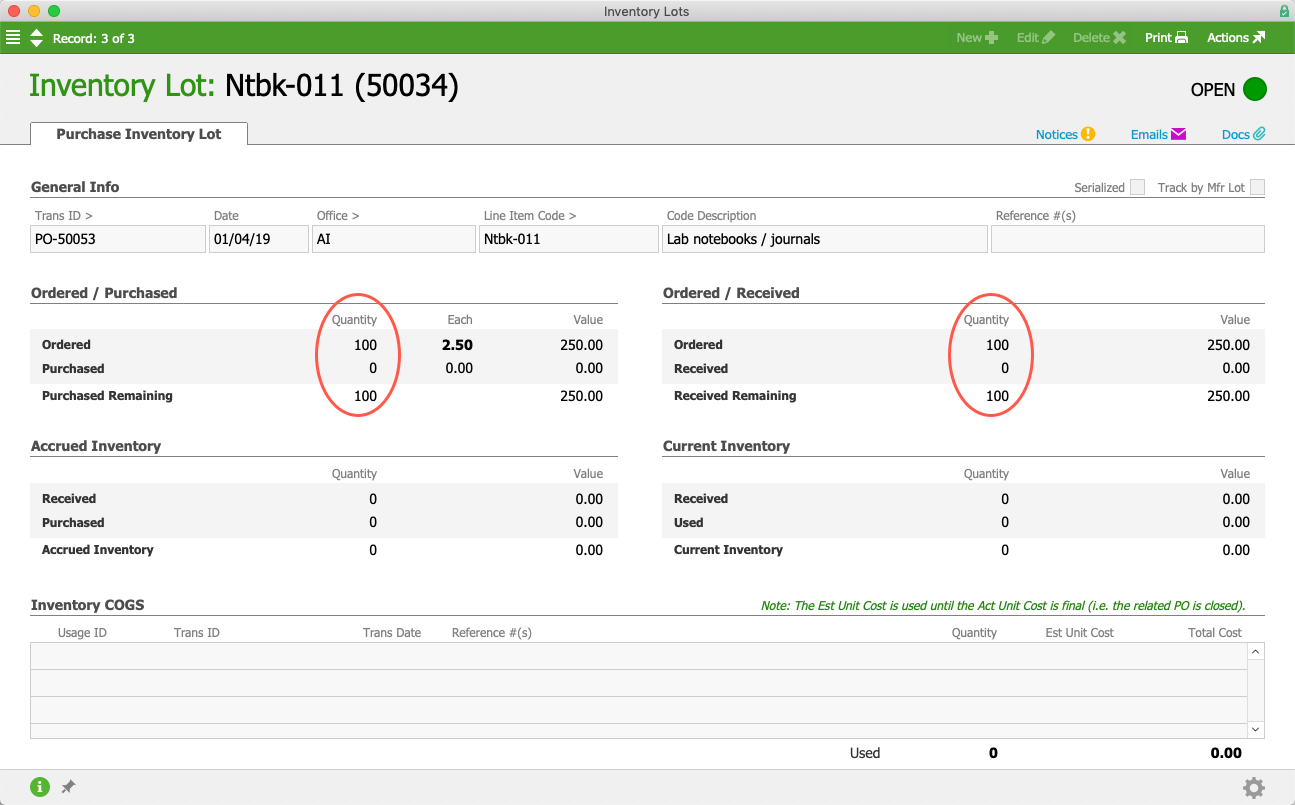

Suppose that aACME Education creates and opens a purchase order for 100 lab notebooks at $2.50 each:

At the Inventory Lots module, we can search for the LIC, then click the Lot number to see an entry has been made to Inventory, showing 100 notebooks on order; however, zero have been purchased and zero have been received, so we currently have zero liability:

Items Received

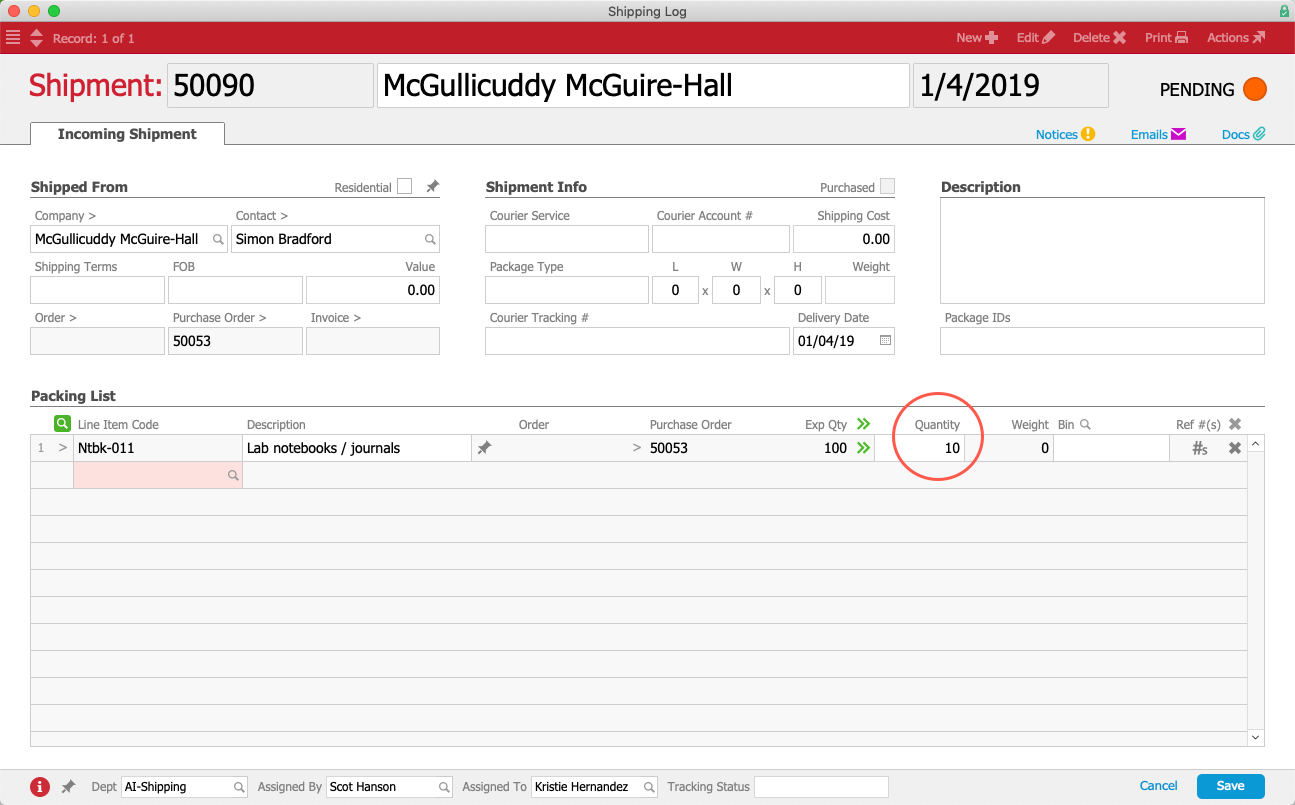

For our example, we receive a partial shipment of 10 notebooks:

The Inventory Lots module updates to show that we have received 10 units (i.e. assets worth $25.00) and current inventory shows we have 10 units available for orders. However, we have not received an invoice from the vendor, so zero units have been purchased:

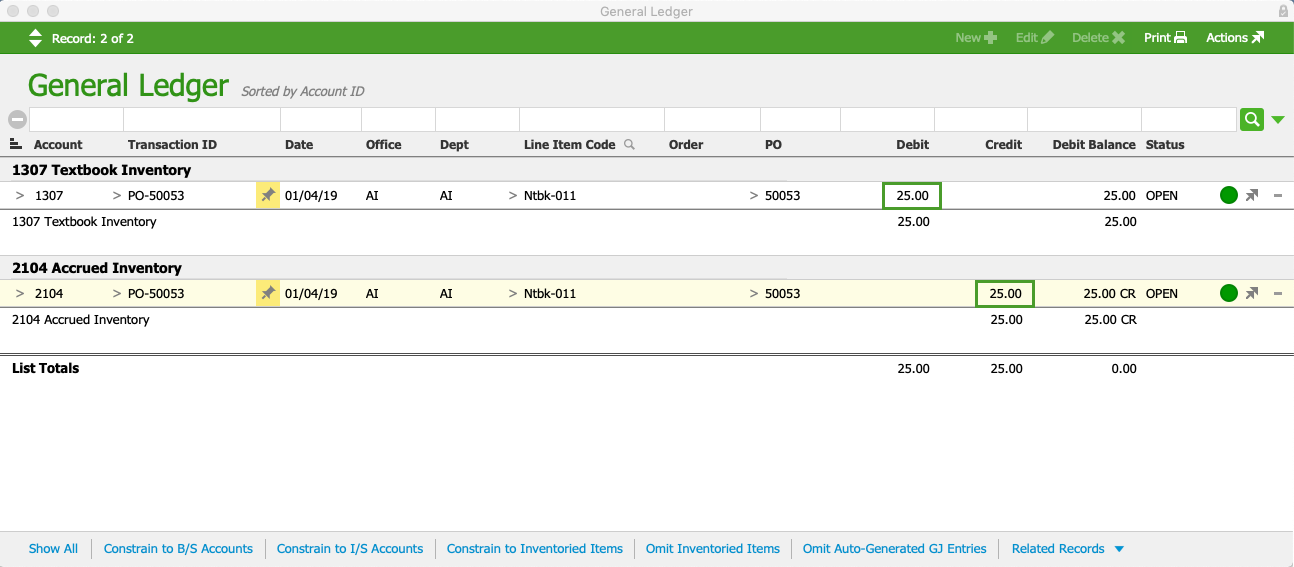

The General Ledger also reflects these balances. To accurately reflect the liability, the Accrued Inventory account carries the value of $25.00. From the PO, we can click Admin Actions (![]() ) > Go to Related General Ledger Entries, then sub-summarize by Account. For this example, the Textbook Inventory account shows the debit entry for the received notebooks, while the Accrued Inventory account shows the balancing credit for goods not yet purchased.

) > Go to Related General Ledger Entries, then sub-summarize by Account. For this example, the Textbook Inventory account shows the debit entry for the received notebooks, while the Accrued Inventory account shows the balancing credit for goods not yet purchased.

Items Purchased

Next in our example, we process the purchase record for the 10 received notebooks. (Note: If needed, we could also record any transportation charges in the +Freight column, helping us track our landed cost for these notebooks.)

aACE updates the Inventory Lots module from this purchase, removing the liability from Accrued Inventory section and also moving that liability to the Accounts Payable account.

The General Ledger now shows the three pairs of transactions that keep your accounts balanced throughout the transactions:

- Entries for the accrual (highlighted with green boxes) — These represent goods received but not yet paid for. They increase both the inventory asset account and accrued inventory liability account.

- Entries for the purchase (highlighted in purple rounded-boxes) — These increase both the inventory asset account and accounts payable liability account.

- Entries reversing the PO (highlighted in red ovals) — The previous entries were temporary values pending the purchase of the goods, so these entries reverse the initial set.

To sum up, the accrued inventory balance reflects the value of the difference between goods received and goods purchased.

For POs where the quantity purchased matches the quantity received, the balance in the Accrued Inventory account will be zero. Additionally, if you close a partially filled PO, you tell aACE that no additional purchasing is going to occur. So aACE will zero out any remaining accrued inventory balances.

Configuring the Accrued Inventory Preference

To activate this feature, navigate from Main Menu > Accounting > Preferences > Chart of Accounts. In the Liabilities section, click the Accrued Inventory dropdown list and select the correct account. Then click Commit Updates.

To deactivate the Accrued Inventory functionality, clear the selection from this dropdown list and click Commit Updates.