This guide explains areas where GL accounts may be linked throughout the system and how to remove those links. It is intended for system administrators.

Before you can delete a GL account, you must remove all relationships. Four types of relationships can link general ledger accounts to other aACE records:

- GL account used as Setup Account

- GL account linked to tax profiles

- GL account linked to line item codes

- GL account linked to general ledger records

Removing each of these relationships is described below.

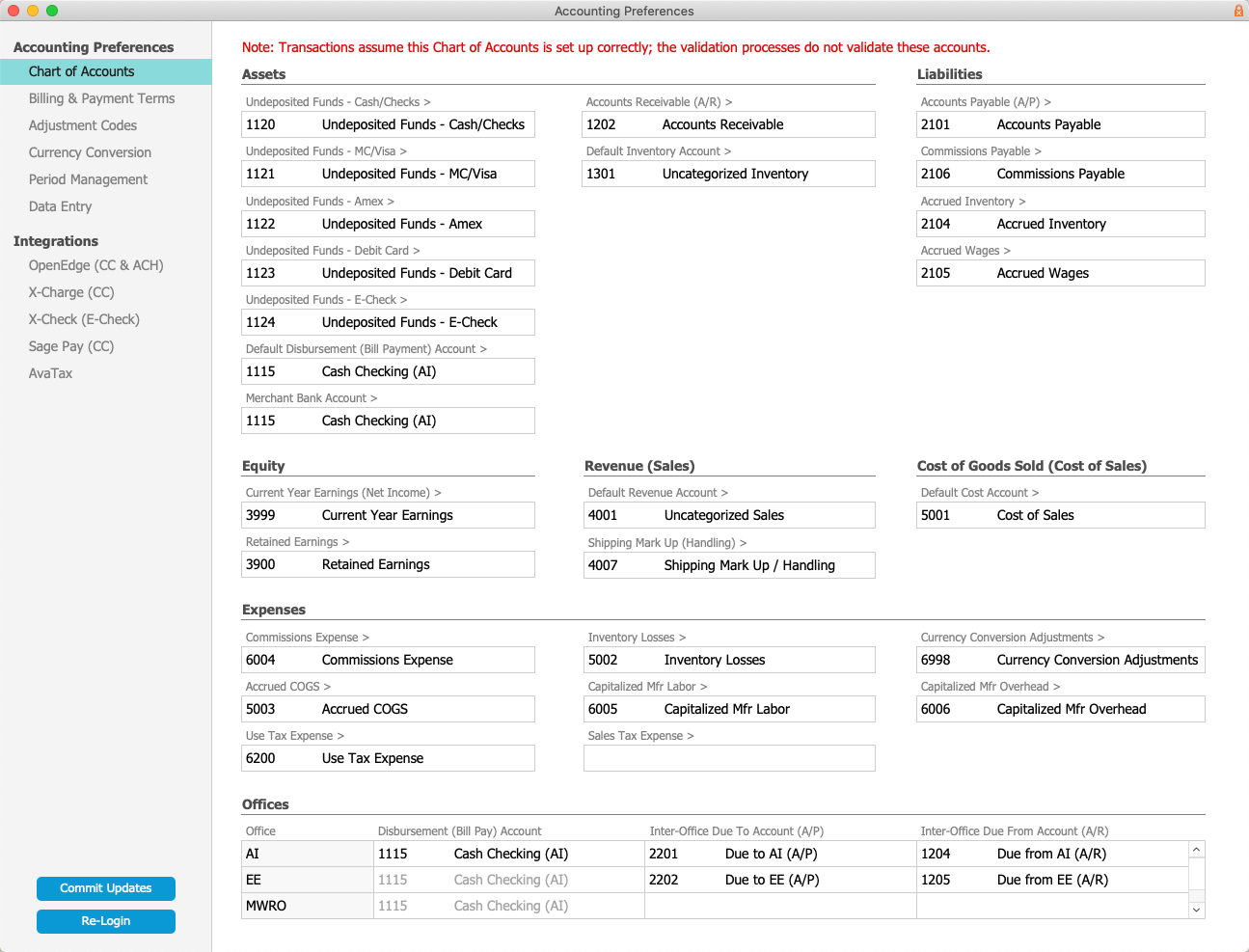

1. Setup Accounts

The Setup Accounts are used as defaults for specific accounting transactions. They are used in the aACE Accounting Setup screen. To view these settings, navigate to Menu > Accounting > Preferences > Chart of Accounts:

You can remove a reference to a GL account for any of these settings by deleting the account number from the field.

Warning: Once you remove a GL account reference, related transactions may fail until you re-populate the reference field value.

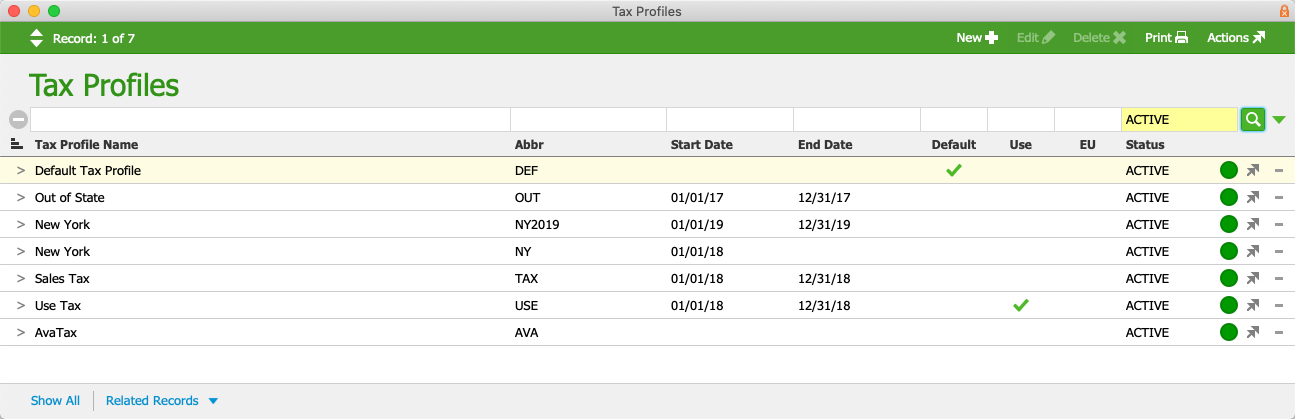

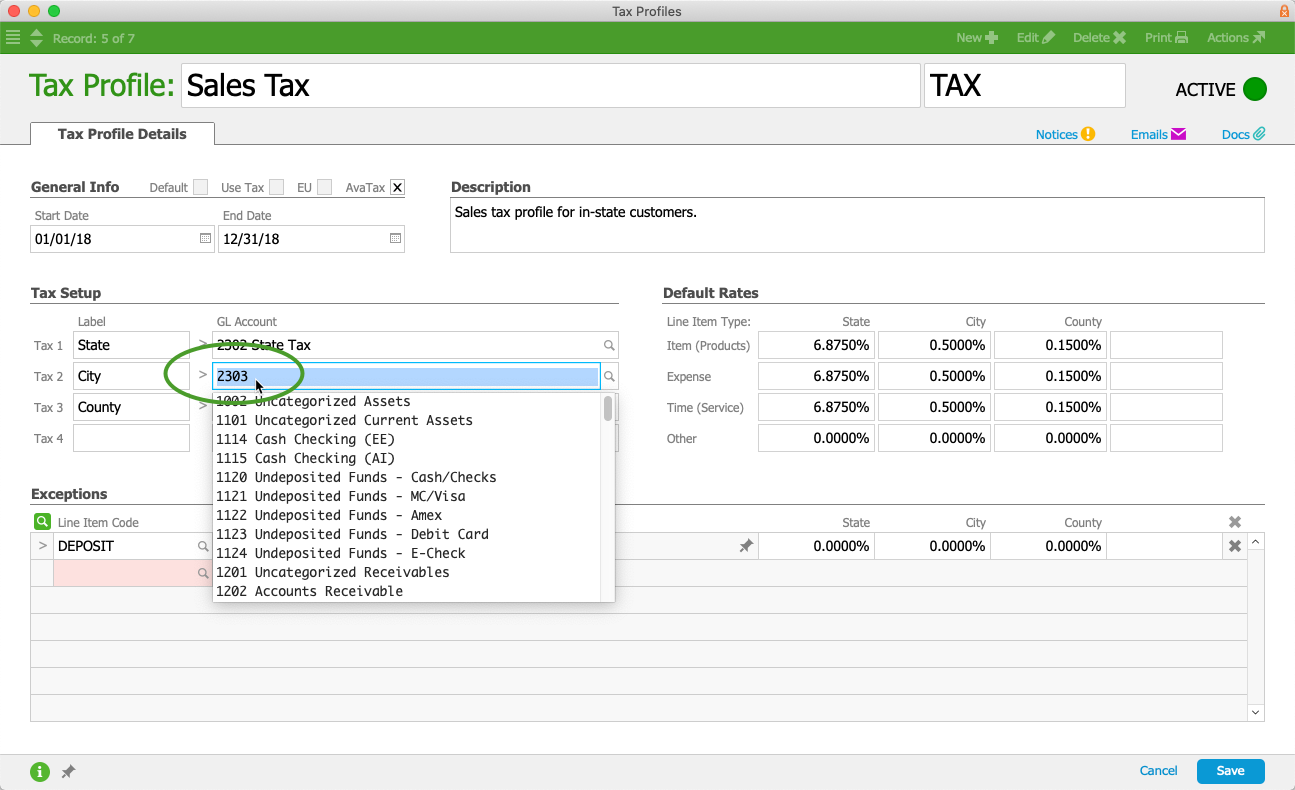

2. Tax Profiles

GL accounts are related to tax profiles in the Tax Profiles module. To work with these settings, navigate to Menu > Accounting > Tax Profiles:

You can remove a tax profile by using the Action menu to either deactivate or delete the profile. If the tax accounts are still applicable, we recommend leaving them in aACE and just unlinking the GL account from the tax profile: click on the Tax Profile Name and review the linked GL accounts. Remove a current GL account by clicking Edit and deleting the account number from the field:

Note: You must enter another GL account in order to save the tax profile.

3. Line Item Codes

Each line item code (LIC) requires a GL account relationship. You can update the revenue, cost, and inventory GL accounts for a single LIC by editing its detail view.

When you need to delete GL accounts, you can prevent conflicts by reassigning LICs to a holding detail account. You may need to create a new GL detail account for this purpose. We recommend assigning the LICs to a general ledger account you plan to keep in aACE.

You can also update multiple LICs at one time:

- Filter the LIC module list view to display all LICs that should be assigned to an account.

- Click Admin Actions (

) > Update Revenue / Cost / Inventory Acct for Line Item Codes in List.

) > Update Revenue / Cost / Inventory Acct for Line Item Codes in List. - Specify the account number the LICs should be assigned to.

4. General Ledger Records

You can reassign general ledger transactions to a holding account.

In addition, if the LIC records are up-to-date with the correct accounts, you can update multiple GL transactions based on the relevant LICs:

- From the General Ledger module list view, filter the list to show the needed account and the transactions related to the needed LIC(s).

- Click Actions > Reassign GL Account for List from Line Item Codes > Update.

Warning: Be careful not to end up with general ledger data that you cannot accurately reassign later. You may need to create a new GL account for reassigning these records.

Best Practices

Recycle Existing Accounts

For some accounts, it may be more effective to update the name and number to match accounts from the COA you are importing. This saves the effort of needing to handle related records twice [as when using a placeholder account, see below] (i.e. first to remove the link to the old account, and then to link to the new, imported account).

You can also update account numbers in a batch:

- From the GL Accounts list view, filter the list to show all the accounts that need to be updated within a single root header account.

- Click Actions > Renumber Account IDs for List.

- At the dialog, enter the new, initial number for the Starting Value and enter the Increment By value.

- Click UPDATE.

Note: When updating GL account numbers, be mindful of preserving the initial numbers, which govern the nine root header accounts, the natural balances of credits/debits, and various reporting results.

Use a Placeholder Account

You can create another account to serve as a placeholder for temporarily linking other records:

- Create an account named "9999 - Temporary Placeholder" or similar.

- Reassign linked records from a remaining account to the placeholder.

- Deactivate and delete the remaining account.

Keep clear notes of these transfers and temporary assignments. After you import the new accounts, be sure to reassign any linked records or transfer funds from the placeholder to the correct, final accounts.

) > Update Revenue / Cost / Inventory Acct for Line Item Codes in List.

) > Update Revenue / Cost / Inventory Acct for Line Item Codes in List.