You may need to adjust your inventory counts due to mis-counted, damaged, missing, or returned items, or for adding beginning balances to your system.

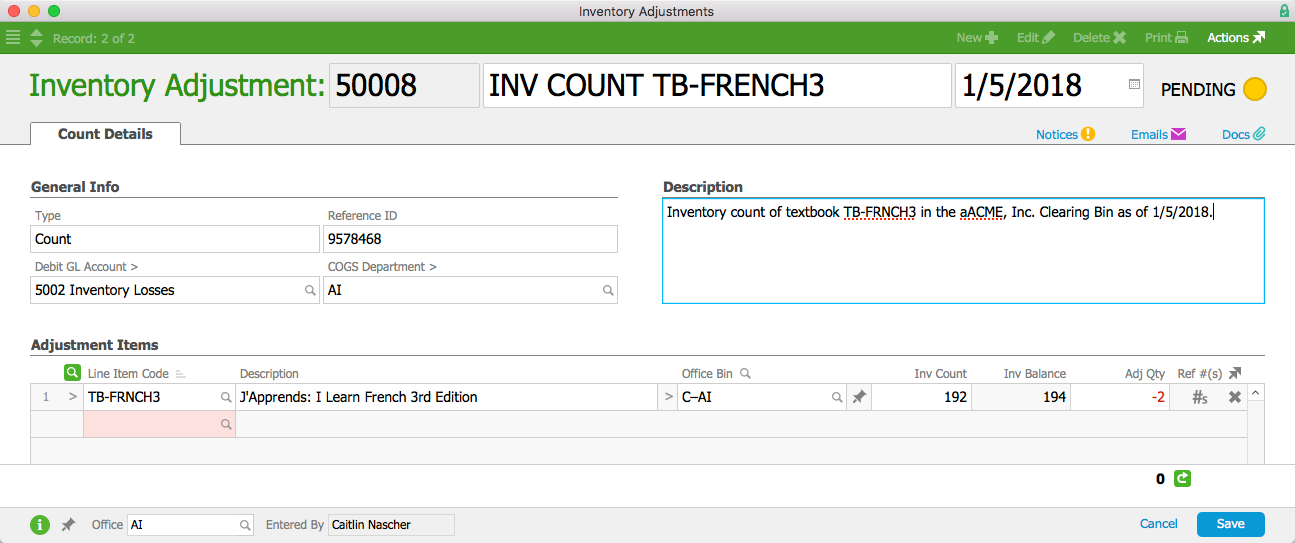

These inventory adjustments tell the system that inventory levels have actually changed, so the entries are integrated with cost of goods sold (COGS) tracking. For example, a decrease of -2 in the Adjustment Quantity field will remove the value of two items from the related GL inventory account:

Adjusting Inventory Quantities

When updating inventory quantities, be sure you use the correct adjustment type. For example, a count adjustment and a beginning balance adjustment can both increase item quantities; however, they have distinctly different impacts on your financials.

- Navigate to Menu > Inventory > Inventory Adjustments.

- Click New and select the appropriate adjustment type (see below for details).

- Enter the details for the adjustment record and for each adjustment item.

Note: Be sure to assign the adjustment to the correct GL account. If you have questions, consult with your accountant or system administrator. - Click Save and Post Inventory Adjustment.

Count Adjustment Details

Count adjustments are for updating the balance of inventory that already exists in the system.

Typically a count adjustment is made when a team member has counted the units on hand to compare against current system records. If the count was uploaded using the aACE Inventory Counter app, aACE automatically creates a Count adjustment and logs the user who submitted the info. The adjustment generates inventory usage records, which will impact the income statement.

Count adjustments are most appropriate for internal 'transfers' (i.e. moving between locations within the same office).

Count adjustments that increase the item quantity are accounted for in aACE as a product return that reverses an inventory usage or creates unallocated inventory usage. For this reason, inventory adjustments for lot-tracked or serialized items require additional validations and constraints.

Loss Adjustment Details

Loss adjustments are for updating existing inventory balances (as with Count adjustments above).

Transfer Adjustment Details

Transfer adjustments are for moving inventory between two separate locations/offices. They generate a shipping record and a receiving record.

Assembly Adjustment Details

Assembly adjustments imply building additional product, thus creating inventory and an inventory lot record.

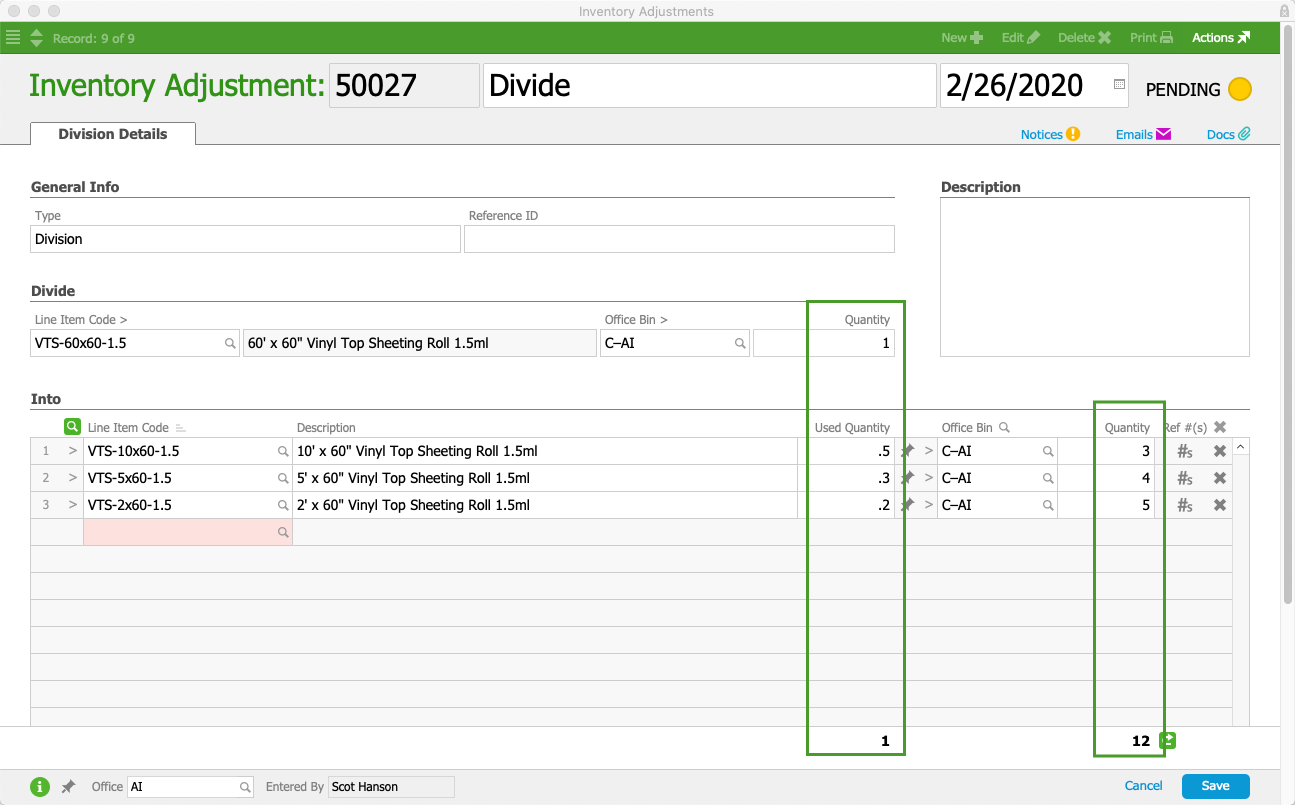

Division Adjustment Details

Division adjustments allow you to divide an existing inventory item into additional items. You can use these additional items for sales and production orders. The adjustment creates inventory and inventory lot records.

When you create a division adjustment, the Quantity in the Divide section must equal the total in the Used Quantity column. For example, suppose you purchase long sheets of an item to separate into smaller sections that you use. You would create a Division inventory adjustment with the starting item specified in the Divide section. Then you would enter the smaller inventory items for the Into lines. As shown in this screenshot, the Used Quantity amounts total to equal the starting item quantity. In contrast, the Into section Quantity column records the number of units made from the starting item: three of the ten foot sheets, four of the five foot sheets, and five of the two foot sheets.

Beginning Balance Adjustment Details

Beginning Balance adjustments are for adding inventory where none existed in the system before. Typically this happens as part of implementing your aACE system or for resolving unallocated inventory usage.

These adjustments are usually assigned to an Opening Equity or expense-related GL account. Beginning Balance adjustments should credit an account that is not an asset account. The adjustment generates inventory lot records and affects value on the balance sheet.

Beginning balance adjustments cannot be used to reverse usage.

Inventory Screens After an Adjustment

When adjustments are posted, you can see the entry reflected in the Inventory Transactions module (except for Transfer type, which are not counted as transactions). Adjustments are also displayed in the Inventory Usage module (except for Transfer and Beg Balance types, which do not generate usage records).

Correcting Posted Inventory Adjustments

If an adjustment was the incorrect record type, you should void and re-enter the adjustment. If the GL account also needs to be corrected, you can update it on the new adjustment.

If an adjustment was the correct record type, but was linked to the wrong GL account, you can change that account: Open the General Ledger module, locate the credit entry corresponding to the adjustment and hide all other entries, then click Actions > Reassign GL Account for List.