This guide explains how to complete basic tasks with invoices. It is intended for beginning users.

aACE allows you to create, adjust, and void invoice records from the Invoices module (Main Menu > Accts Receivable > Invoices).

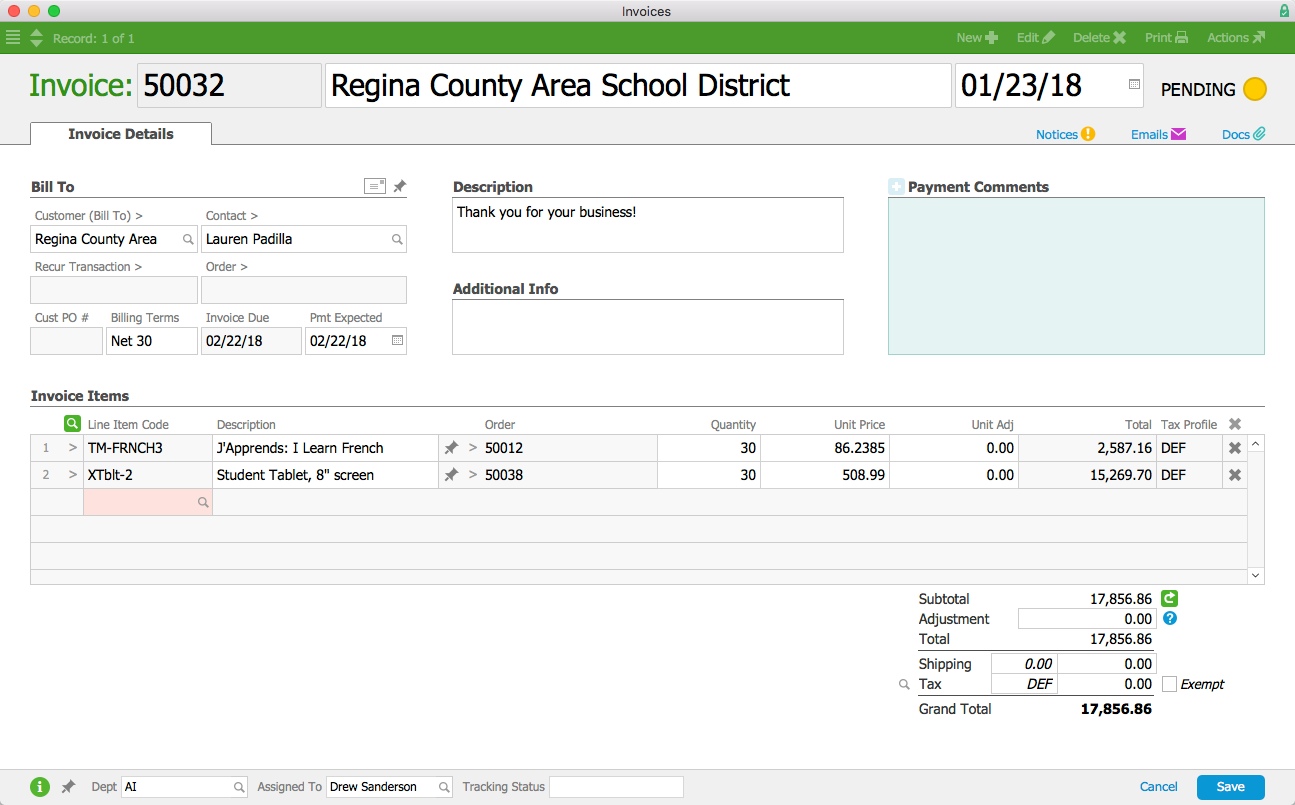

Manually Creating an Invoice

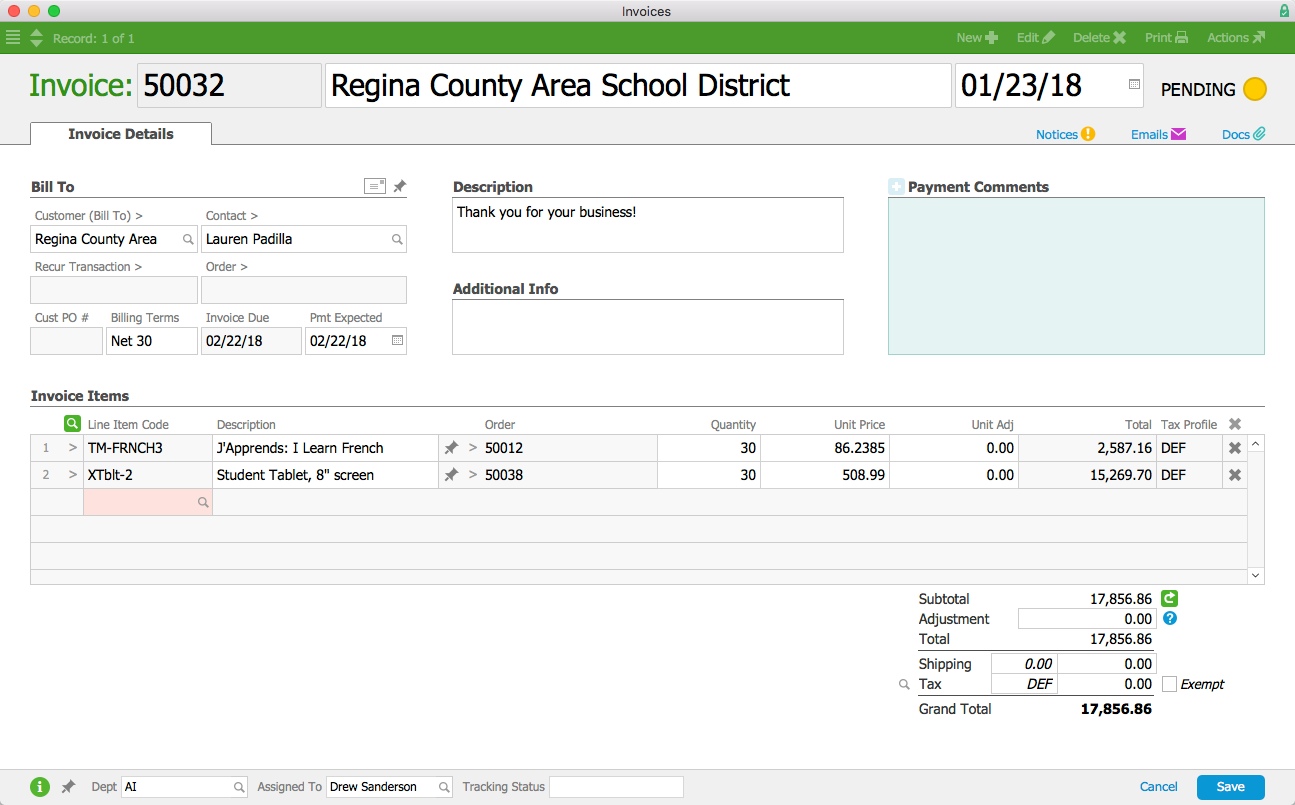

aACE is typically configured to generate invoices automatically when an order is shipped. You can manually create an invoice at other times.

- At the Invoices module menu bar, click New.

- In the Customer field, select the customer you want to work with.

- Review any LICs auto-populated in the Invoice Items section and make any needed adjustments.

- Click Save.

Importing Invoices

aACE provides robust functionality for importing data. When you download the import spreadsheet for invoices, you must include the following columns of required data:

- Company Abbr — This code or company name must match a customer company record in your system.

- Invoice ID — A unique numerical code for the record

- Invoice Date — Any date in mm/dd/yyyy format

- Department Abbr — This code must match a department in your system.

- Assigned To — These initials must match a team member record in your system.

- Tax Profile Abbr — This code must match a tax profile in your system.

- Historical — If you intend to collect money for the invoices, enter "False" in these cells.

- Historical Balance — Enter the total amount due in this field.

Note: You can also quickly generate a spreadsheet for importing records by clicking Actions > Export Invoices, then editing the spreadsheet. A spreadsheet exported this way from active invoices will not include a column for Historical and Historical Balances.

Imported invoices are left in Pending status for you to review or edit.

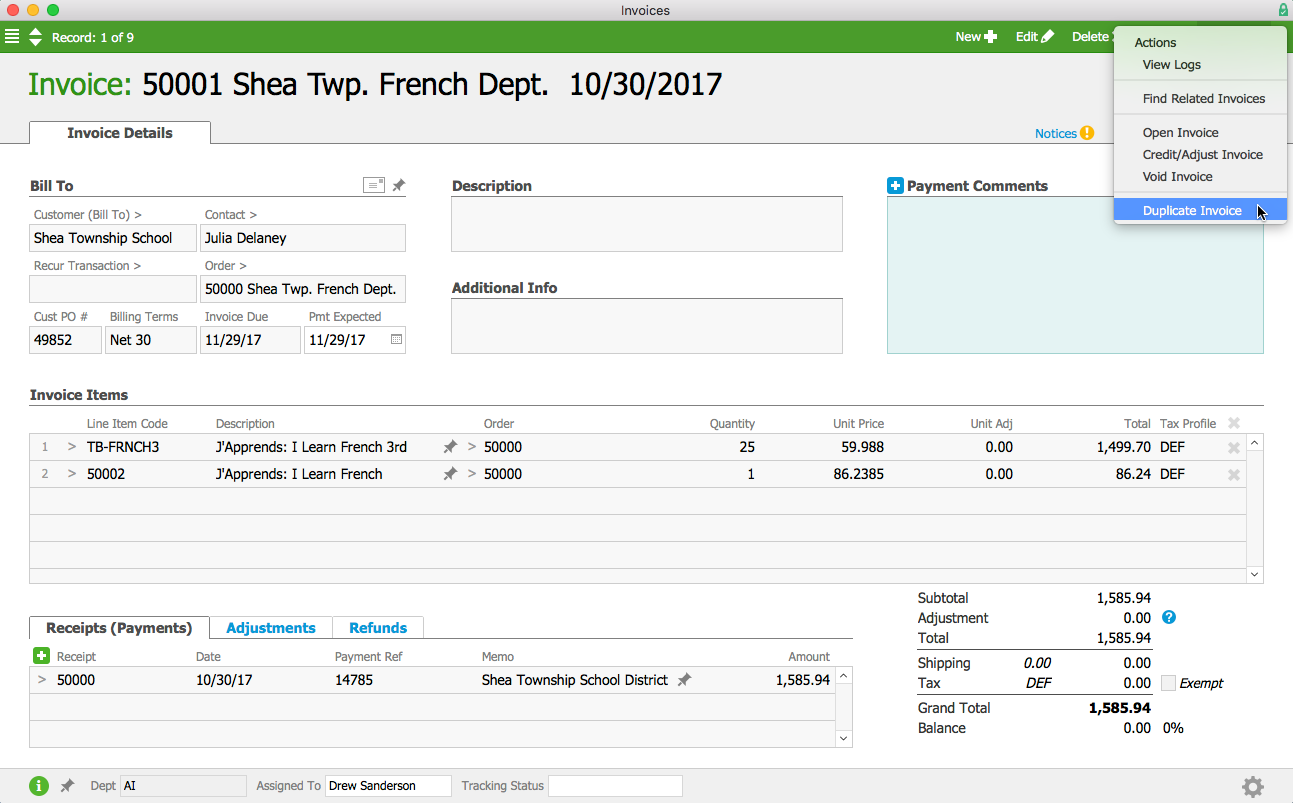

Duplicating an Invoice

Duplicating an invoice carries over any applicable information (e.g. customer, LICs), but does not copy other information (e.g. order number, dates).

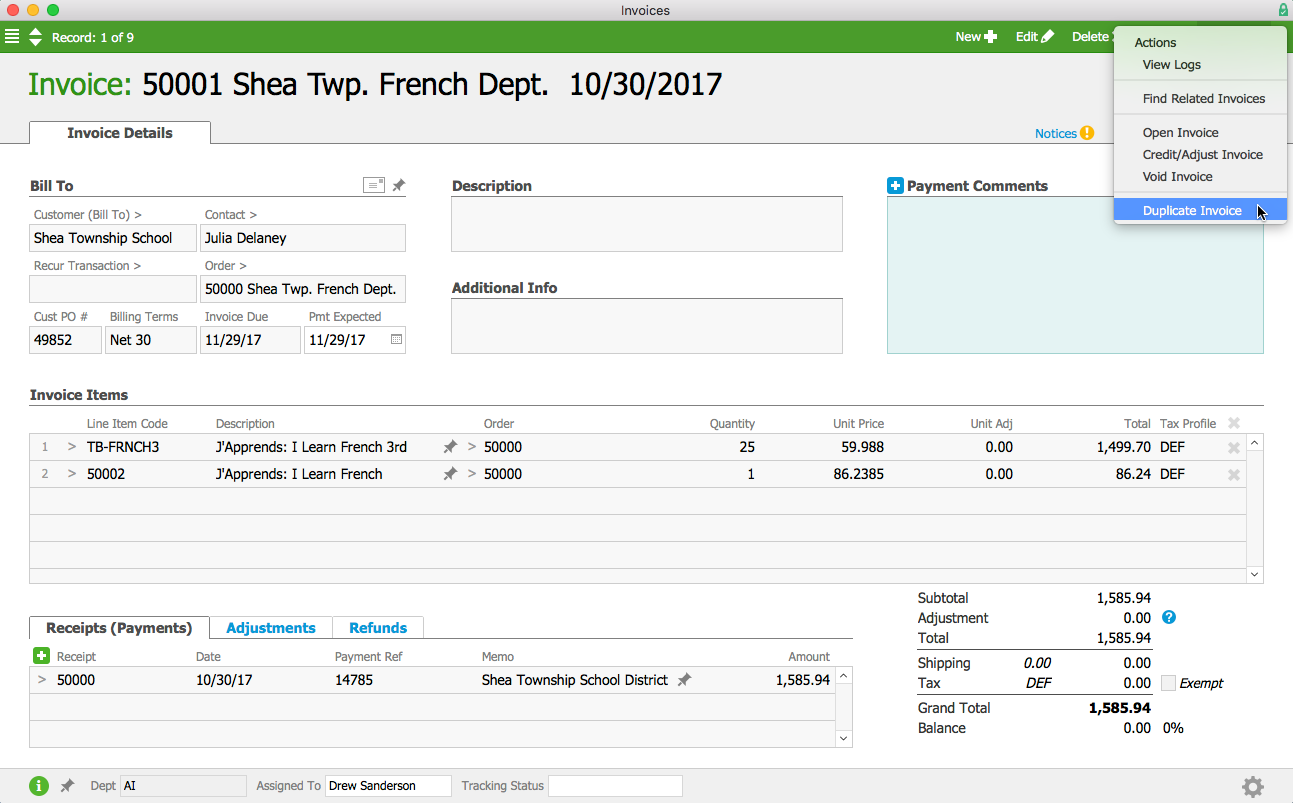

- At the Invoices module list view, locate the desired invoice.

- Click Actions > Duplicate Invoice.

- At the confirmation dialog, click Duplicate.

- On the new invoice record, modify the pre-filled information, as needed.

- Click Save.

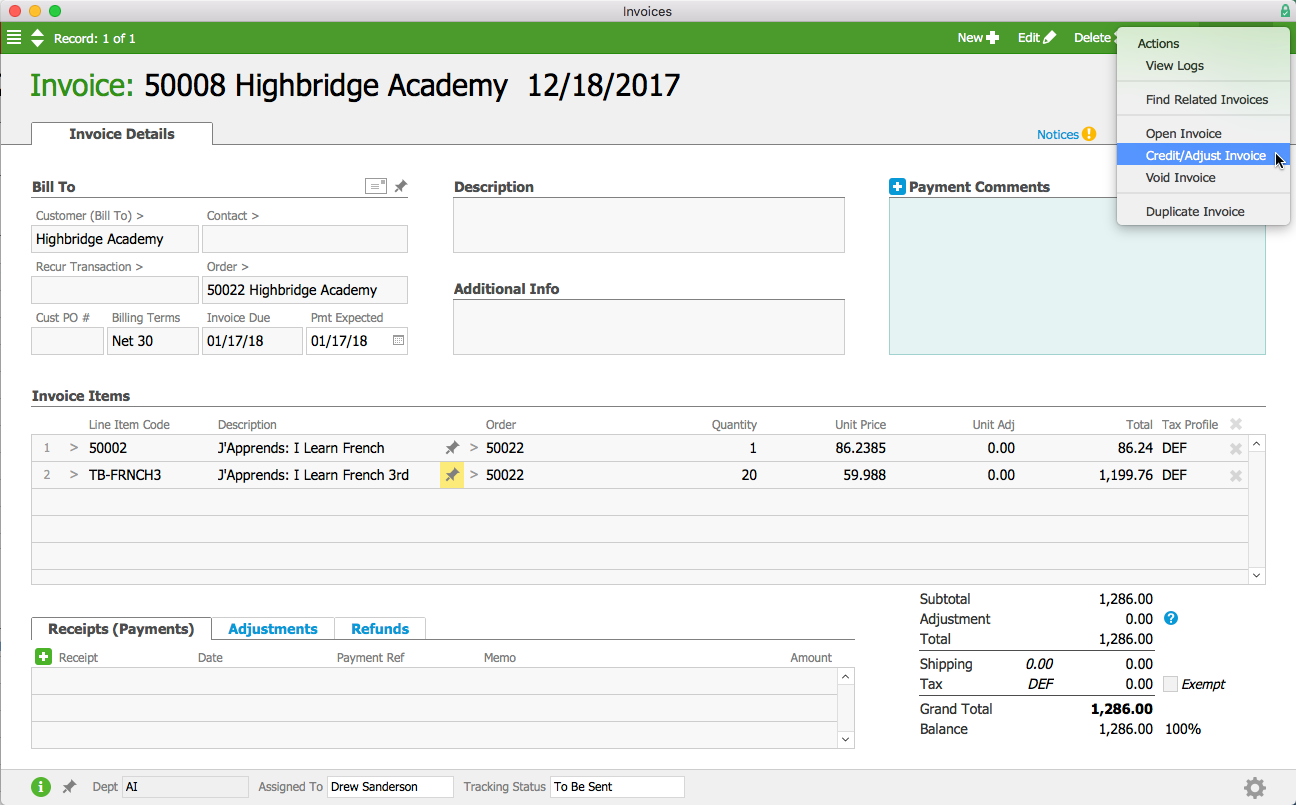

Editing an Open Invoice

Warning: Invoices in Open status have already impacted the accounting system — you must track edits and adjustments carefully.

You can make minor adjustments (e.g. include a discount or change a quantity) to an existing record. You can also void an invoice entirely (see following section).

- At the Invoices module list view, locate the desired invoice.

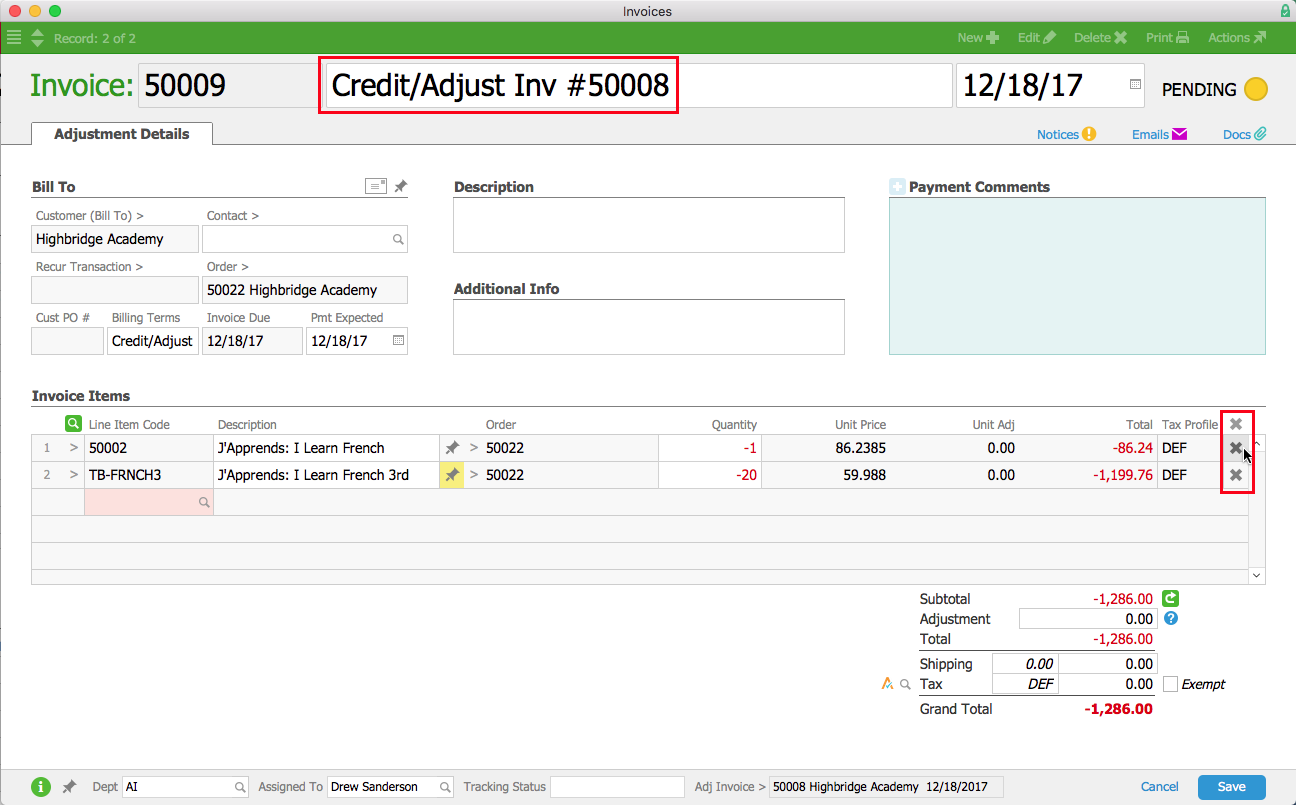

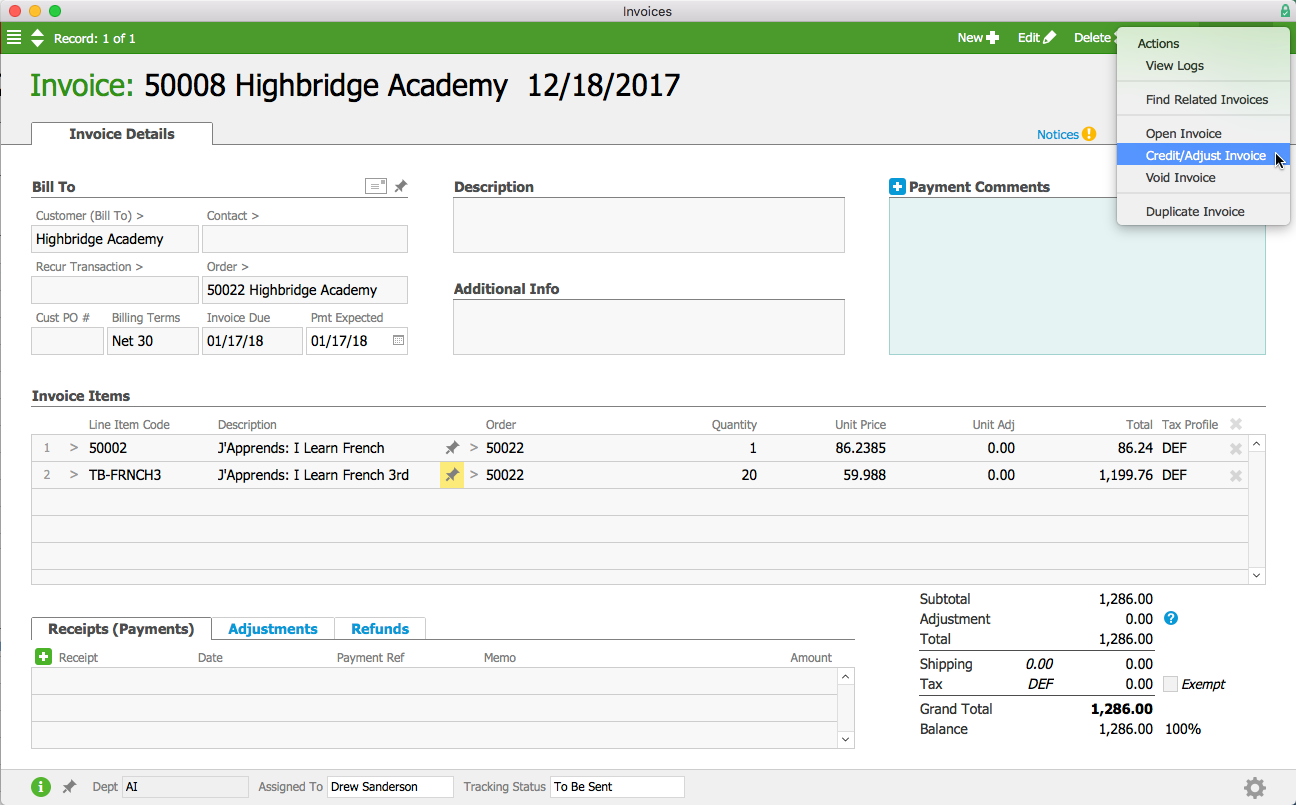

- At the invoice detail view, click Actions > Credit/Adjust Invoice.

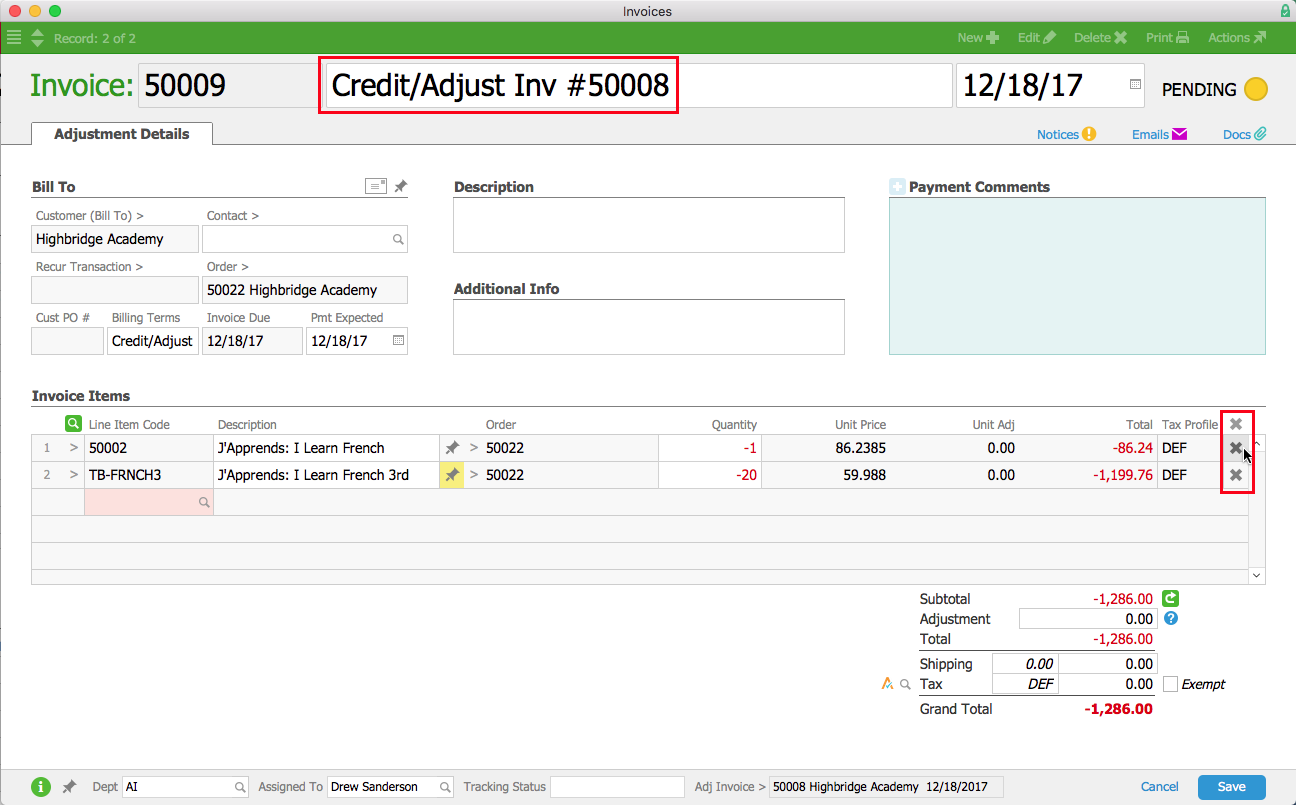

- At the new record, eliminate any line items you do not want to include in the adjustment by clicking the X at the end of each record row.

- Enter other adjustments as needed.

- Click Save and Open.

Voiding an Invoice

Voiding a record leaves the information accessible in aACE, but completely removes the record from use. You cannot 'unvoid' a voided record.

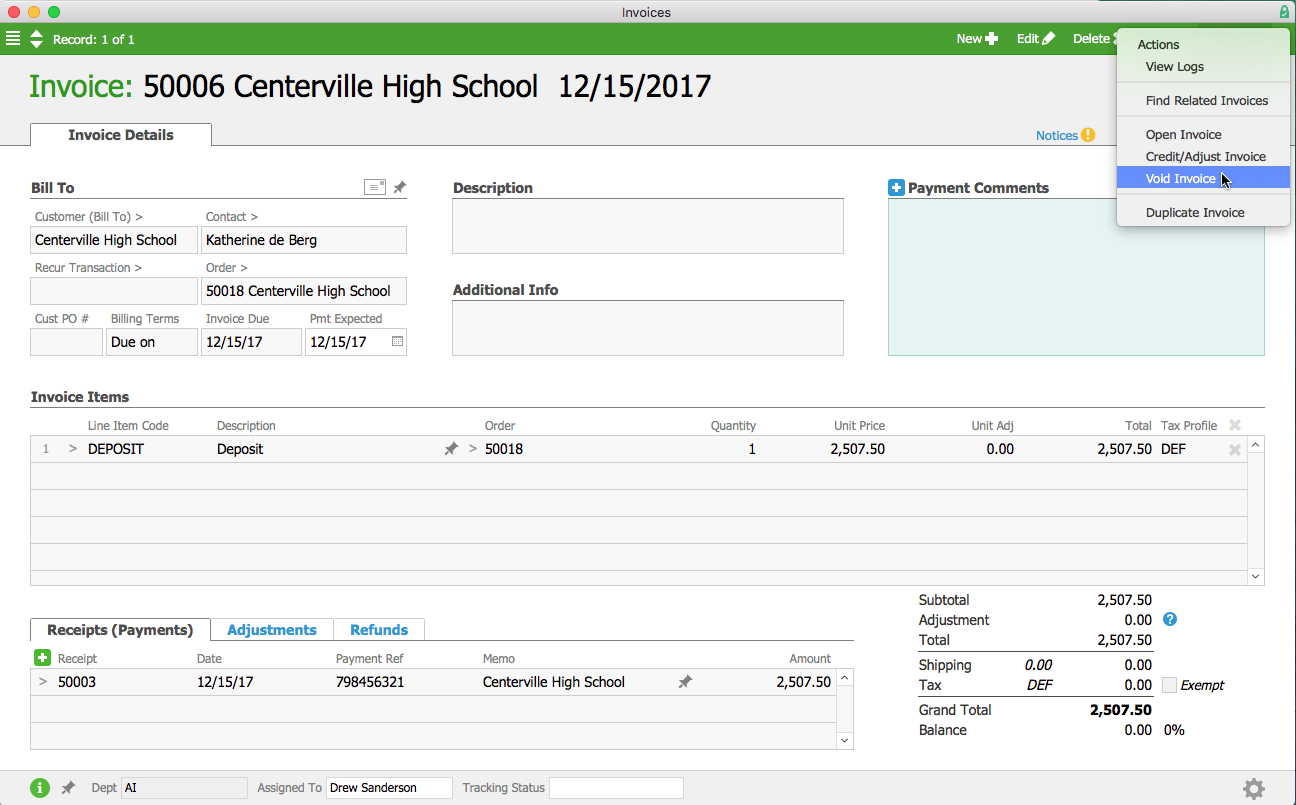

- At the Invoices module list view, locate the desired invoice.

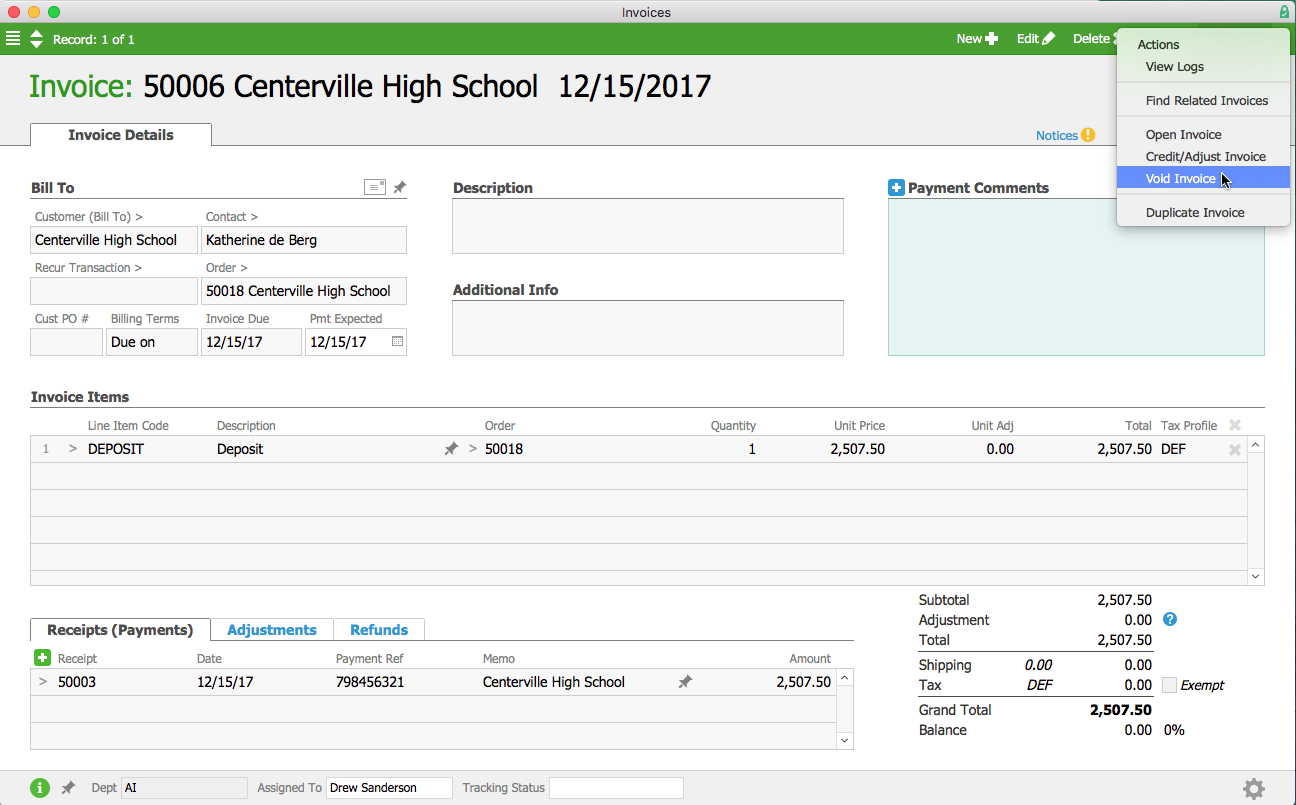

- At the invoice detail view, click Actions > Void Invoice.

- At the Reversal Date dialog box, enter the date and click Void.

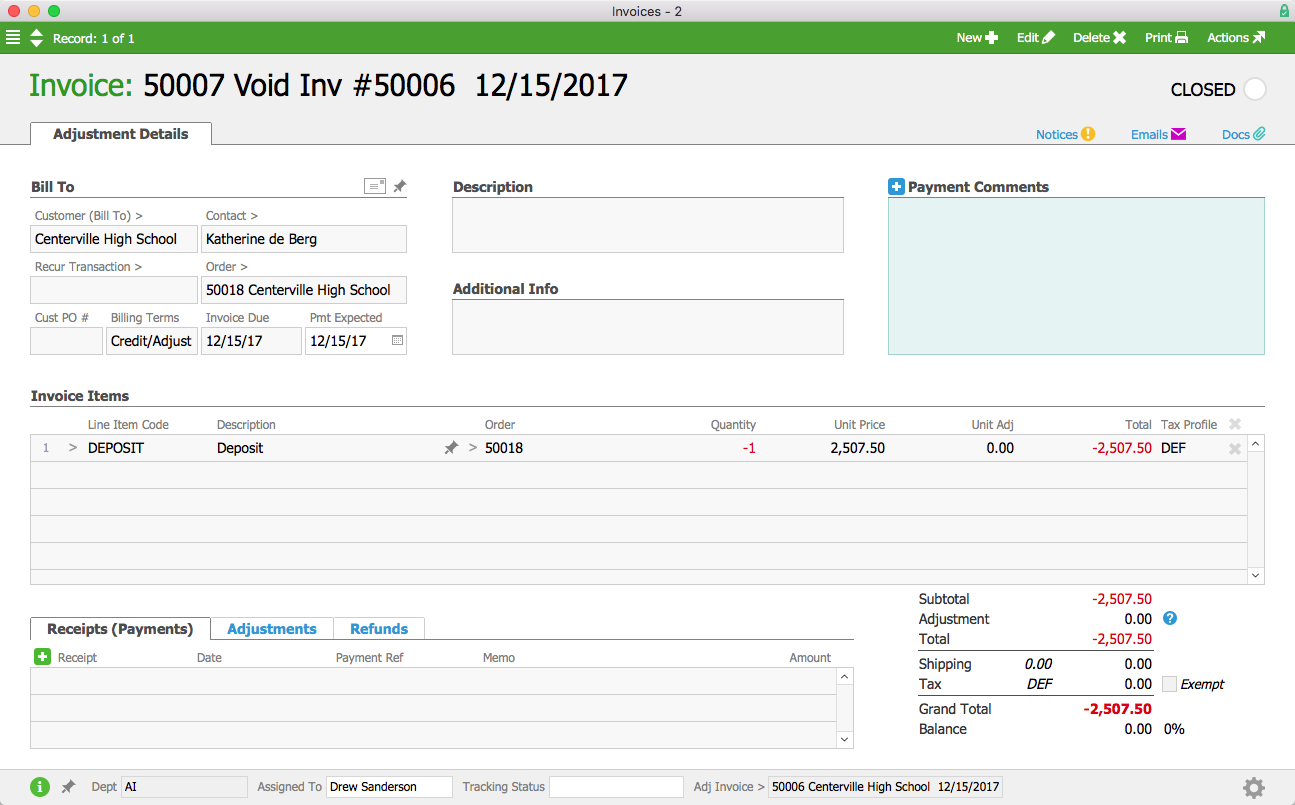

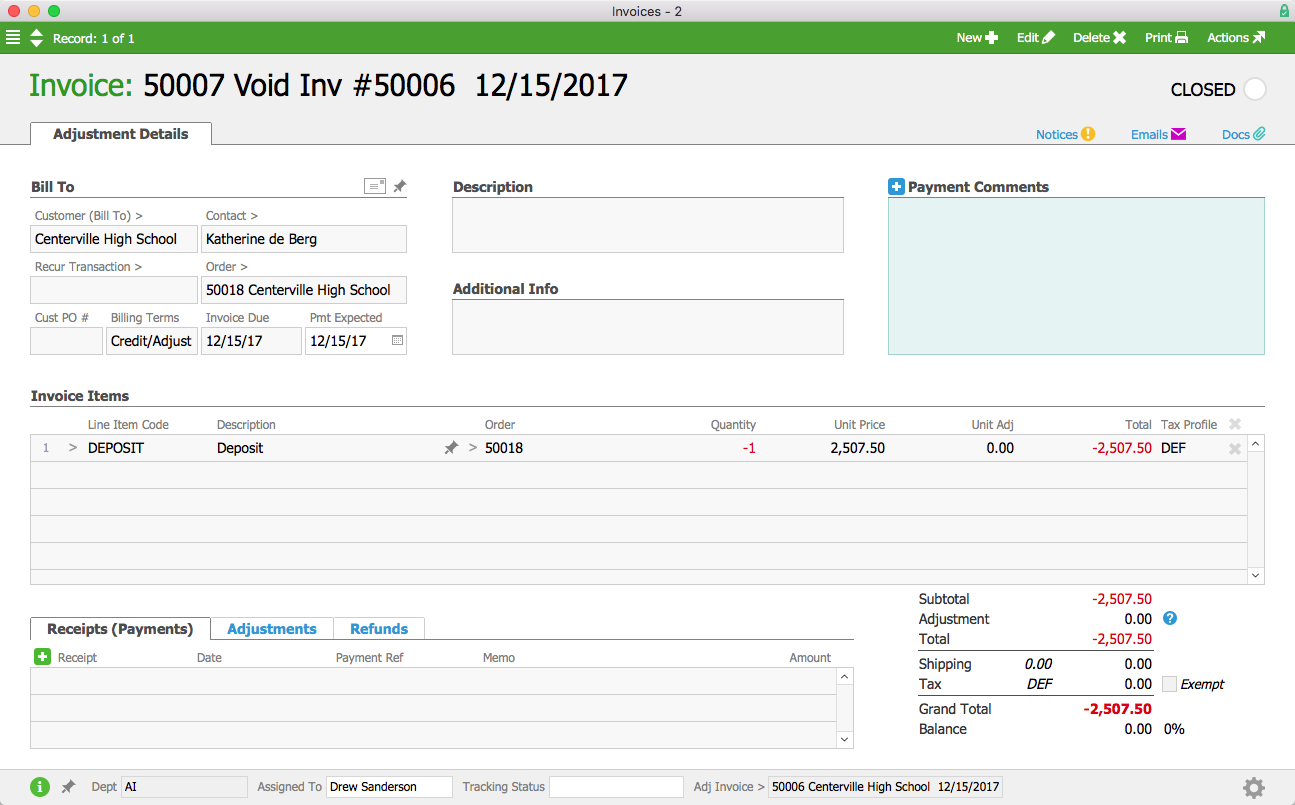

The system creates a new record to offset the invoice. - At the review dialog box, click Yes.

To help you to identify this record as an adjustment, aACE formats the title of the new adjustment invoice as <Invoice #><Void Inv #>.

Invoices and Customer Deposits

To handle customer deposits, you use two types of invoices: a deposit invoice when the customer delivers the funds, then a revenue-recognition invoice later to reverse the deposit. This second invoice will include a line item to recognize each source of revenue from the order, as well as a line item to reverse the earlier deposit(s).

Note: If an order has a deposit balance, manually creating an invoice will reverse that deposit.