This guide explains how to receive a payment greater than the invoice amount. It is intended for basic users.

There may be times when you receive overpayments for open invoices. It is important that you process the overpayment transactions to reflect reality.

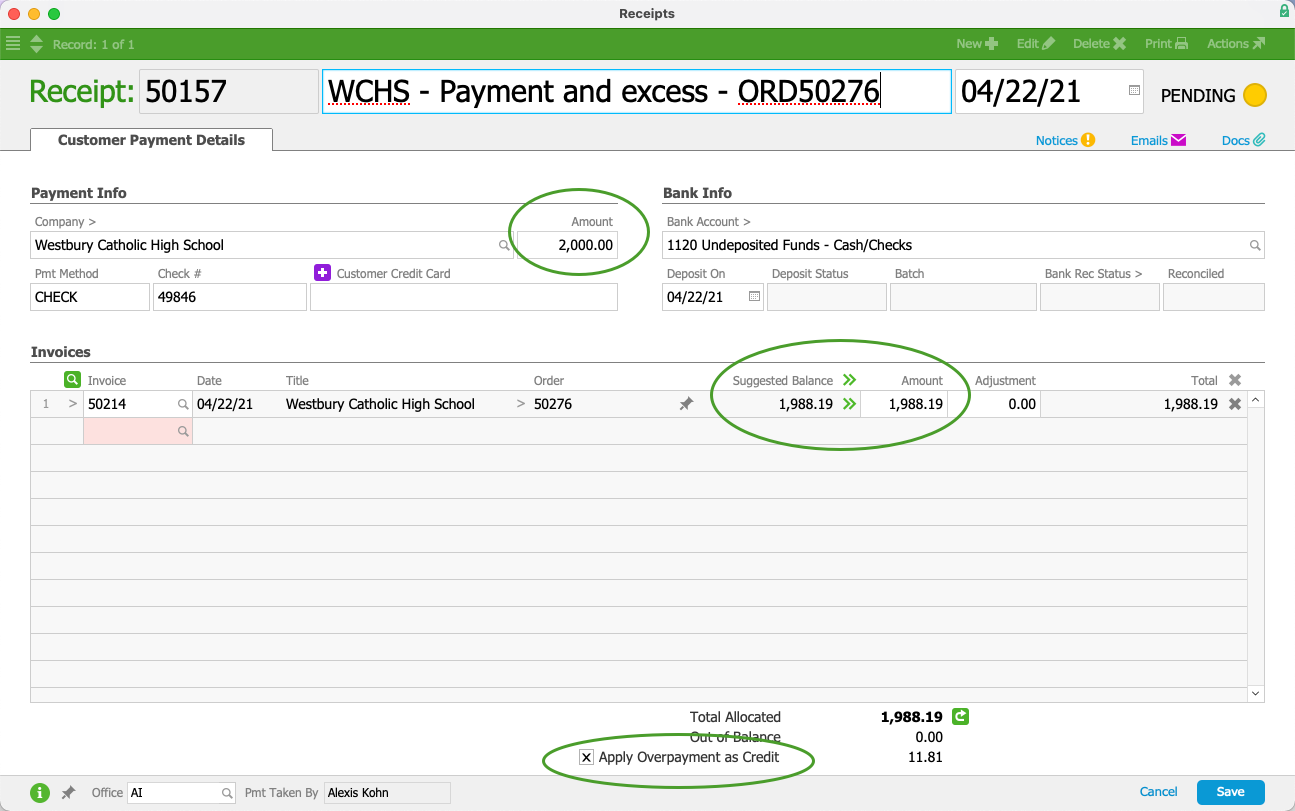

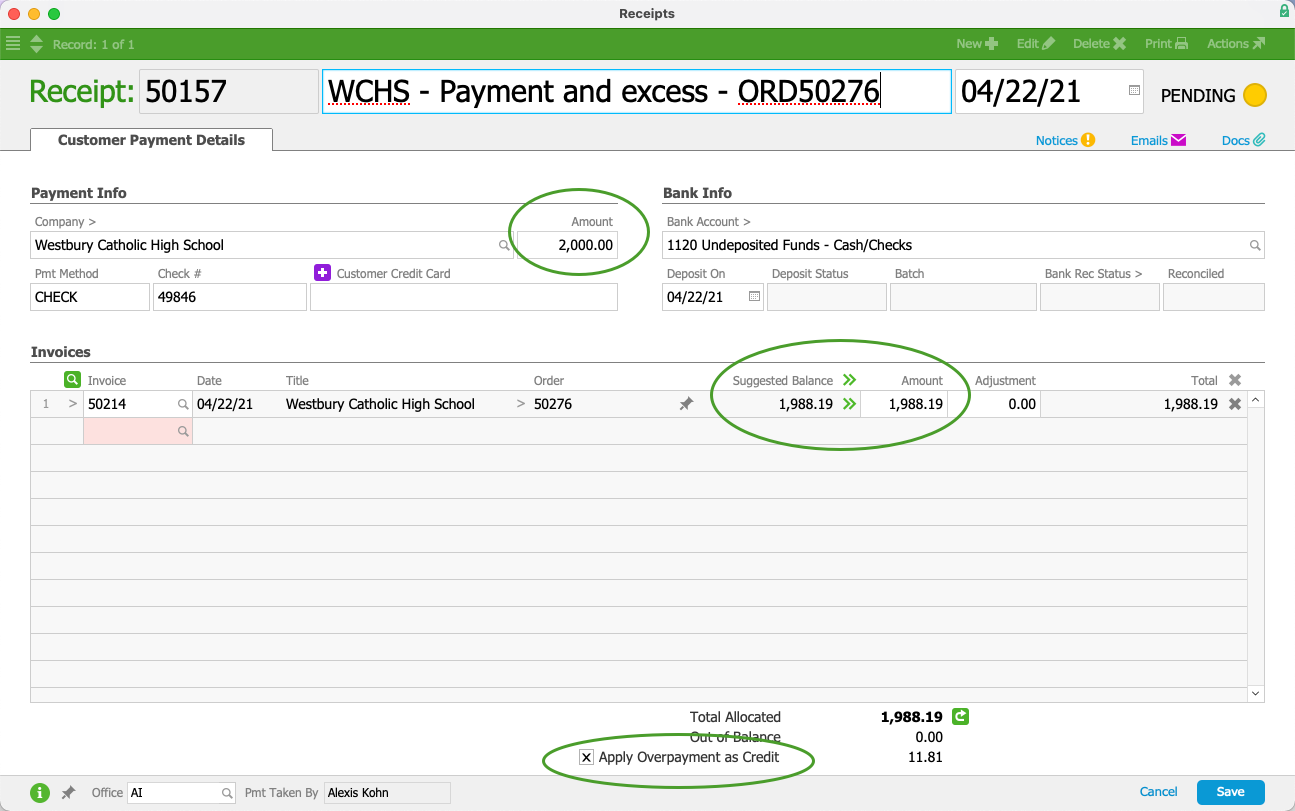

Suppose you have a customer with an outstanding invoice of $1,988.19, but you receive a check for $2,000.00 as payment.

- Navigate from Main Menu > Accts Receivable > Receipts, then create a new customer payment for the customer.

- Enter the receipt as normal, but with these specifications:

- Record the full amount received in the Amount fields (e.g. $2,000.00).

- Apply only the total amount of the invoice to the invoice Amount column (e.g. $1,988.19).

- Click the Total Allocated Refresh icon (

).

). - Verify that the Apply Overpayment as Credit flag is marked.

- Save and post the receipt.

At this point, the receipt includes a line item for a credit memo the amount of the overpayment. You can carry the overpayment until you apply it to future invoices or you can issue a refund.