In addition to support for printing 1099s, aACE includes several related features designed to simplify the 1099 process.

Flag Company Records as Requiring 1099s

You can set this flag manually for specific companies or you can run a batch update from the list view.

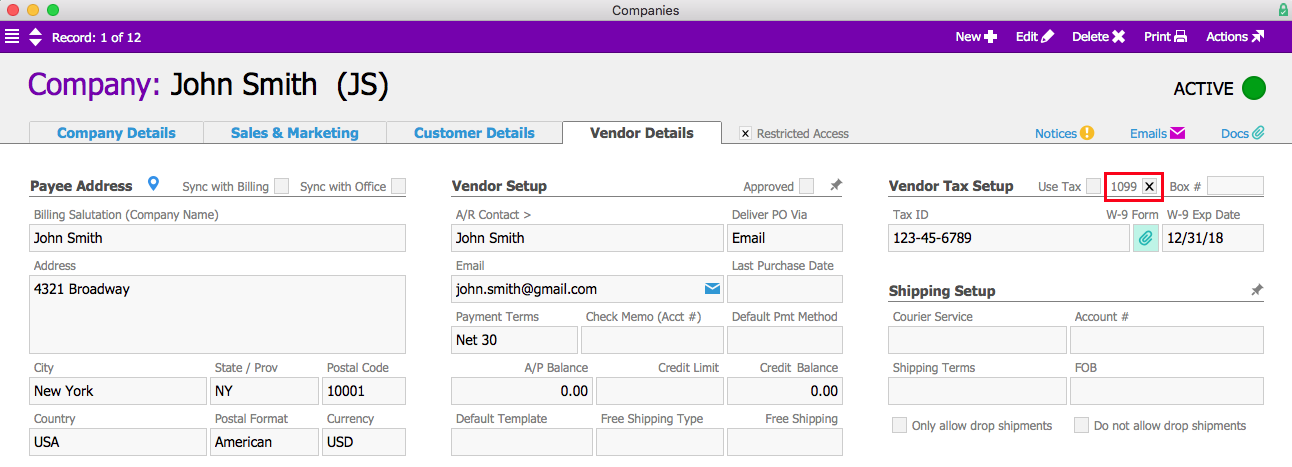

Flag a Specific Company

- Navigate to CRM & Sales > Companies.

- Use the Quick Search bar to locate the desired company.

- On the detail view, click the Vendor Details tab.

- In the Vendor Tax Setup section, mark the flag for 1099.

Flag Companies with Batch Update

At the Companies list view, use the Quick Search bar to display all the companies that need to be flagged. Then click the Admin Actions (![]() ) icon and select Update 1099 Setting for List. At the prompt, select True to flag these companies, or select False to remove the flag for these companies.

) icon and select Update 1099 Setting for List. At the prompt, select True to flag these companies, or select False to remove the flag for these companies.

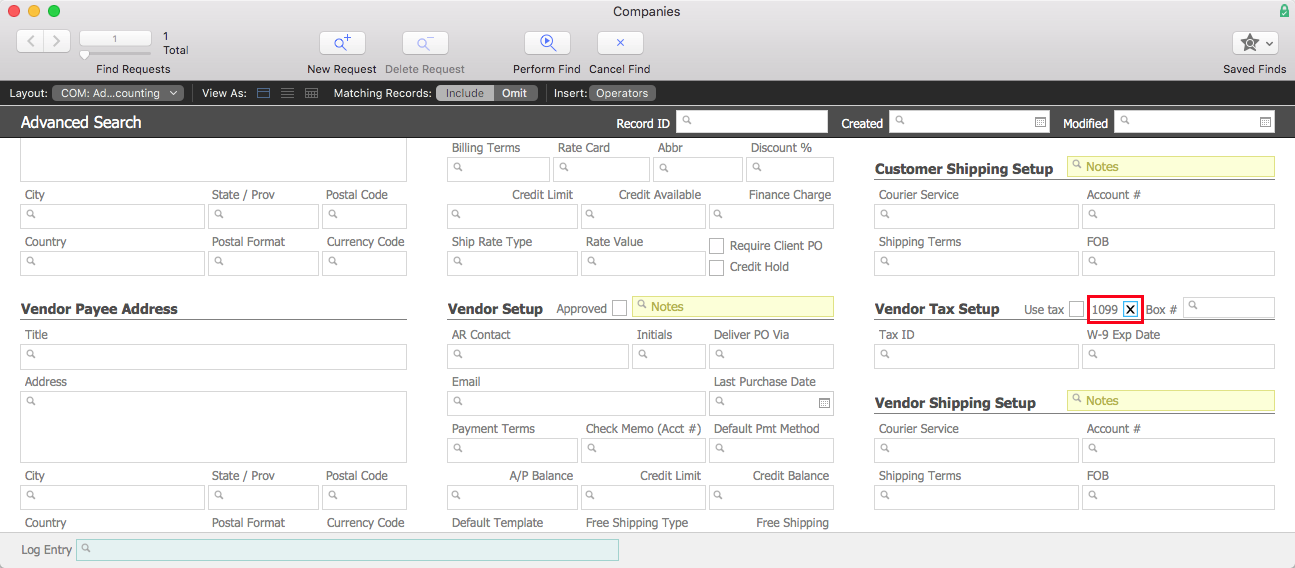

Displaying All 1099 Companies

You can easily list all companies that require 1099s.

- Navigate to CRM & Sales > Companies > Search Options (

) > Go To Advanced Search.

) > Go To Advanced Search. - In the Advanced Search screen, scroll down to the Vendor Tax Setup section.

- Mark the flag for 1099.

Note: You can enter additional criteria to constrain your list of 1099 companies further. - In the menu bar, click Perform Find.

Vendor Disbursement Volume Report

Only users with the Finance/Accounting access privilege can run this report.

The report summarizes 1099 data. It includes the company name, tax ID, address, and disbursement volume for the specified tax year. The results come from the companies currently displayed in the list view. Note: If you have not filtered the list to show only 1099 companies, you may have non-1099 companies affecting the results.

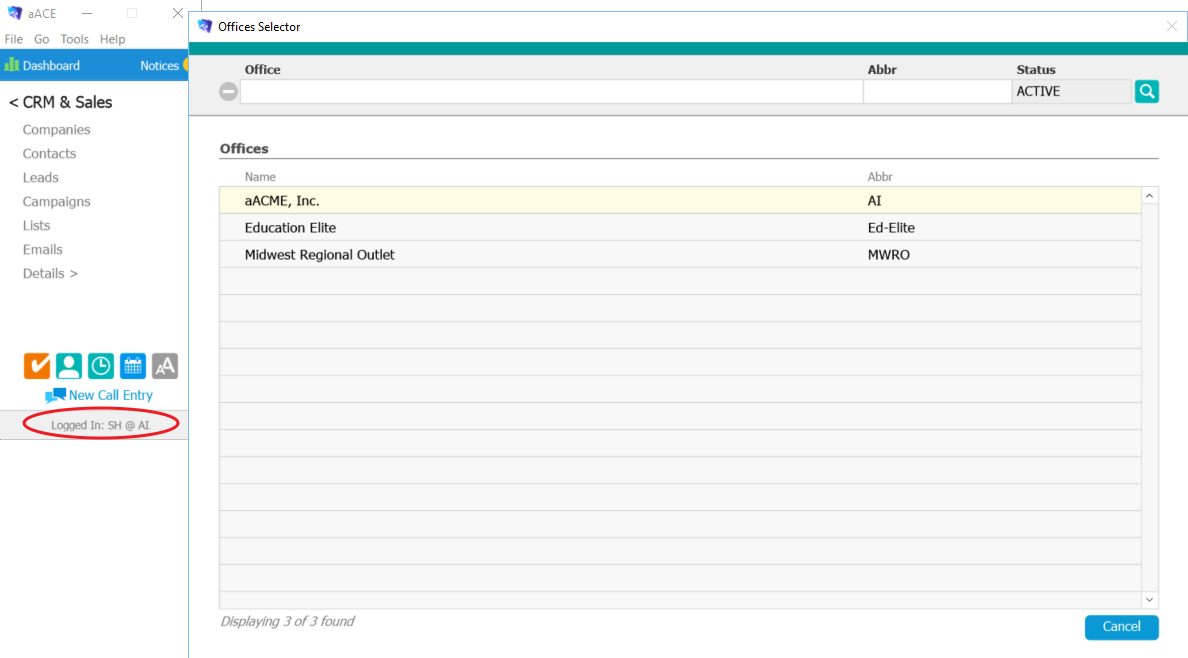

The disbursement volume is based on the office you are currently logged in under. To run the report for a different office, you must manually switch offices (if your account includes the "Can Switch Offices" access privilege) — click the office code at the bottom of the main aACE menu:

Launch the Disbursement Volume Report

- Navigate to CRM & Sales > Companies.

- In the menu bar, click Print > Open Report Selector.

- Click Vendor Disbursement Volume.

- At the tax year dialog, enter the desired year, then click OK.

- At the report title dialog, enter a name for this version of the report, then click Continue.

Find Companies with x Disbursement Volume

You can easily search for vendors based on their disbursement volume. At the bottom of the Companies module List View, click the link for Find Companies with x Disbursement Volume.

aACE prompts you for a tax year, a target disbursement volume, and (optionally) an office.

This search reviews the disbursements data for the year entered and returns a list of companies that have a total disbursement volume equal to or exceeding the value you specified.

Note: This search does not constrain your list to companies flagged as 1099. After you have the list, you can run the Update 1099 Setting for List process to set the 1099 flag on the companies. You can also further constrain the list to display all 1099 companies (see above).

Printing 1099s

From the Companies module Print menu, you can select Print Vendor 1099s for List.

aACE prompts you for a tax year and (optionally) an office.

The results for this printout are based on the currently displayed list. If you haven't already filtered the list for 1099 companies, you may have non-1099 companies in the printout. The value in Box 7 of the 1099 will be the total amount disbursed to the vendor for the tax year you specified.

Filing 1099s

There are many qualified companies who can assist you with filing 1099s. One that we have had positive experience with is eFile360.