At times you may have one or more balances for invoices that will not be paid and need to be zeroed out. Depending on your company policies and the specific details of the situation, you can resolve this issue in three ways:

- Crediting an invoice — Useful for adjusting a specific invoice

- Creating a receipt that includes a bad debt adjustment — Useful for quick corrections in simple scenarios

- Creating a credit invoice to reverse a batch of invoices — Useful for adjusting larger numbers of invoices

Crediting a Specific Invoice

When you have a single invoice to consider, you can create a credit/adjustment invoice to eliminate the bad debt. Using an adjustment invoice will keep a clear history on the order, will update the sales tax amounts appropriately, and will result in accurate sales amounts.

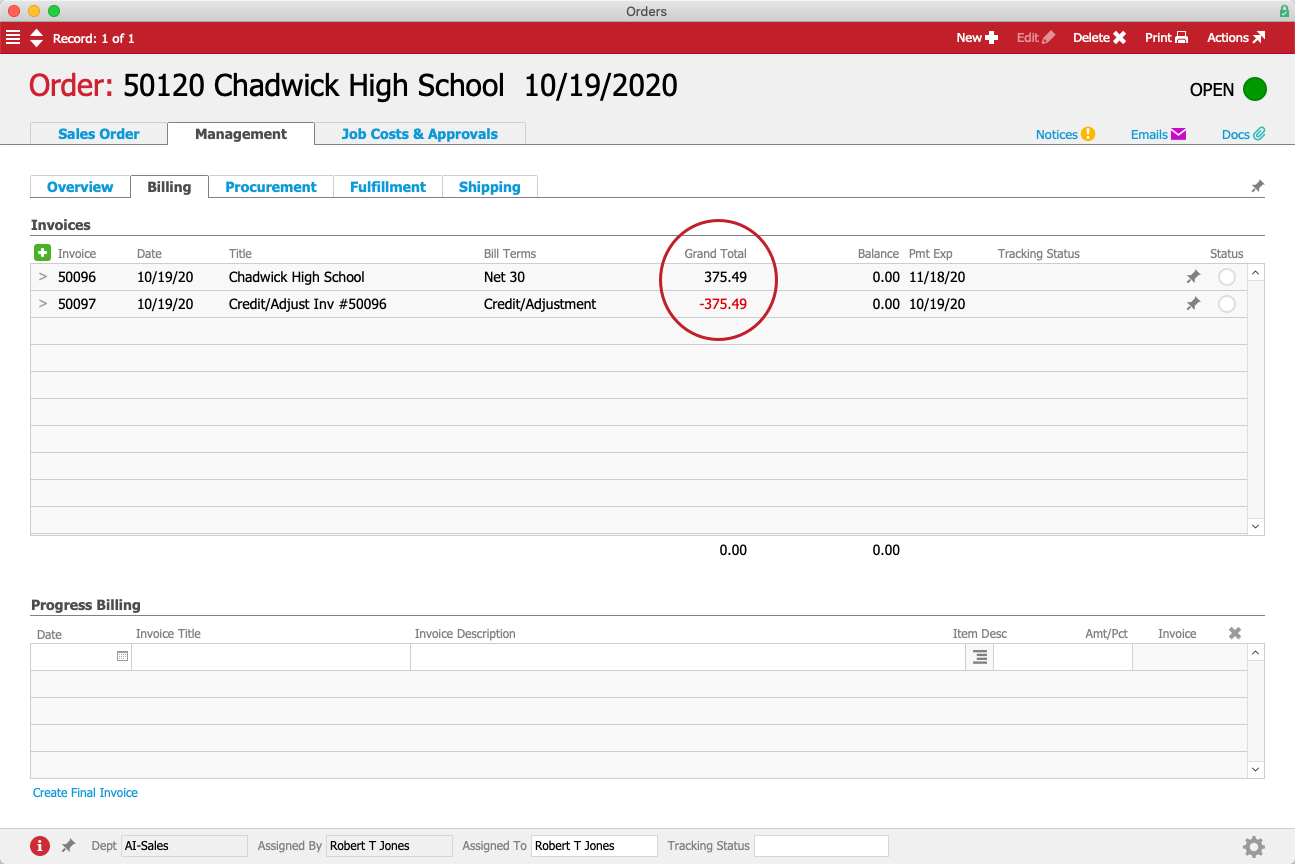

The invoicing history for an order where the original invoice was reversed in its entirety might look like this:

Using the Adjustment Column in Receipts

When you have only a few invoices to consider, involving relatively small adjustment amounts, and sales tax values are not a concern, you can apply an adjustment on a receipt item. This will change the amount applied to the balance of the related invoice. This is a quick method for resolving bad debt; however, it does not reduce the tax liabilities of the bad debt.

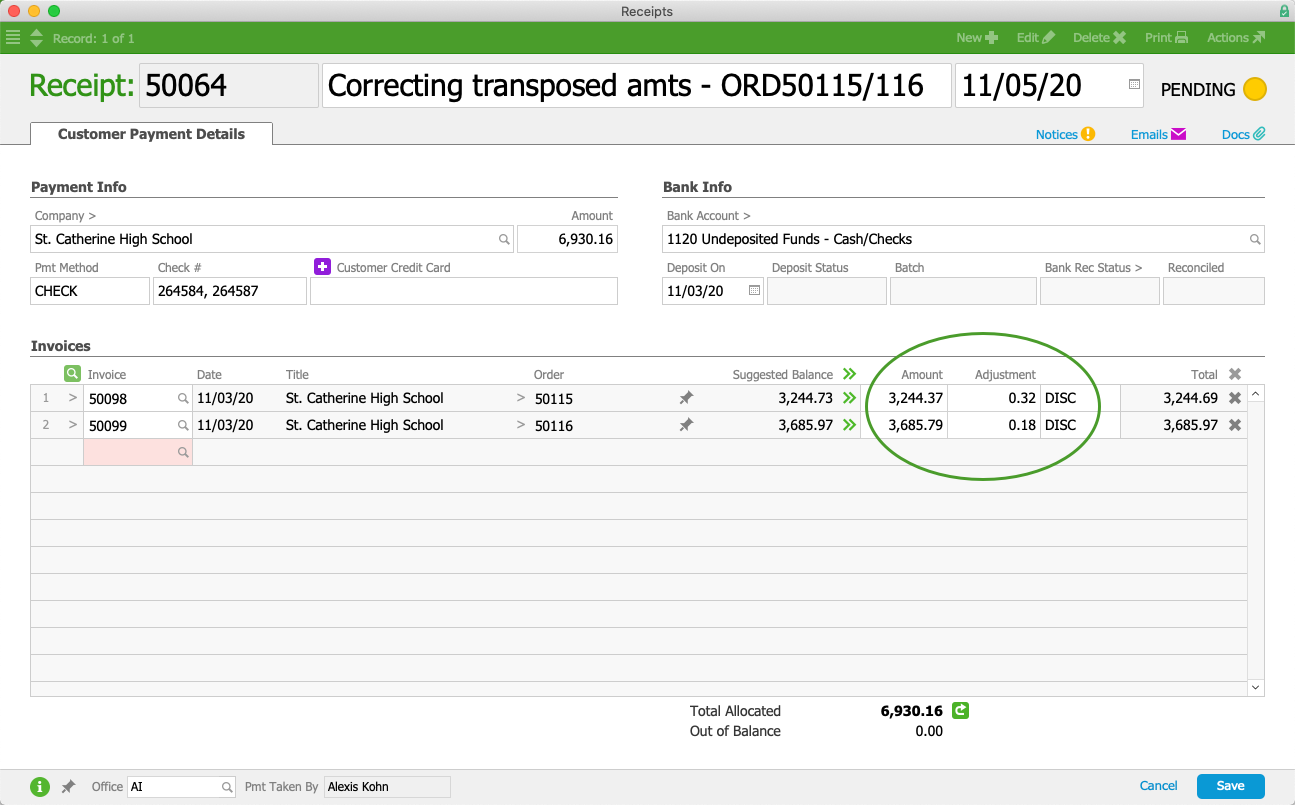

For example, suppose a certain customer repeatedly transposes numbers on payments. In paying two invoices for $3,244.73 and $3,685.97, they have sent checks for $3,244.37 and $3,685.79. Posting these checks would result in the invoices remaining open with balances of $00.32 and $00.18. To resolve the issue, the A/R rep would receive the two checks as they are written, then record the imbalance amounts in the Adjustment column as discounts given to the customer:

When the A/R rep posts this receipt, the invoice balances will be zero. (For other details of the accounting impact, see our guide on using the adjustment column in receipts.)

Using a Credit Invoice

When you need to write off a larger number of invoices or debit multiple GL accounts, and also need to reduce the sales tax liabilities of the bad debt, you can use this two-step process.

First, create a credit invoice that includes negative values for the sum total of what is being written off (e.g. -3 widgets assigned the correct tax profile). This invoice posts the total negative amounts to the appropriate GL Accounts. Second, use a zero-value receipt to 'pay' both this credit invoice and the bad debt invoices that need to be zeroed out. (Note: This second step is identical to moving a payment.)

You can construct your credit invoice in two ways, depending on your business needs and policies:

- Write off the bad debt using specific line item codes (LICs) and tax profiles — This creates a 'summary' invoice using the details from all the invoices you are writing off.

- Write off the bad debt using a generic LIC for "Bad Debt" and a generic LIC for "Tax Lines" — This streamlines the process, while still ensuring that the values are attributed to the appropriate GL accounts.

Write Off Bad Debt Using Specific LICs

Using the specific LICs from the bad debt invoices is helpful because it drives the negative values to the separate GL accounts.

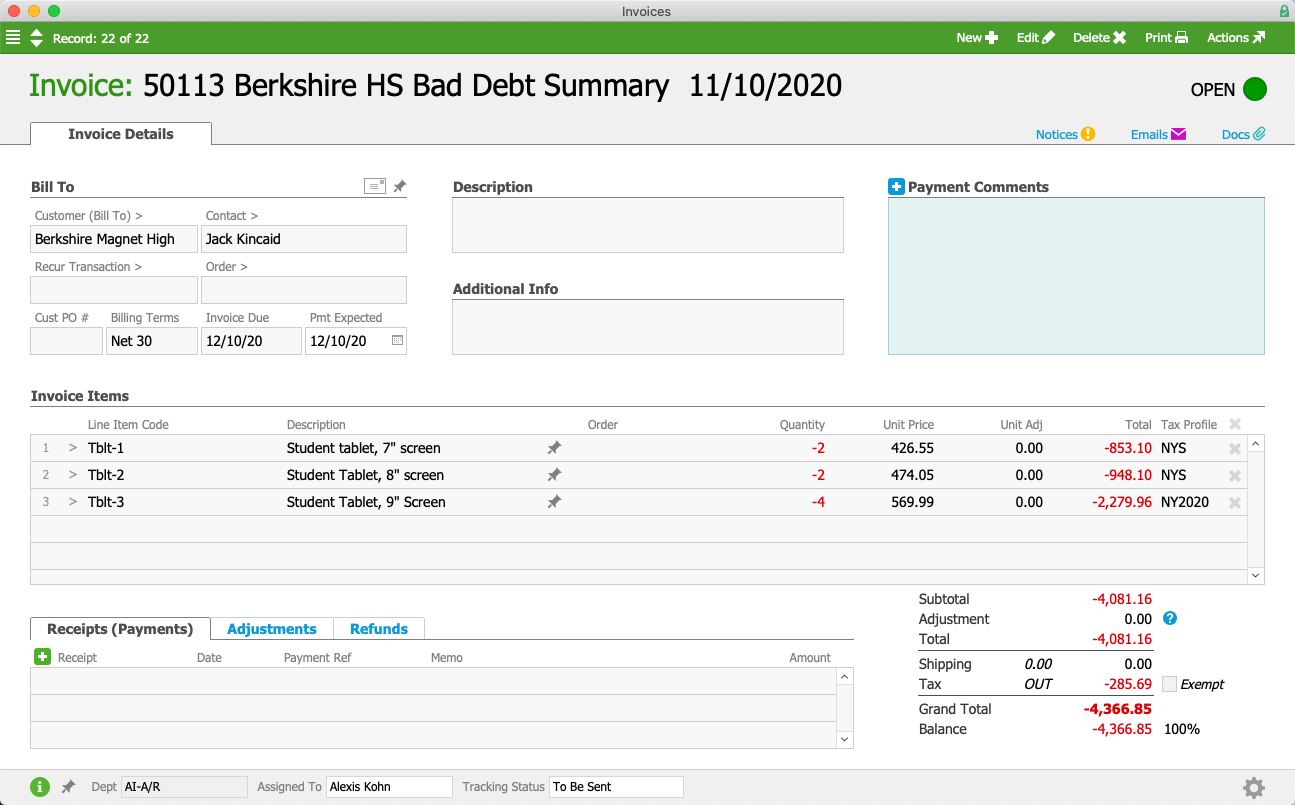

For example, suppose a customer went bankrupt, leaving several outstanding invoices, totaling $4,366.85. Your A/R rep would create a new credit invoice that 'summarizes' the customer's bad debt:

- Date — Must reflect the accounting period in which you are recording the bad debt.

- LICs — Populated with the specific items being written off (i.e. all LICs that were included on all the bad debt invoices).

- Quantities — Converted to negative values (e.g. a bad debt invoice with 10 textbooks should be reflected in the summary invoice as -10 textbooks).

- Unit Prices — Matched to those used on each of the bad debt invoices.

- Tax Profiles — Matched to those used on each of the bad debt invoices.

- Tax Exempt Flag — Cleared so the specified tax profiles will be applied.

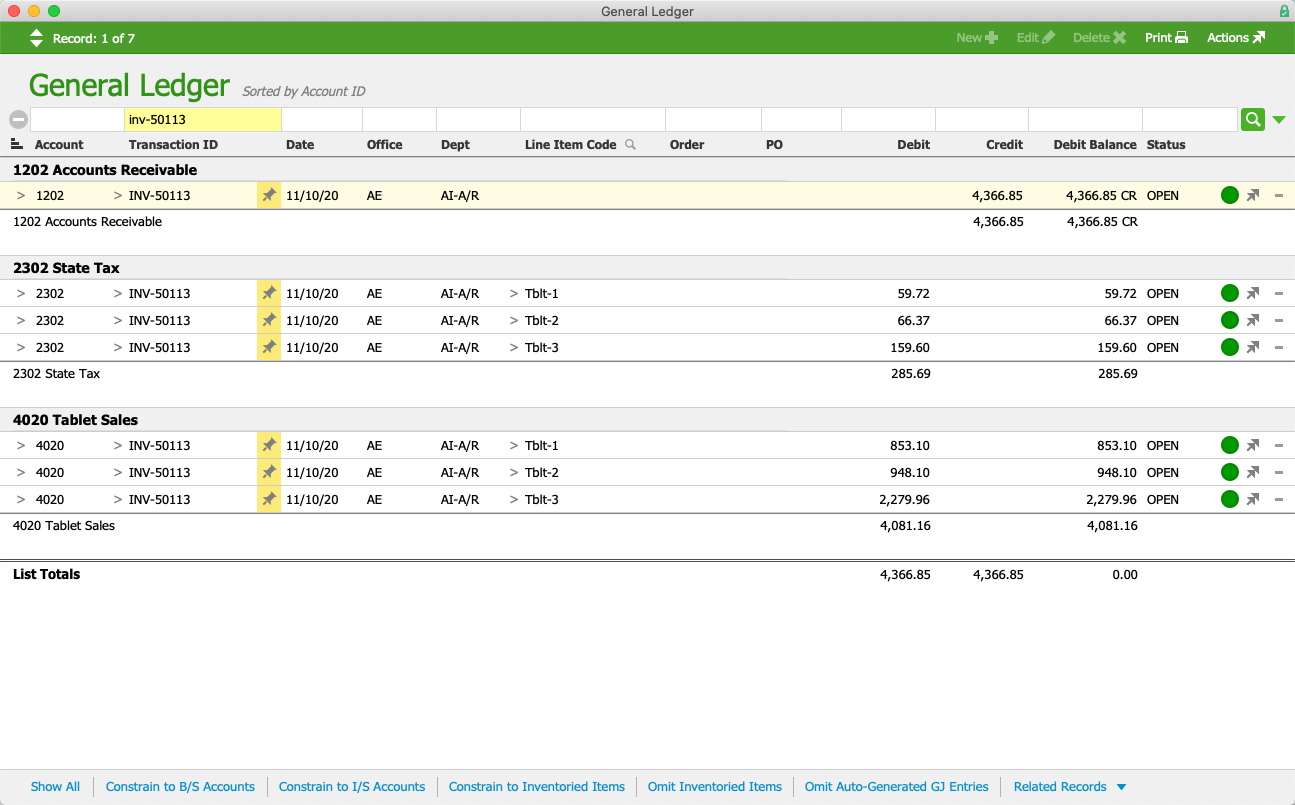

When the A/R rep saves and opens the credit invoice, it would result in general ledger entries that reverse the values for each LIC/tax profile combo.

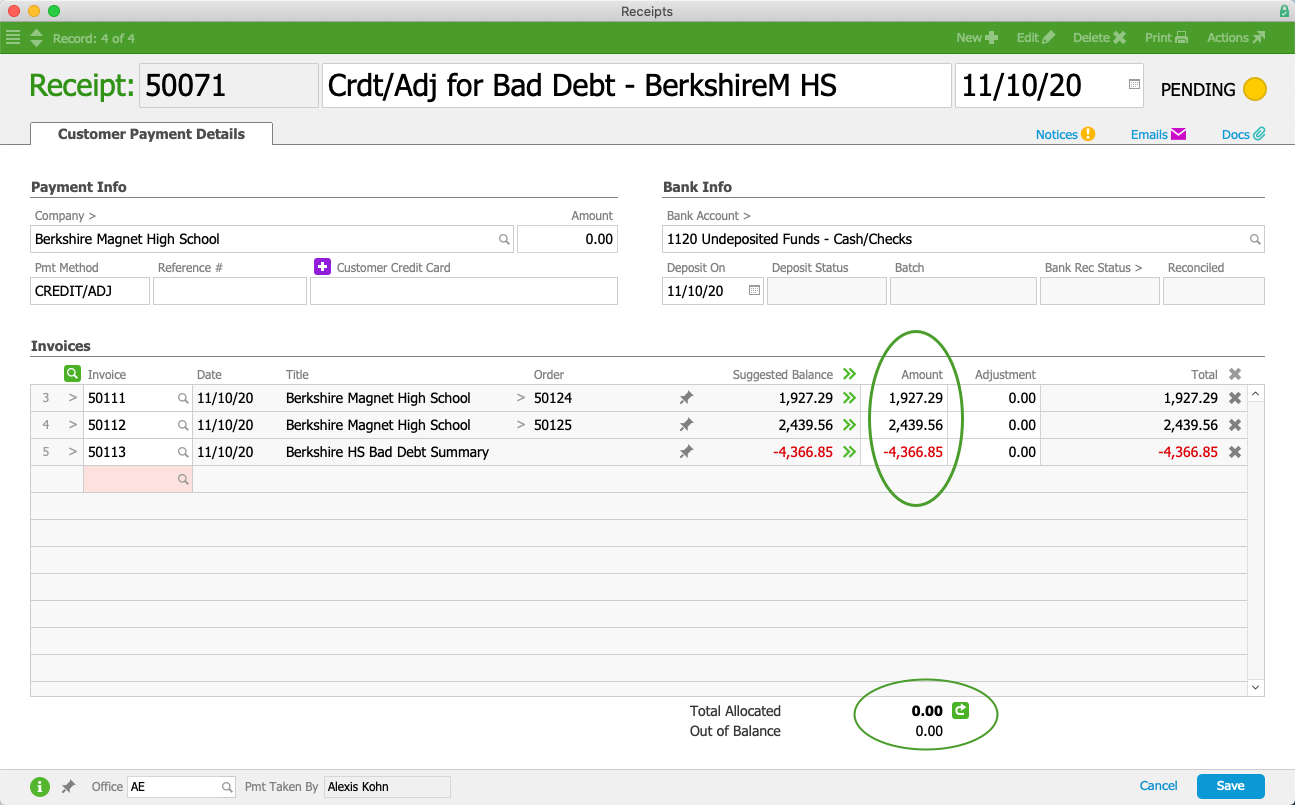

Next, the A/R rep would create a new customer payment at the Receipts module. This credit/adjustment receipt should have an Amount of $0.00, and should include all the bad debt invoices plus the new credit invoice. (Note: This step is identical to moving a payment.)

Write Off Bad Debt Using a Generic Bad Debt LIC

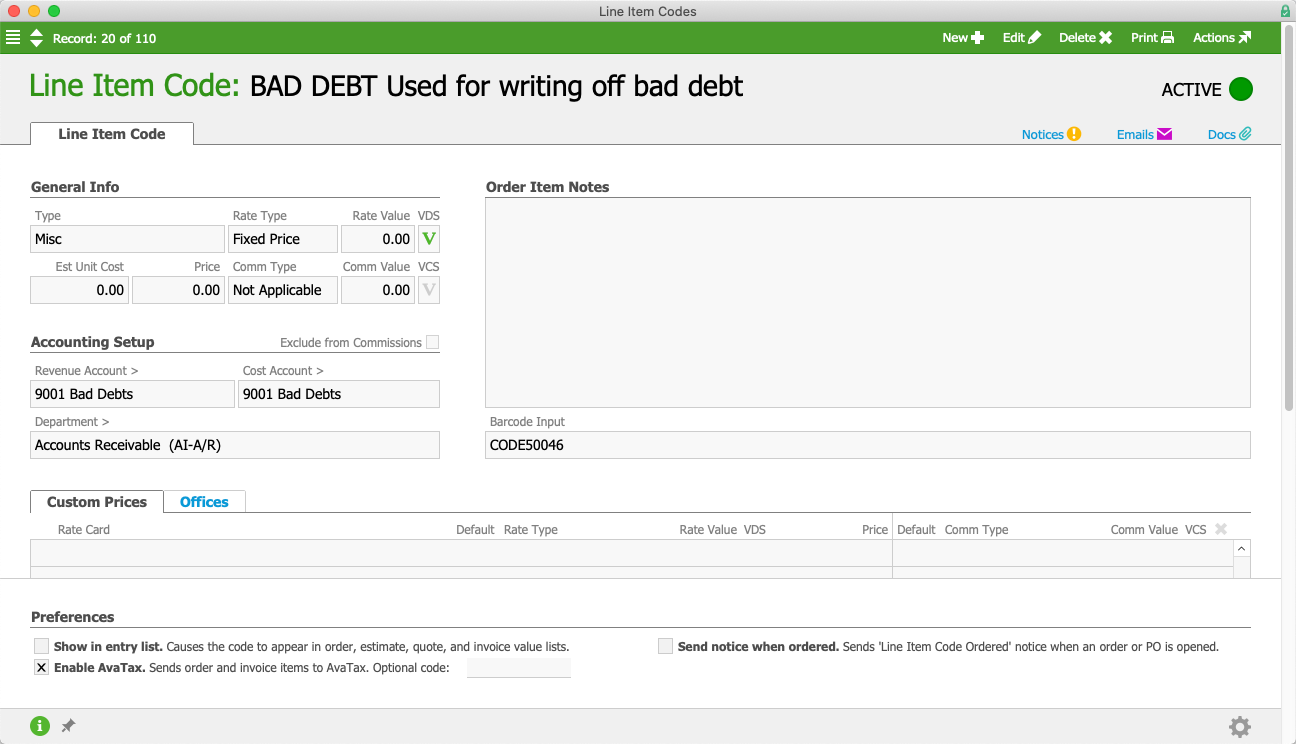

Using a single LIC streamlines the process of writing off a batch of invoices, attributing the value to a single GL account. Before using this method, verify whether your system already includes a "Bad Debt" LIC for this purpose. If it does not, ask your system administrator to create one similar to this example. (Note: The Revenue Account should reference the account in the GL where bad debts accrue.)

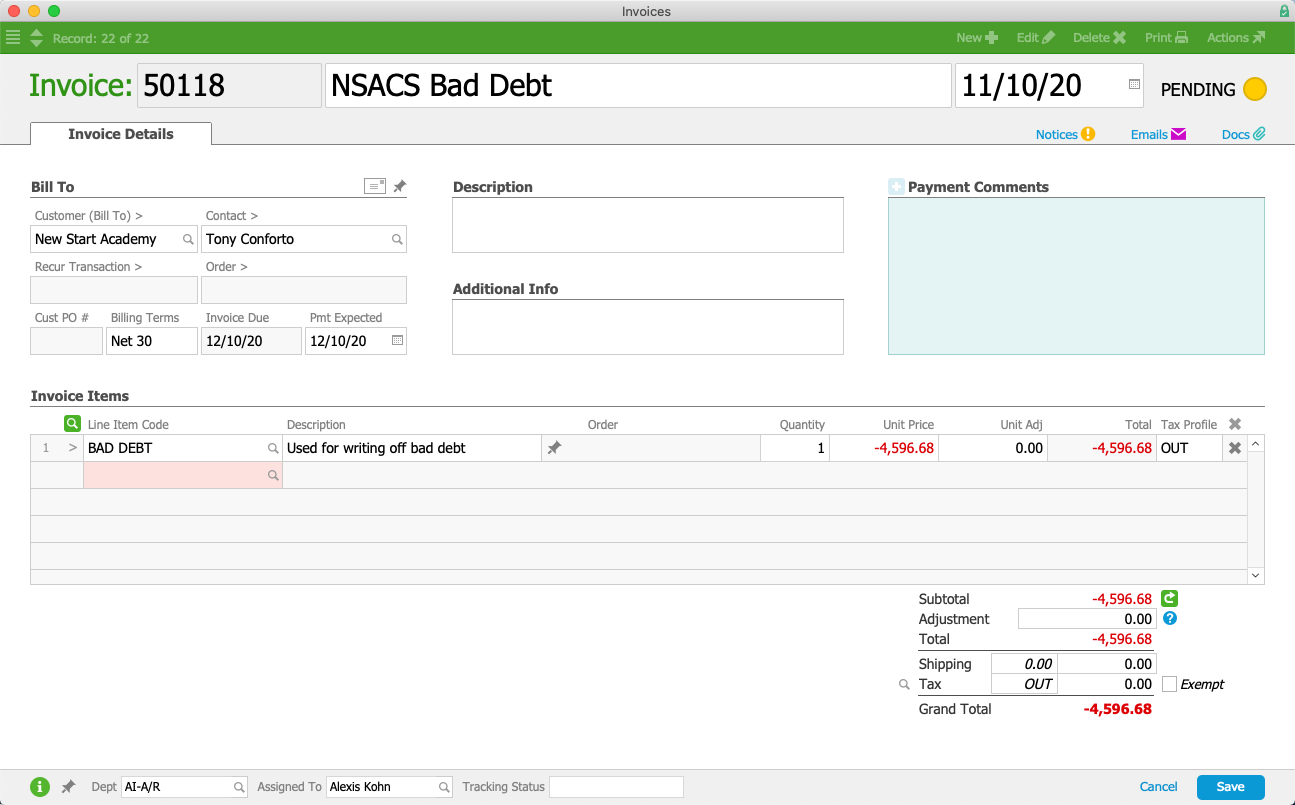

As an example of using this method, suppose you need to zero out multiple invoices for a customer that total $4,596.68. Your A/R rep would create a credit invoice for that customer:

- Date — Must reflect the accounting period in which you are recording the bad debt.

- LICs — Populate it with the single LIC for Bad Debt.

- Quantity — Set to one.

- Unit Price — Enter a negative value equal to total of the invoices you are writing off.

- Tax Profiles — Leave the default setting. Usually Other-type LICs would use a 0% tax rate.

Note: If you need to also reduce sales tax liabilities, use a separate line on the invoice. (See below for details.)

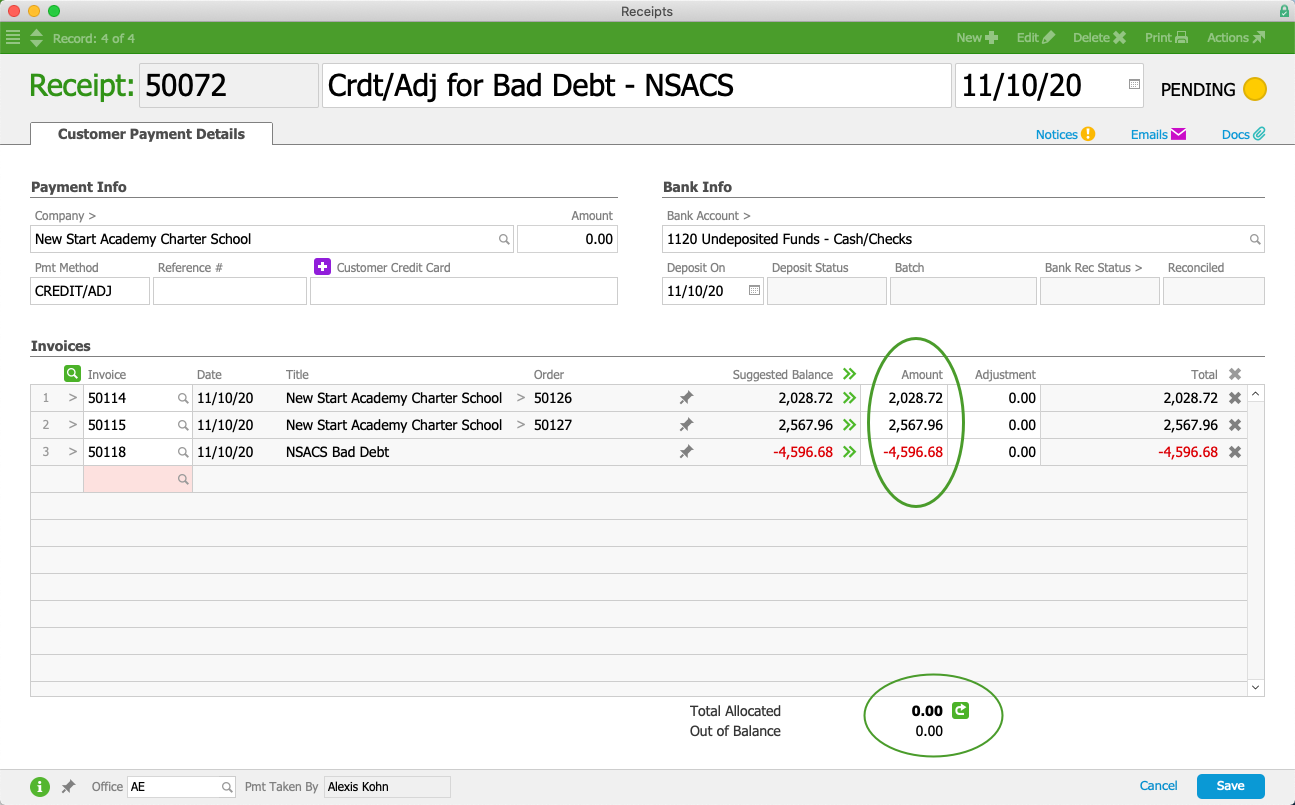

Next, the A/R rep creates a new customer payment from the Receipts module. This credit/adjustment receipt should should have an Amount of $0.00, and should include all the bad debt invoices plus the new credit invoice. (Note: This step is identical to moving a payment.)

Notes about Taxes

Organizations that collect sales tax may also need reversing entries for tax accounts in order to avoid paying sales taxes on bad debt. Be mindful if using either of the last two methods (i.e. creating a receipt that includes a bad debt adjustment and creating a credit invoice to reverse a batch of invoices).

If adjustments to sales tax accounts are required, your system administrator can create generic LICs for each tax jurisdiction. These should be Other-type LICs, leaving the default 0% tax rate for all tax profiles. When your A/R rep creates a credit invoice, he should add a line for each applicable tax jurisdiction, entering the correct tax amount with detailed notes.