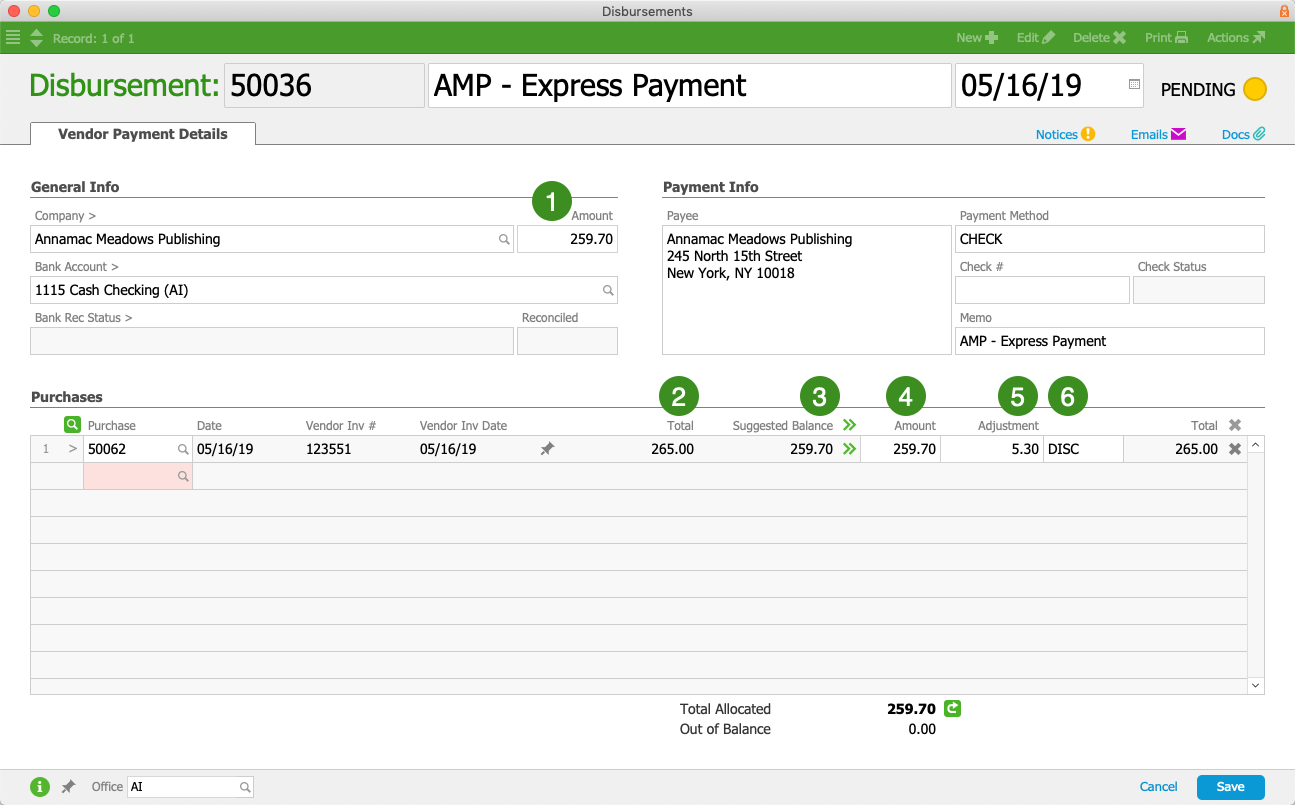

The Adjustment field in Disbursements can be used to account for early payments and other discount-taken scenarios. The Adjustment Code (#6 in the screenshot below) allows you to drive the discount to the applicable GL account. (Note: Your system administrator manages the adjustment codes.)

As an example, you might have an outstanding purchase to a vendor for $265.00, with terms of Net 10 2%. You could opt to take advantage of the early payment discount, sending a check for the discounted amount of $259.70. The disbursement entered in aACE would look like the following screenshot:

General Info Section

- Amount — The payment that will go to the vendor

Purchases Section

- Total — The full amount from the original purchase record

- Suggested Balance — aACE's calculation of the amount due

- Amount — The amount you are paying toward the purchase's balance

- Adjustment — The amount you are applying to the purchase's balance as a discount of some sort (see Adjustment Code below)

- Adjustment Code — A dropdown menu that becomes active after an amount is entered in the Adjustment field. This allows you to specify the reason for each adjustment.

Accounting Impact of Adjusting a Disbursement

When you post an adjusted disbursement:

- The Total will debit the A/P Account.

- The Amount will credit the Bank Account.

- The Adjustment will credit the Disbursement Adjustments (Discounts Taken) Account associated with the selected adjustment code.

- The Total will be applied towards the related purchase's balance. If the purchase is fully paid, it will be automatically closed.