aACE provides thorough, flexible control over tax calculations using tax profiles as the central tool. You can create as many tax profiles as needed. Before starting to create a new profile, you should research the specific taxation percentages as detailed by the relevant taxing authorities.

Create a New Tax Profile

For more details on various tax profile fields, read the overview of tax profiles.

- Navigate from Main Menu > Accounting > Tax Profiles.

- At the list view header, click New.

- At the new record's detail view, enter a Tax Profile Title and an Abbreviation.

- In the General Info section, mark all the flags needed to indicate where this tax profile should be applied:

- Default — Set using the Actions menu. Only one tax profile can be assigned this role.

- Use Tax — Set using the Actions menu. Only one tax profile can be assigned this role.

(Read more details about working with use taxes.) - EU — Set using the Actions menu. Only one tax profile can be assigned this role.

- AvaTax — The tax profile should be used with your aACE+ AvaTax integration. Multiple tax profiles can have this flag marked.

- Optionally, specify the Start Date and End Date.

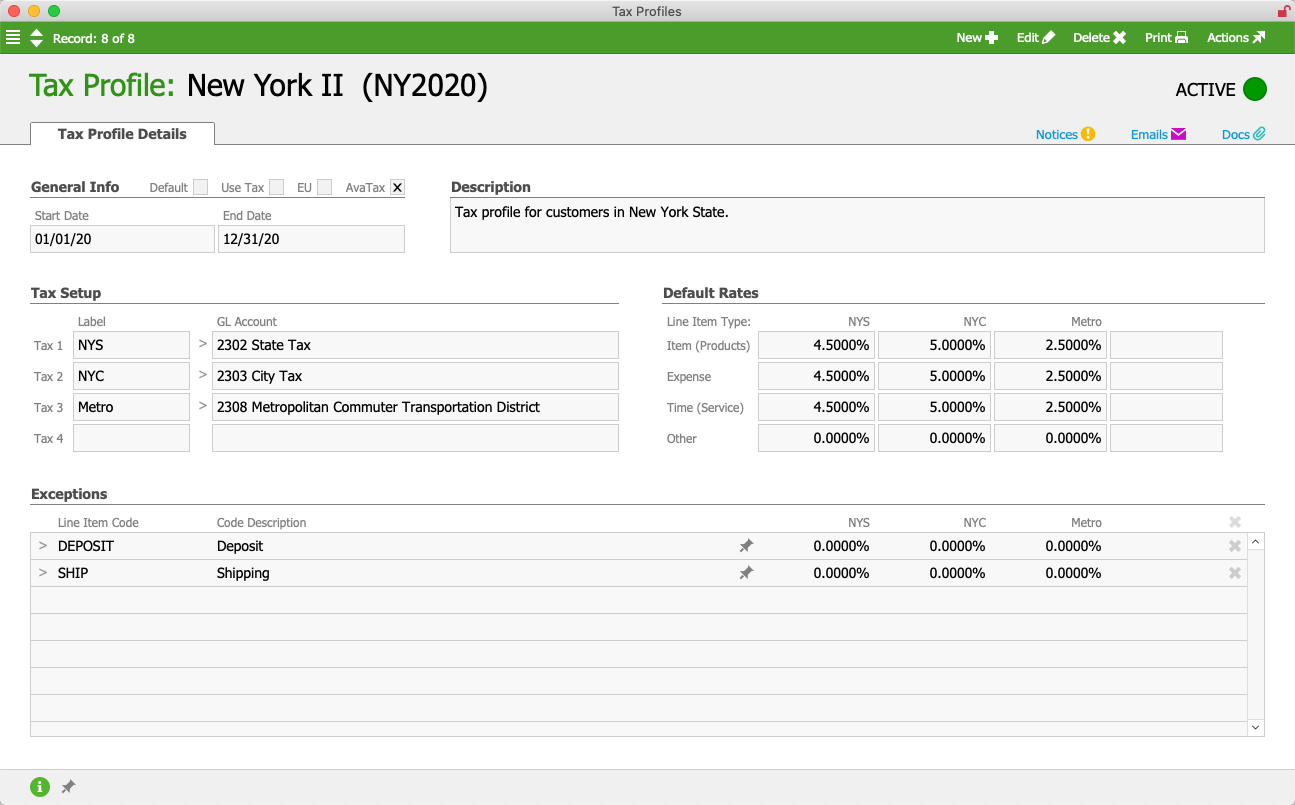

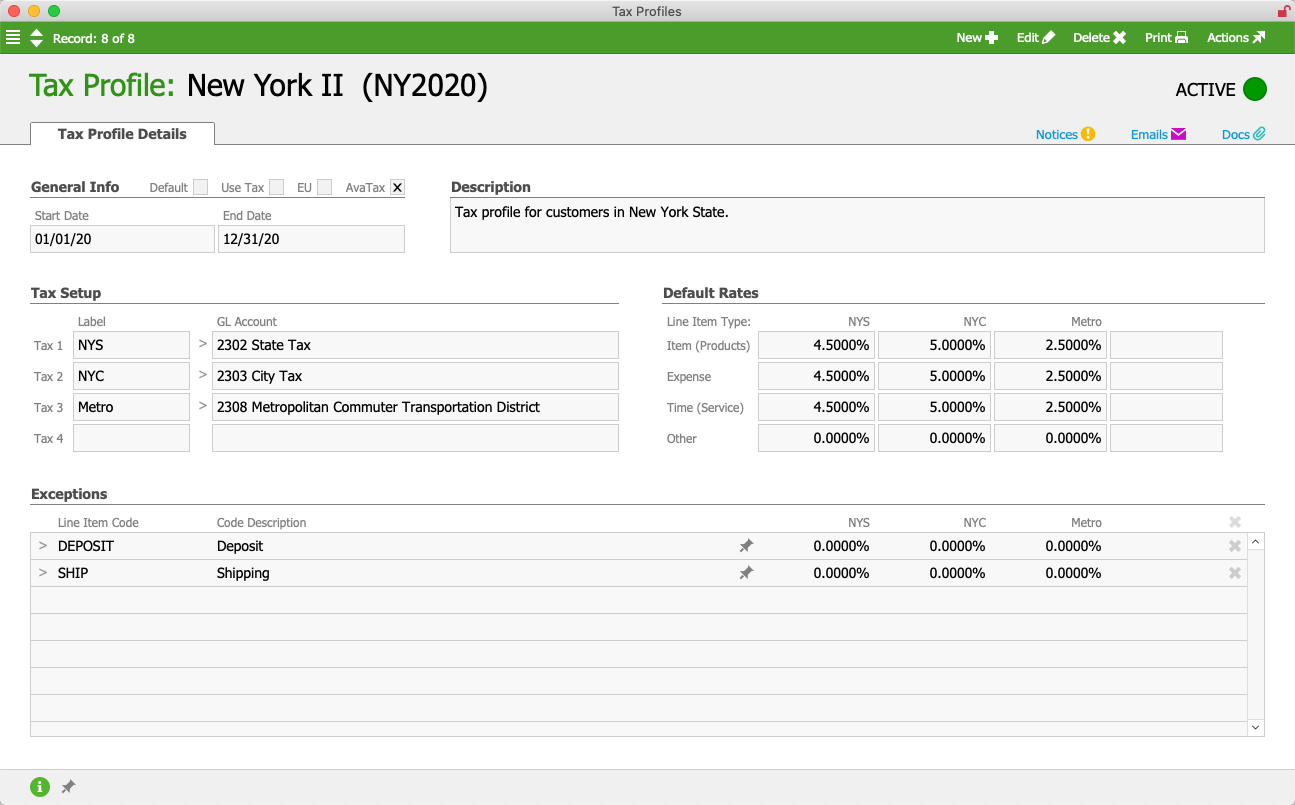

These dates can be used to help plan for tax rate changes. When the end date arrives, aACE will automatically send a notice to the assigned team for Rate Card / Tax Profile Reminders. - In the Tax Setup section, label up to four taxing entities that will share in the total tax value for this profile, then assign a General Ledger account to each.

- In the Default Rates section, enter the percentage of the total tax that each taxing entities will receive, as specified by your taxing authorities.

- In the Exceptions section, specify any line item codes (LICs) that do not conform to the default rates.

- Click Save and Activate.

Example

Suppose a company is expanding their sales and shipping into Chicago. They need to set up a new tax profile.

The team meets to identify the jurisdictions involved. Using Illinois state government web sites, they find that the overall tax rate for general merchandise is 10.250%. But this is divided across four tax entities: 6.250% for Illinois state, 1.750% for Cook County, 1.250% for Chicago, and 1.000% for the Regional Transportation Authority (RTA).

A team member navigates to the Tax Profiles module and creates the new record. In the Tax Setup section, he enters labels for the taxing entities and the corresponding GL accounts. In the Default Rates section, he enters the tax percentages for products and services, then saves the tax profile.