This guide explains how to compare aACE financial records against bank records. It is intended for general users.

aACE provides a bank reconciliation tool for easy account balancing. This helps you identify any unusual transactions which may signal accounting errors or other issues. After you receive a statement from your bank or credit card company, follow these steps:

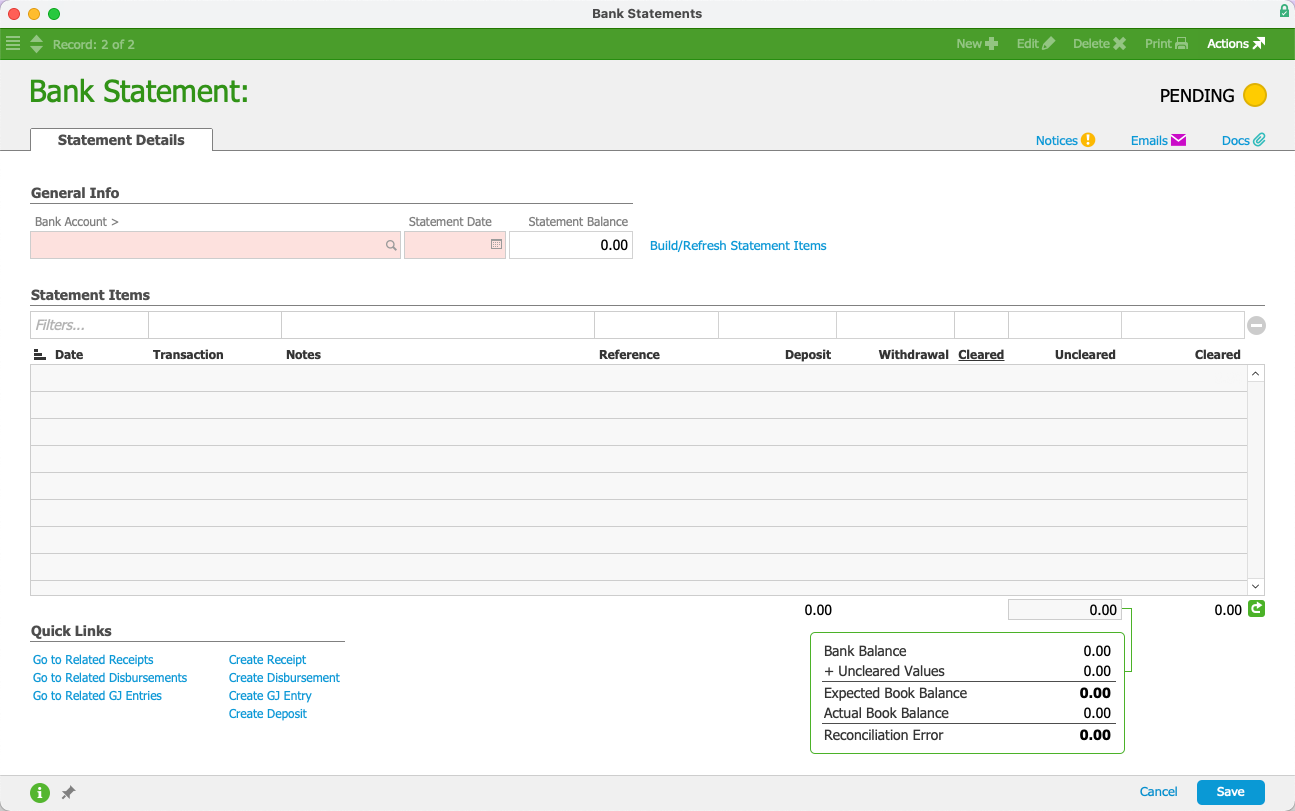

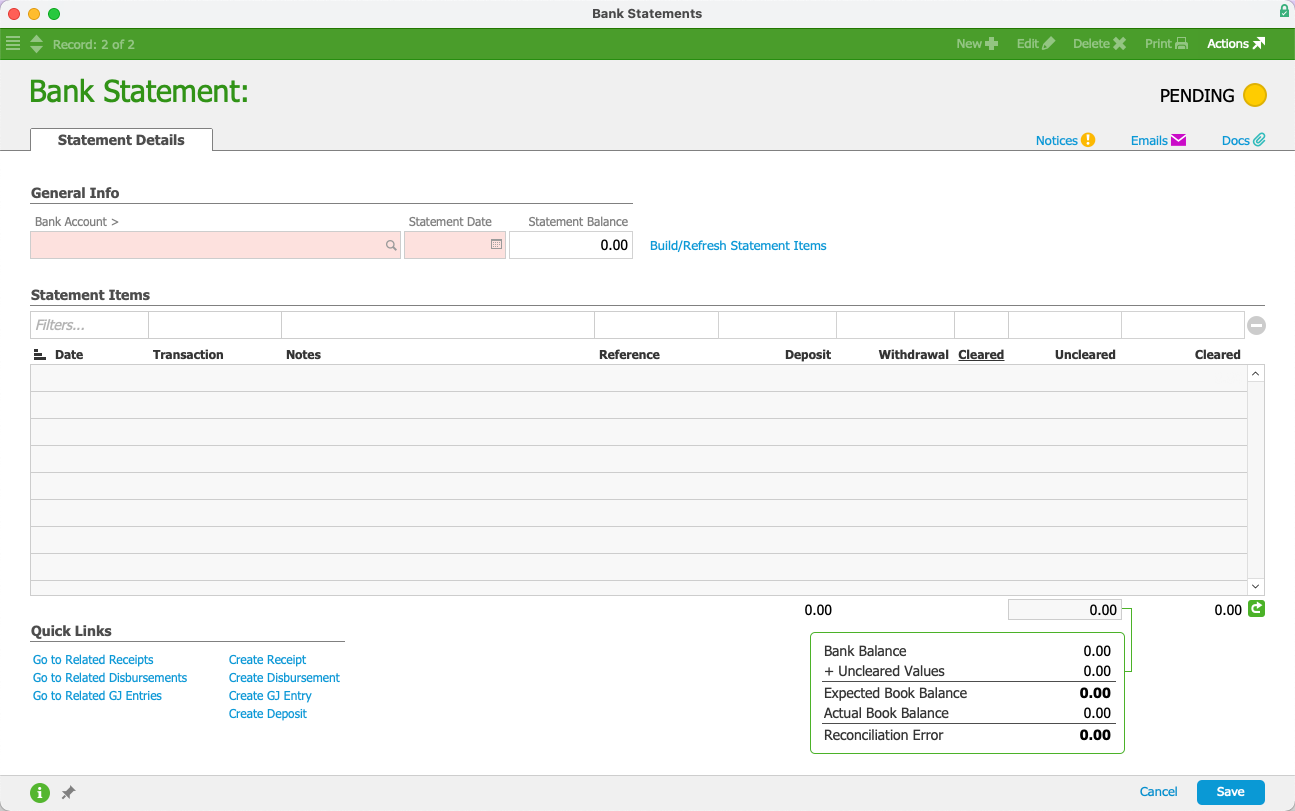

- Navigate from Main Menu > Accounting > Bank Reconciliation, then click New.

- At the new bank statement record, enter the reconciliation details:

- Specify the Bank Account (or credit card account) to reconcile.

- Enter the Statement Date (see below for details).

- Enter the Statement Balance from the bank statement.

- Click the link to Build/Refresh Statement Items.

- aACE populates the list of Statement Items so you can reconcile them against the items appearing on the bank statement (i.e. for each matching item, mark the Cleared flag).

Note: You can create additional transactions in aACE using the Quick Links. When you return to the bank reconciliation, be sure to click Build/Refresh Statement Items again to display any new items you created. - Click the Totals (

) icon to calculate / recalculate the totals shown on the screen and review the reconciliation totals shown in the lower-right — the Reconciliation Error should show zero.

) icon to calculate / recalculate the totals shown on the screen and review the reconciliation totals shown in the lower-right — the Reconciliation Error should show zero. - Click Save.

- At the confirmation dialog, click Clear.

Record Dates for Accurate Reconciliations

You might have problems with a reconciliation if the dates are incorrect. These issues may arise because the GL entries for the purchase carry the date of the purchase, while the check register entries carry the date of the disbursements. This is as-designed so you can reconcile each expense with the statement.

For example, if a purchase is dated 9/15, you should reconcile the account as of 9/15. If you reconcile it as of an earlier date, it's possible that the GL account will show an inaccurate balance.

Note: Changing the date for the GL entries to match the date of the expense can cause additional problems. For example, this would put the aging reports out of sync with the GL. A purchase record has a single aging entry based on its purchase date. Using the sample dates from above, the aged balance would be $0 as of 9/14. This is because the purchase didn't exist then — it wouldn't even appear on the report. However, the GL would show a balance. Manipulating GL entry dates this way can also cause other complications when dealing with Purchases or other subsidiary ledgers.