Use Tax is a sales tax on purchases made outside one's state of residence, when you buy taxable items that will be used, stored or consumed inside one's state of residence, and when the state of purchase didn't collect any tax. aACE provides several features you can use to help handle these taxes.

Setting Up the Tax Profile

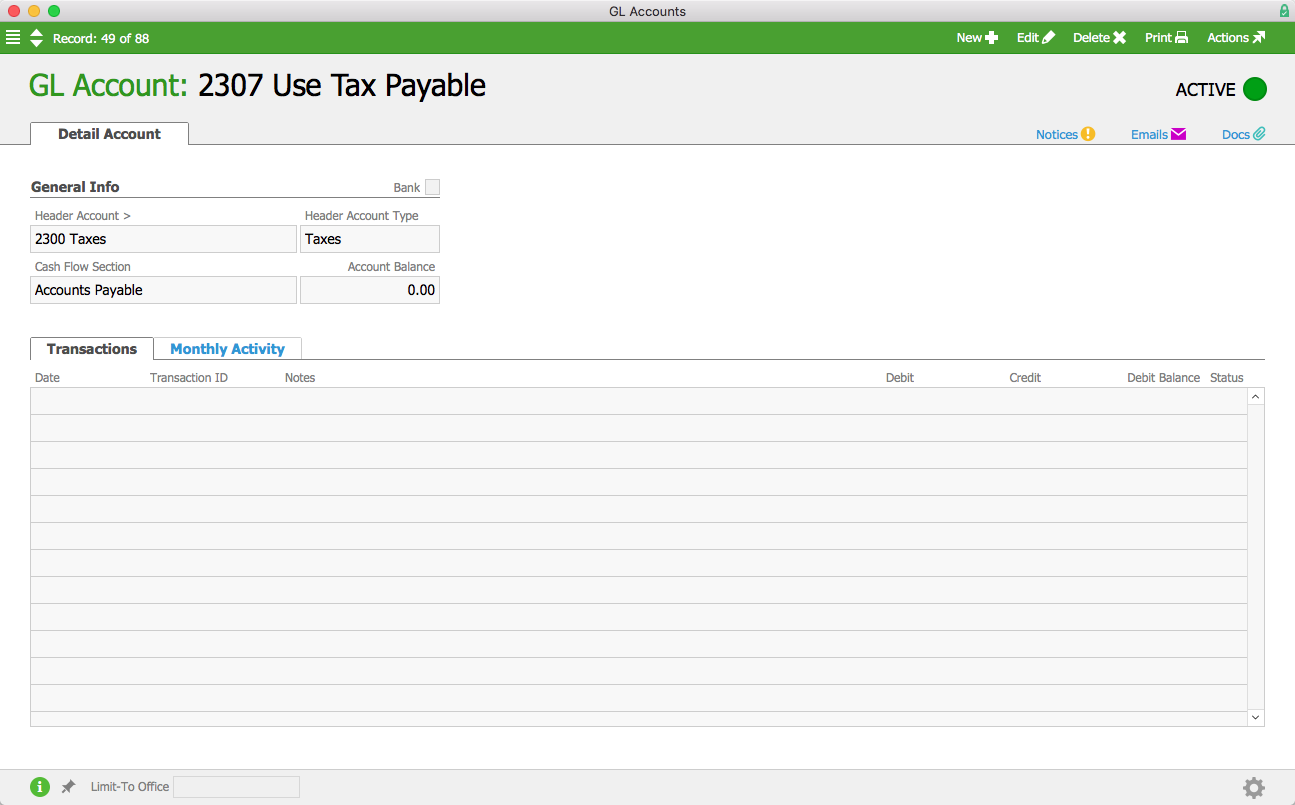

- Create a new GL Account called "Use Tax Payable." This will serve as a bucket for the eventual check you'll cut to the government.

Note: Most companies have a single tax tier going to a single GL Account; however, if you pay use taxes for multiple jurisdictions, you'll need to create multiple GL Accounts.

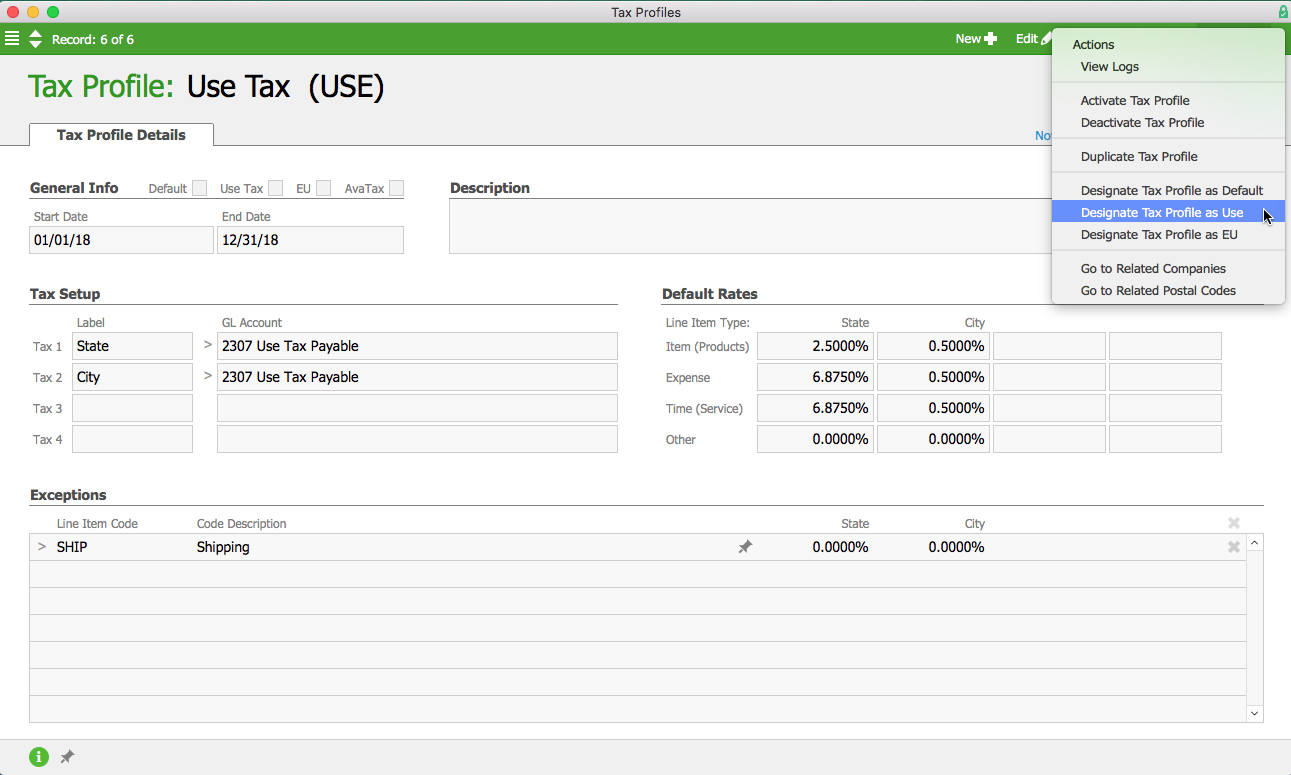

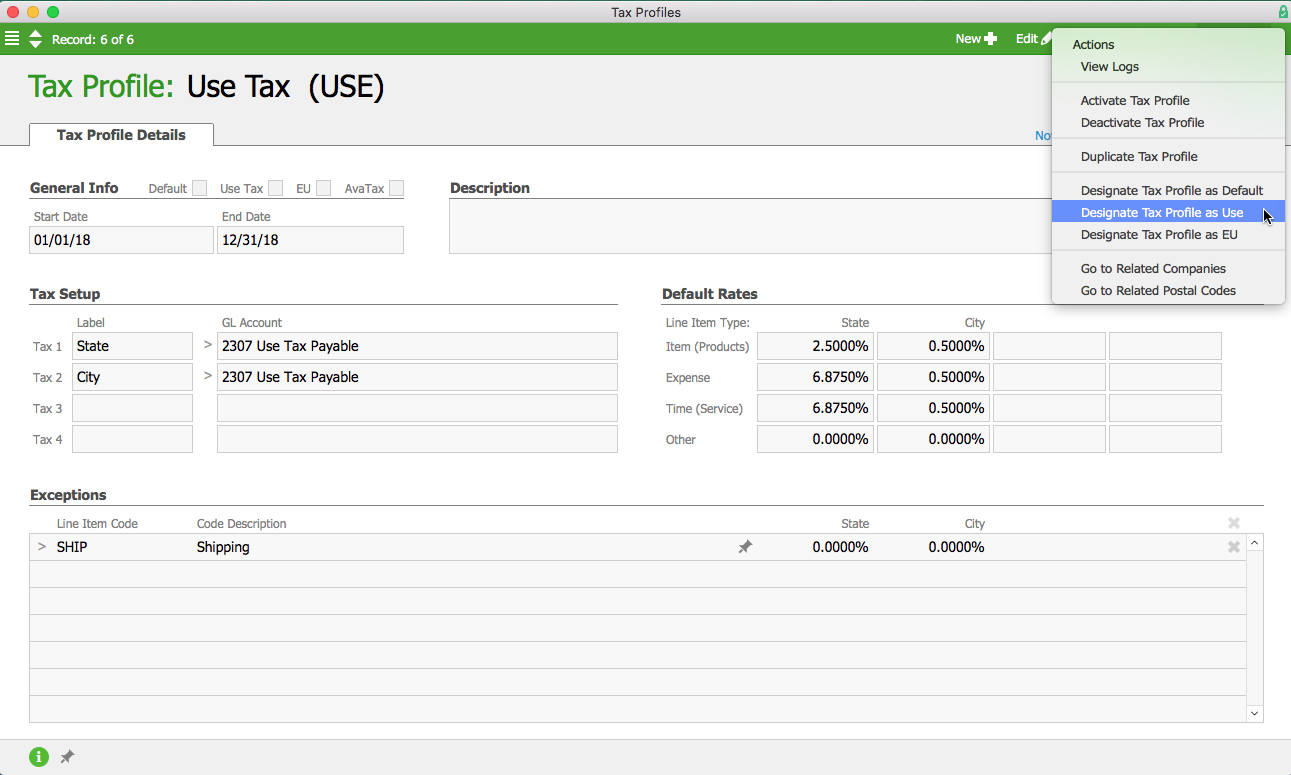

- Navigate to the Tax Profiles module (Accounting > Tax Profiles) and create a new tax profile.

Set this profile up like other tax profiles, using tiers (ex: Tax 1, Tax 2, etc.), associated GL Accounts, rates for each category record type, and exceptions. - After you save and activate the profile, click Actions > Designate Tax Profile as Use.

This flags the profile as the system's use tax profile. Note: Only one tax profile at a time can be designated as the use tax profile.

Using the Tax Profile in Purchase Orders and Purchases

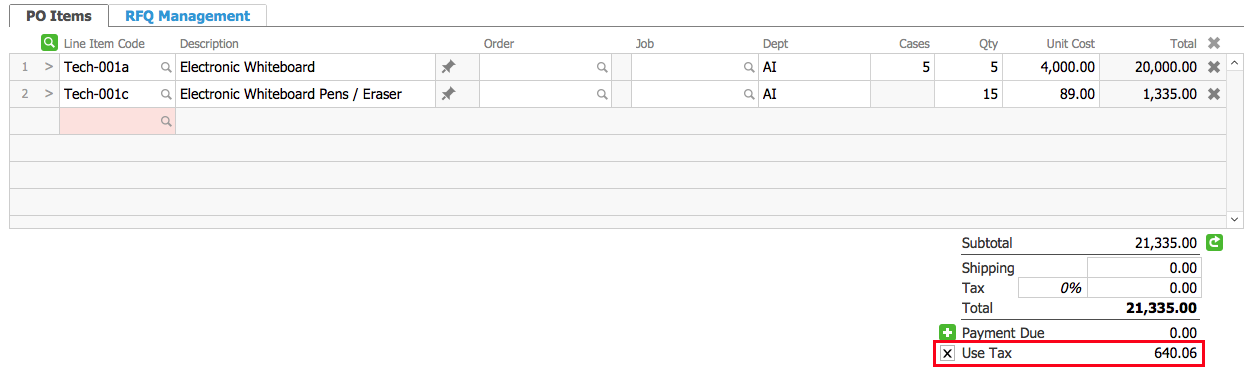

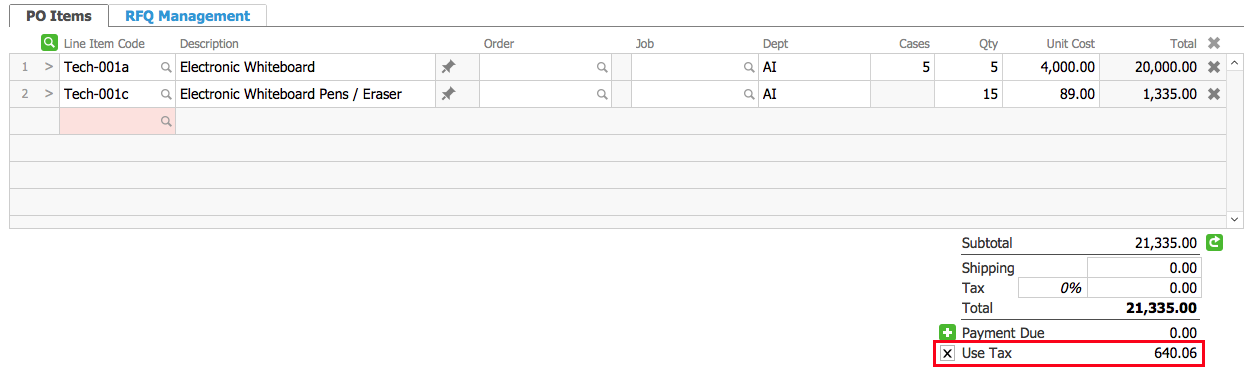

When you create a PO or a purchase, you can flag it for Use Tax:

- When editing the PO or purchase record, in the totals section, mark the Use Tax flag.

- aACE checks the line items and calculates the correct tax for each item, based on the use tax profile, then displays a single use tax value.

Note: This tax value is placed below the Total field because it's not incorporated into the transaction total. - Save and open the record:

- Purchase Orders — The use tax amount is only an estimate at this point; it does not affect the general ledger.

- Purchases — aACE creates general ledger transactions based on the use tax infrastructure.

Paying Use Taxes

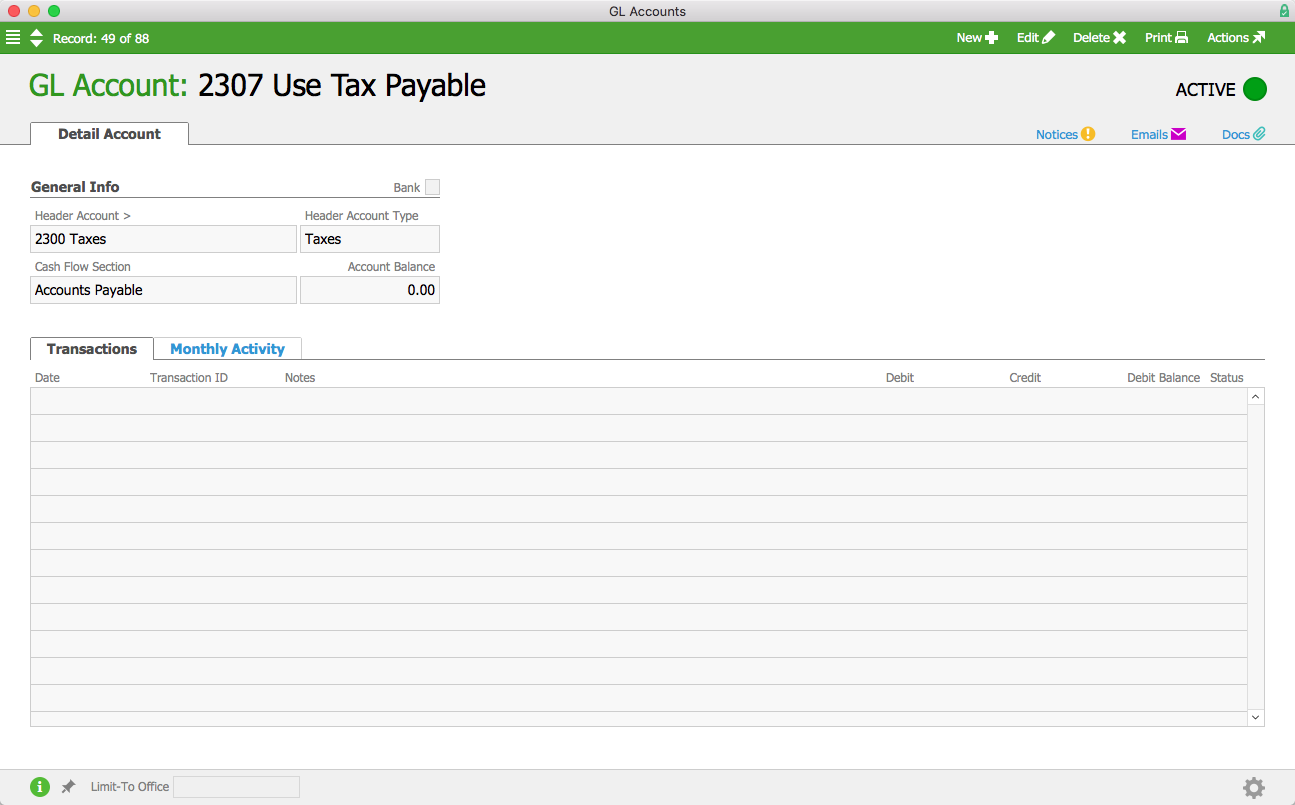

When you're ready to pay the use taxes that have accumulated, navigate to the Use Tax GL account(s). Note the balance there, then do one of the following:

- Create a disbursement using the OTHER type to cut a check.

- Create a general journal entry to reduce the Use Tax GL account(s) balance to zero.

To get the balance of the account as of a certain date, you can also query the general ledger. Note: The Balance field in GL accounts gives you the balance as of the current moment, which may include days' or weeks' worth of use taxes that are not due yet.