Payments with Automated Clearing House (ACH) are processed through aACE's integration with Global Payments Integrated (GPI). The GPI secure payment processing service stores all sensitive account data, then provides a randomly generated alias (or "token") for use in future aACE transactions (unless your system has been configured otherwise).

About ACH

ACH is an electronic network for financial transactions in the United States. ACH payments are possible when a customer gives you authorization to debit directly from their checking or saving account. To use this method, you must first obtain the customer's routing number and account number.

Note: While credit cards are able to obtain an alias without processing a payment, ACH does not process information that way. You must fully process a payment in order to obtain the alias for future use. A typical workaround that companies use for ACH is to process a payment for a few cents in order to obtain the alias.

Apply a Customer Payment to an Order

- In the Orders module, locate the desired Open order that has a payment due.

- On the detail view, next to the Payment Due field, click the Plus (

) icon.

) icon.

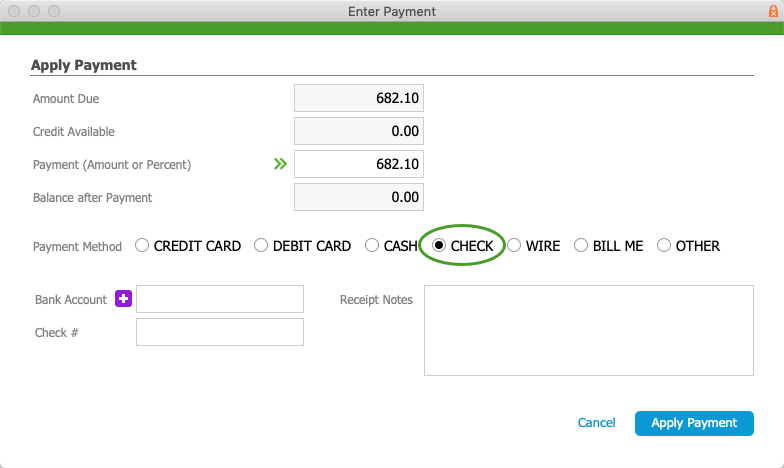

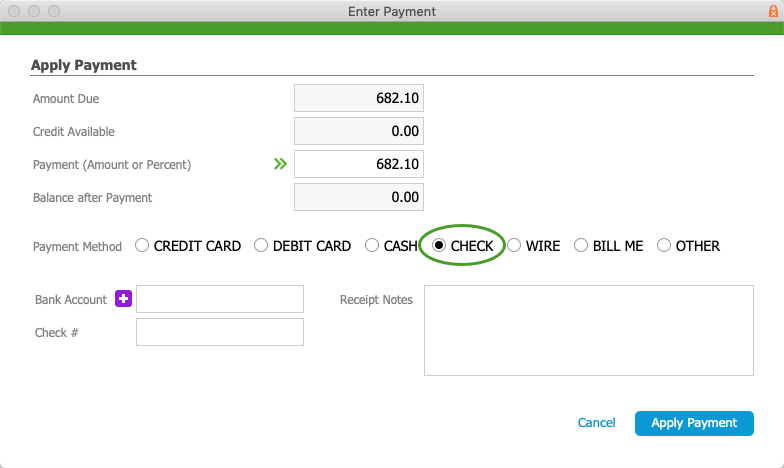

- At the Enter Payment window, verify the Amount Due, then select Check.

- Specify the Bank Account:

- If an alias already exists, select it from the dropdown list.

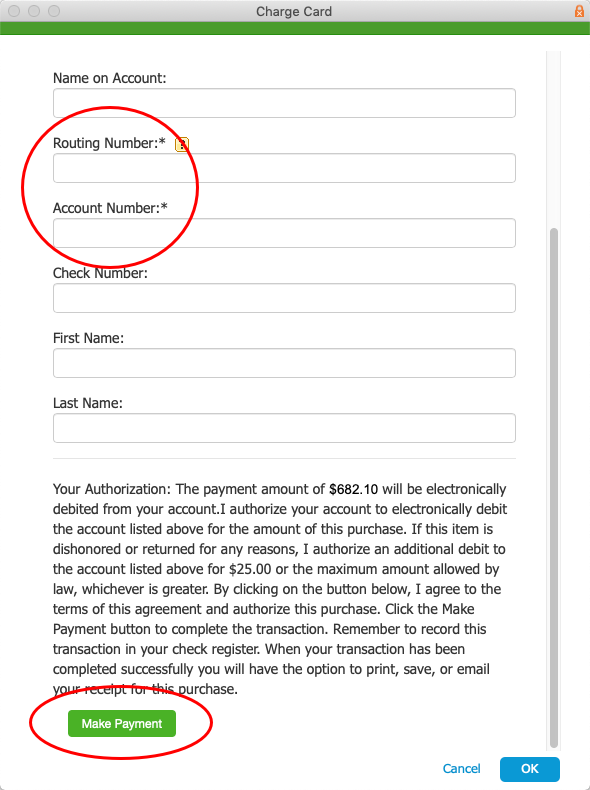

- If an alias is not stored in aACE for this account, click the Plus (

) icon, enter the Routing Number and Account Number, then scroll down and click Make Payment.

) icon, enter the Routing Number and Account Number, then scroll down and click Make Payment. This submits the account information to GPI to validate the account, authorize the charge, and capture the funds.

This submits the account information to GPI to validate the account, authorize the charge, and capture the funds.

Warning: You cannot cancel the ACH payment after you click Make Payment. Instead, you would have to refund the payment amount.

- At the Transaction Result dialog, click OK.

The Check # field displays a check number that was randomly generated by GPI. - On the aACE Apply Payment dialog, click Apply Payment.

aACE stores the account alias and posts the receipt.

) icon.

) icon.

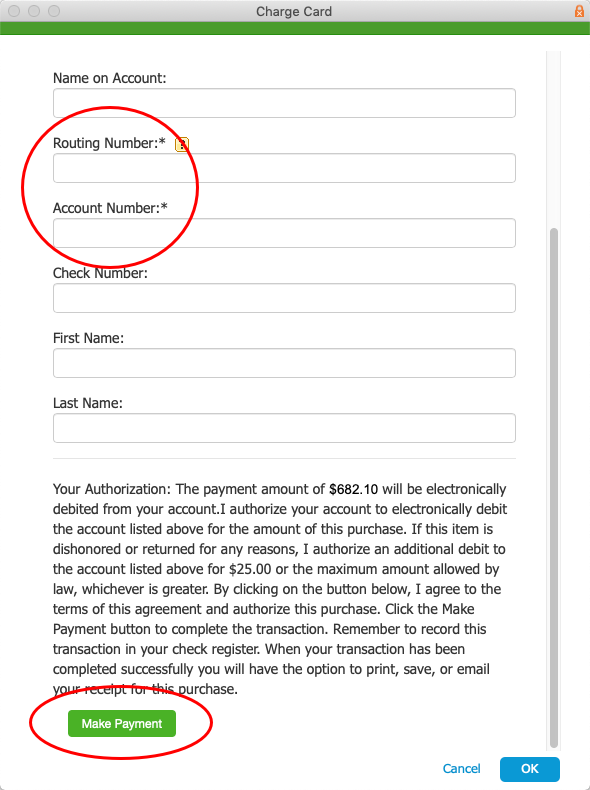

) icon, enter the Routing Number and Account Number, then scroll down and click Make Payment.

) icon, enter the Routing Number and Account Number, then scroll down and click Make Payment. This submits the account information to GPI to validate the account, authorize the charge, and capture the funds.

This submits the account information to GPI to validate the account, authorize the charge, and capture the funds.