To handle customer deposits, you will initially create an invoice for the value of the deposit using the Deposit line item code; later, you will reverse that value with a revenue-recognition invoice.

About Deposit Invoices

Before you can create a deposit invoice, your system administrator must configure the Deposit line item code.

Deposit invoices are different from regular invoices in a few important ways. One distinction is that they do not register in the Order Overview tab's Quantity Invoiced column. In other words, even if you have generated multiple deposit invoices, the Overview tab will only consider revenue-recognition invoices. However, the Overview tab does show the Deposit Balance in the lower-right:

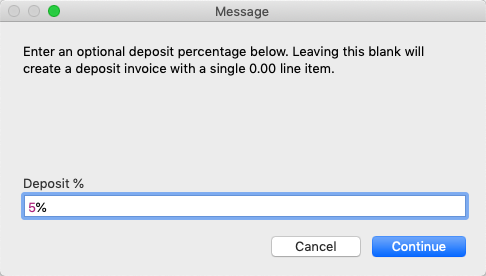

Another difference is that deposit invoices will only contain a single line corresponding to the amount the customer is paying, as shown in this example:

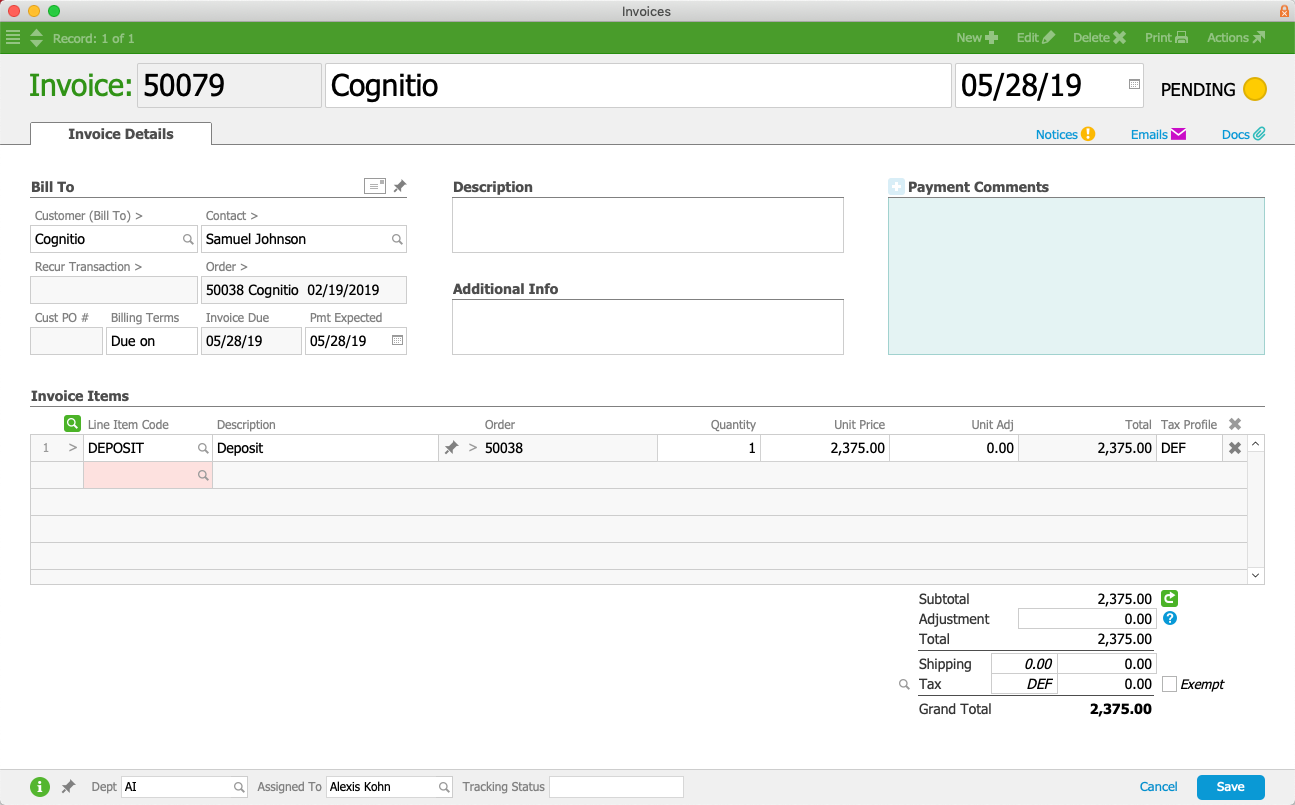

When the deposit invoice is opened, aACE debits the A/R account and credits the deposit account that is specified in the Deposit LIC:

About Revenue-Recognition Invoices

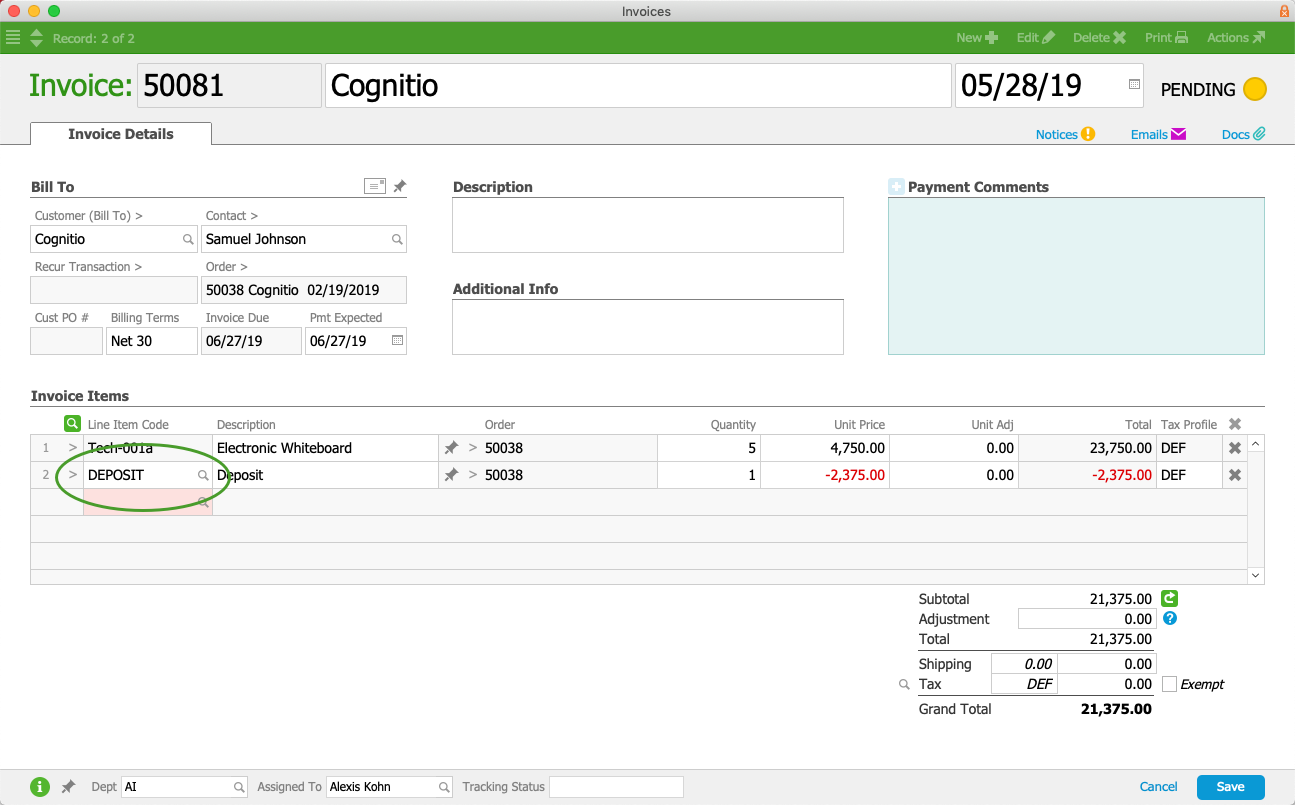

Later, you will reverse the deposit by creating a revenue-recognition invoice. This invoice will have a line item to recognize each source of revenue from the order, as well as a line item to reverse the earlier deposit(s), as shown in this example:

When the revenue-recognition invoice is opened, the deposit is reversed:

When the revenue-recognition invoice is opened, the deposit is reversed:

Methods for Generating Deposit Invoices

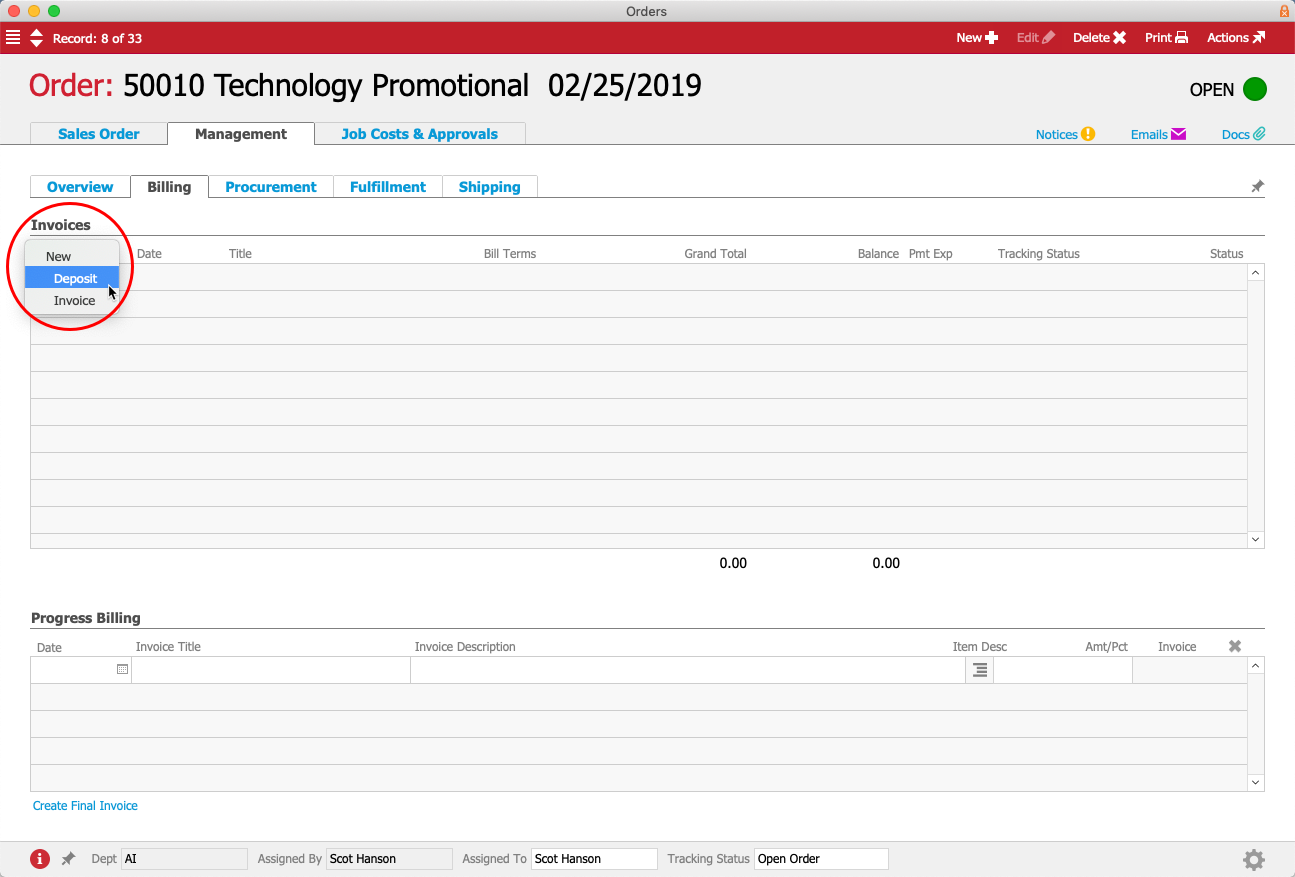

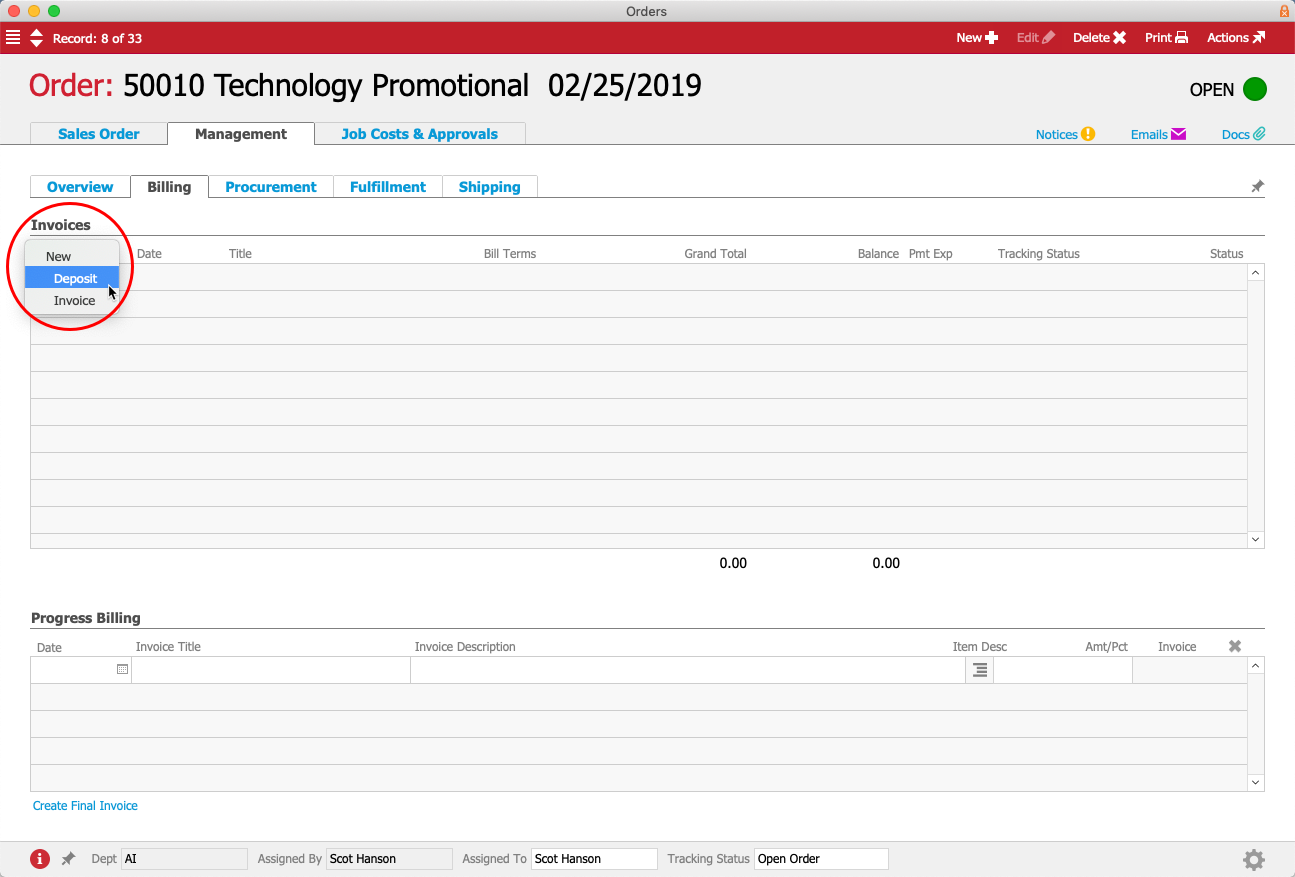

From an Order or Project

- At the order/project, click Management tab > Billing tab, and in the Invoices section, click Plus (

) > Deposit.

) > Deposit.

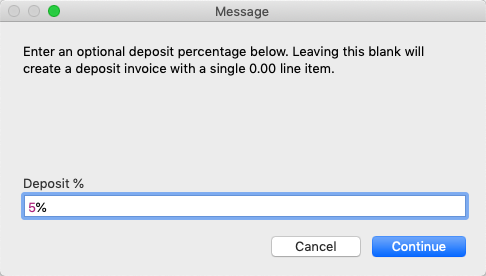

- In the dialog box, enter the percentage of the deposit and click Continue.

From the Payment Dialog

When you take a payment for an order, the Enter Payment dialog allows you to flag the payment as a deposit. This method allows you to specify an exact amount for the deposit. When you mark this flag, the system automatically generates a deposit invoice for the Payment.

Your system administrator can make this 'Payment is a Deposit' option be flagged automatically (Menu > System Admin > Preferences > Billing > 'Record payments as deposits').

Orders which already have a final invoice open will not display the 'Payment is a Deposit' flag. You can receive multiple deposit payments; however, after a non-deposit invoice has been generated, you can only manually create a deposit invoice manually from the Management tab. This constraint helps prevent confusion with your transactions — manually creating the deposit invoice ensures that you construct it with clear expectations about the results.

For example, suppose there was an order for $60.00. If you take a deposit for $30.00, aACE generates a $30.00 deposit invoice and a receipt, as expected. If you then issue an invoice for $60.00, the $30.00 deposit is applied and the invoice shows a balance of $30.00, as expected. It would be unusual to take another deposit, but possible through issuing the deposit invoice manually or setting up progress billing. (Note: Allowing the second deposit to go through the payment dialog would result in an adjustment invoice against the original deposit invoice, rather than applying it to the open invoice.)

From Billing Terms

Orders can include a Billing Terms setting that specifies a deposit percentage. When you open one of these orders, the system auto-generates an invoice with the deposit as a line item.

From Progress Billing

Progress billing invoices are deposit invoices, and when you click the Create Final Invoice link, it generates the revenue-recognition invoice.

Partially Reversed Deposits for Partial Shipments

When you ship part of an order, the default revenue-recognition invoice that the system auto-generates will reverse the full amount of the deposit. However, you may want to only reverse part of the deposit, corresponding to the partial shipment.

Your system administrator can navigate to Menu > System Admin > Preferences > Billing and mark the flag to 'Prorate deposit reversal'.

Note: This option only takes effect if the related flag is marked to 'Auto-generate invoices on shipment'.

Example Scenario

Suppose a company takes an order amounting to $1,000.00, consisting of several small items and one larger item. The customer also pays a deposit of 25% or $250.00. Even though the larger, more expensive item is on backorder, the smaller items are shipped, amounting to $200.00 (or 20% of the order).

With the 'Prorate deposit reversal' flag marked, the shipment process auto-generates a revenue-recognition invoice that reverses only a percentage of the deposit: the prorated deposit reversal invoice shows the $200.00 shipment minus $50.00 (or 20% of the deposit amount). So the total on that invoice is $150.00. Later, when the backordered item is shipped, aACE auto-generates a second revenue-recognition invoice, subtracting the deposit's remaining $200.00, resulting in a total of $600.00.

Using the same example order, if the 'Prorate' flag was not marked, the shipment process would auto-generate a revenue-recognition invoice that reverses the full amount of the deposit. Because the amount for this shipment ($200.00) is less than the deposit amount ($250.00), the invoice would show a negative amount (-$50.00). Later, when the backordered item is shipped, the total of the two invoices would be $750.00 (-$50.00 + $800.00).

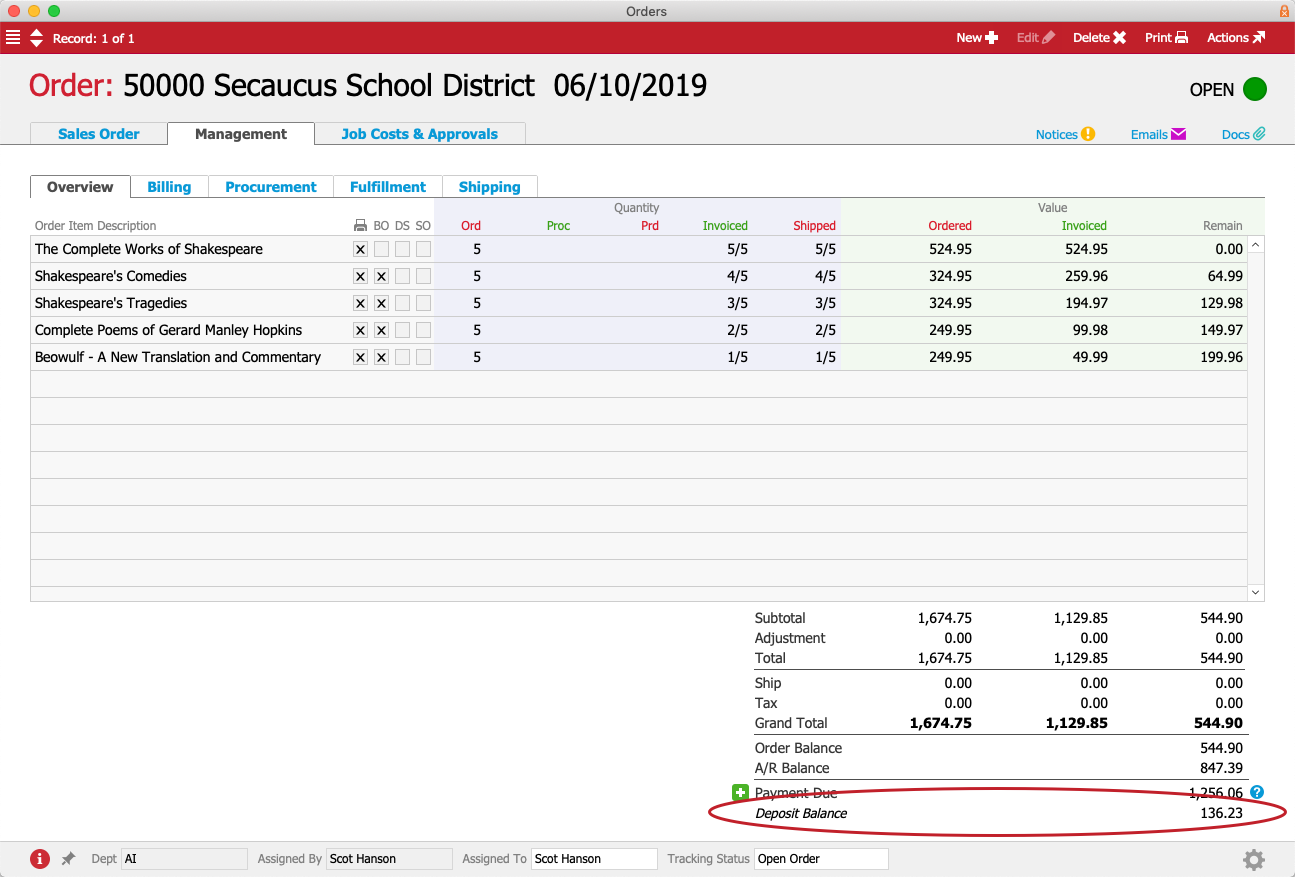

Deposit Balance

A deposit is a liability representing unfulfilled customer obligations. For this reason, the deposit balance must be at $0.00 before you can close an order or project. If the deposit balance is greater than zero, aACE will keep the order or project in Open status, even if the invoicing and shipping are complete.

You can review the outstanding deposit balance at the Order or Project Overview tab:

) > Deposit.

) > Deposit.