Local, state, and federal tax rates may change and/or new ones may be implemented. To ensure that you're collecting proper tax amounts, you'll need to make these changes in aACE manually when a new tax rate takes effect.

It’s best to first deactivate the current tax profile, then create a new one. You can address part of this effort before the new tax rate takes effect, then complete the update after it takes effect.

Before a New Tax Rate Takes Effect

- Navigate to Accounting > Tax Profiles.

- Choose the relevant profile.

- Click Edit.

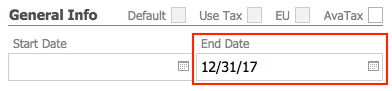

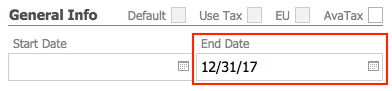

- Change the End Date to the last day the current tax rate will be in effect.

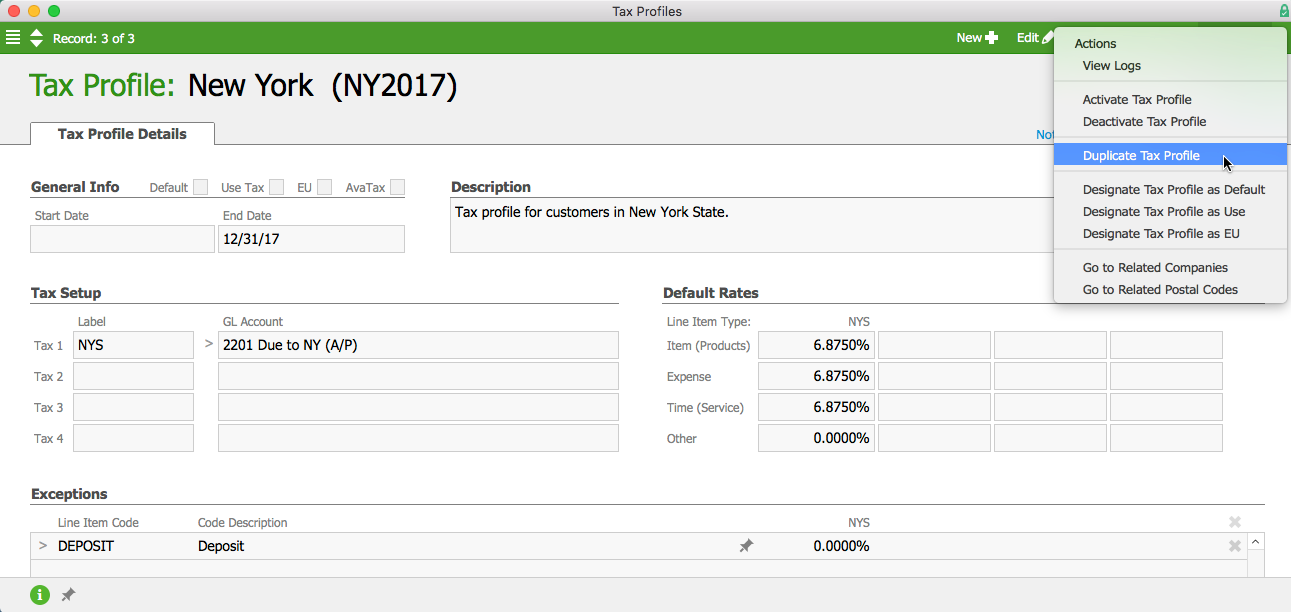

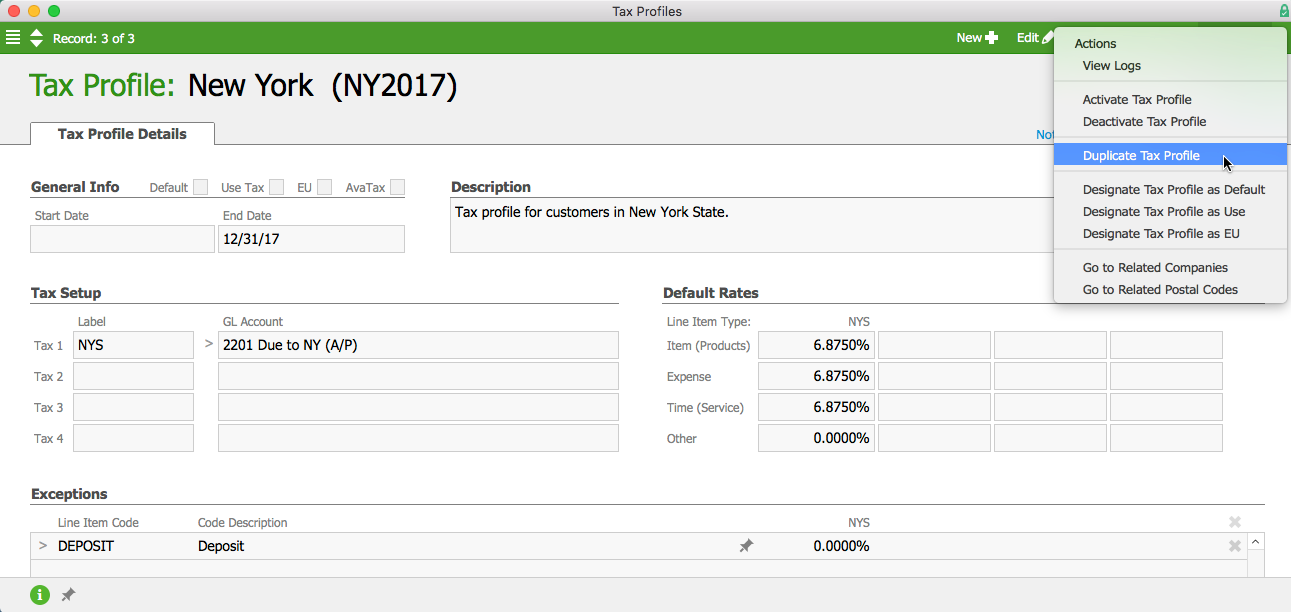

For instance, if the new tax takes effect on January 1, 2018, you would change the End Date to December 31, 2017. This will trigger a notification on that date, letting you know the tax profile is expiring and will need to be updated. Note: Setting this date will not automatically update the tax profile — it will simply remind you that this process (see next section) needs to be done manually. - Change the profile’s abbreviation to make it clear this profile is out of date (e.g. “x-NY” or “NY2017”). This will allow you to reuse the same code for the new tax profile.

- In the Actions menu, select Duplicate Tax Profile.

- In the confirmation dialog box, click Duplicate.

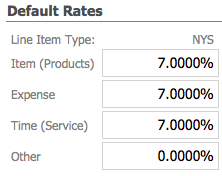

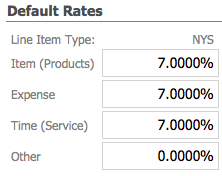

- On the new tax profile, enter the basic settings:

- Name - Enter the name from the original profile.

- Abbreviation - Enter the abbreviation from the original profile.

- Start Date - Enter the day the tax rate goes into effect (e.g. January 1, 2018).

- Enter the new tax rates in the Default Rates section.

After a New Tax Rate Takes Effect

When you receive the notification you set up with the process above, complete these additional steps:

- Navigate to Accounting > Tax Profiles.

- Select the old tax profile.

- Click Edit.

- If you have not already done so, complete steps 5-9 above.

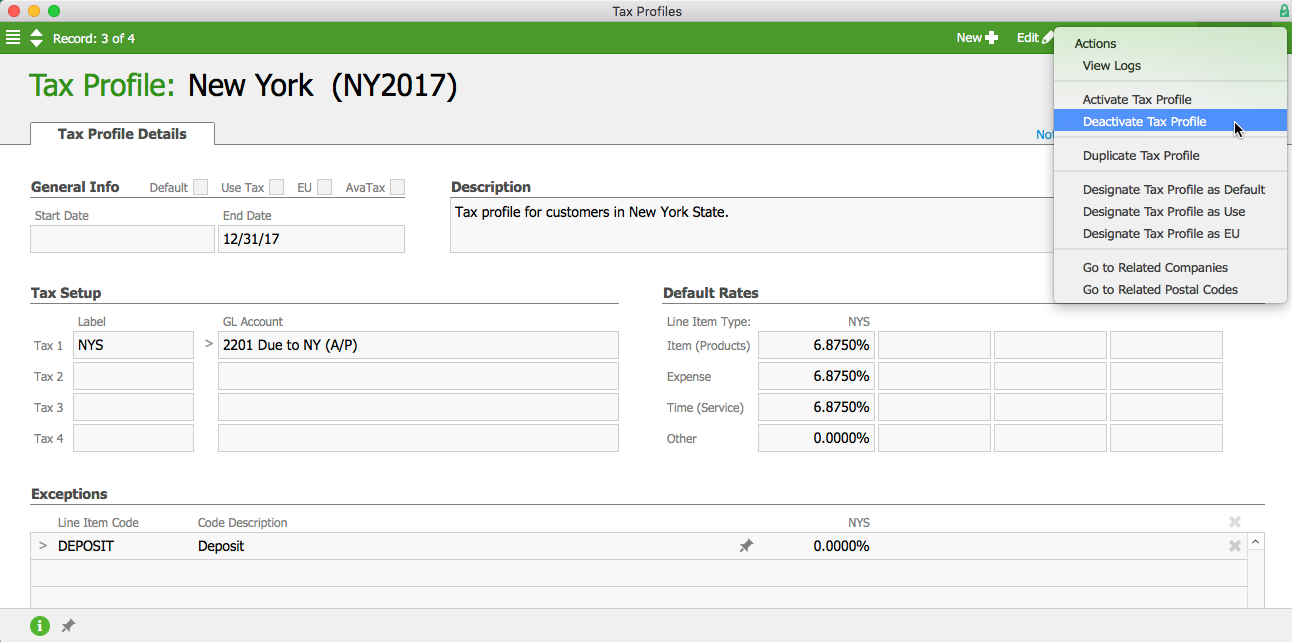

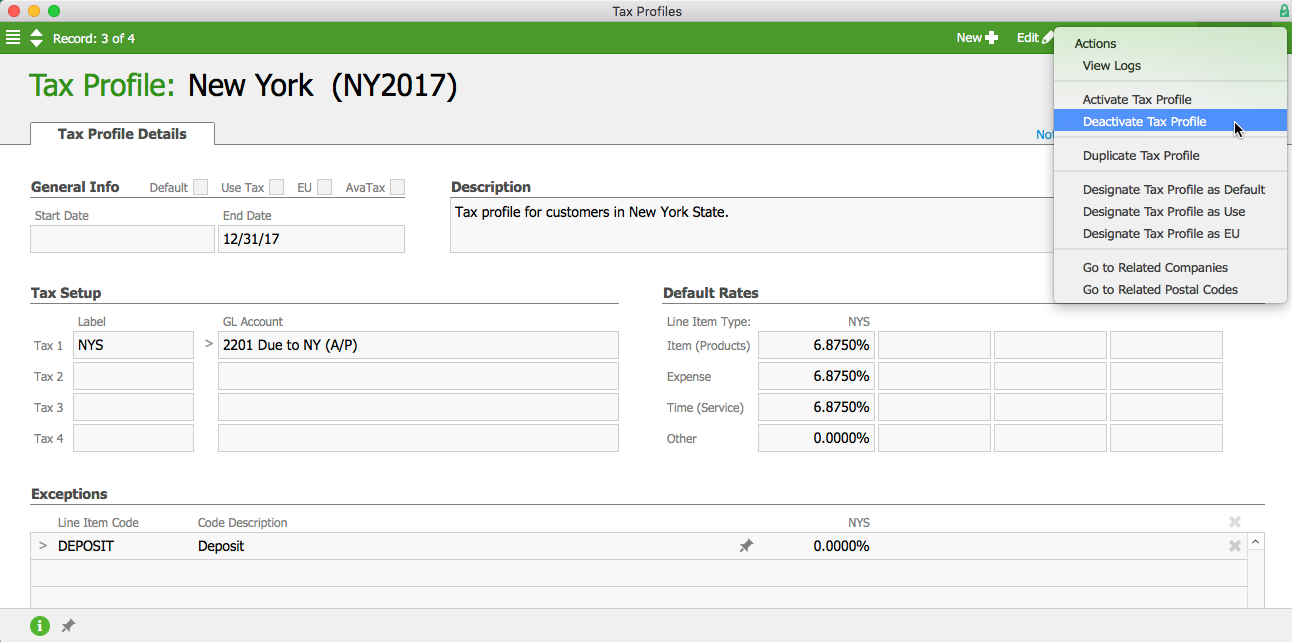

- In the menu bar, click Actions > Deactivate Tax Profile.

- At the prompt, update the related company records, assigning them to the new tax profile.