This guide explains how to make adjustments to the amount on a receipt. It is intended for basic users.

Adjustments on a receipt record can be used to account for early payments and other discount-given scenarios. The Adjustment Code column allows you to drive the discount to the applicable GL account. (Note: Your system administrator manages the adjustment codes.)

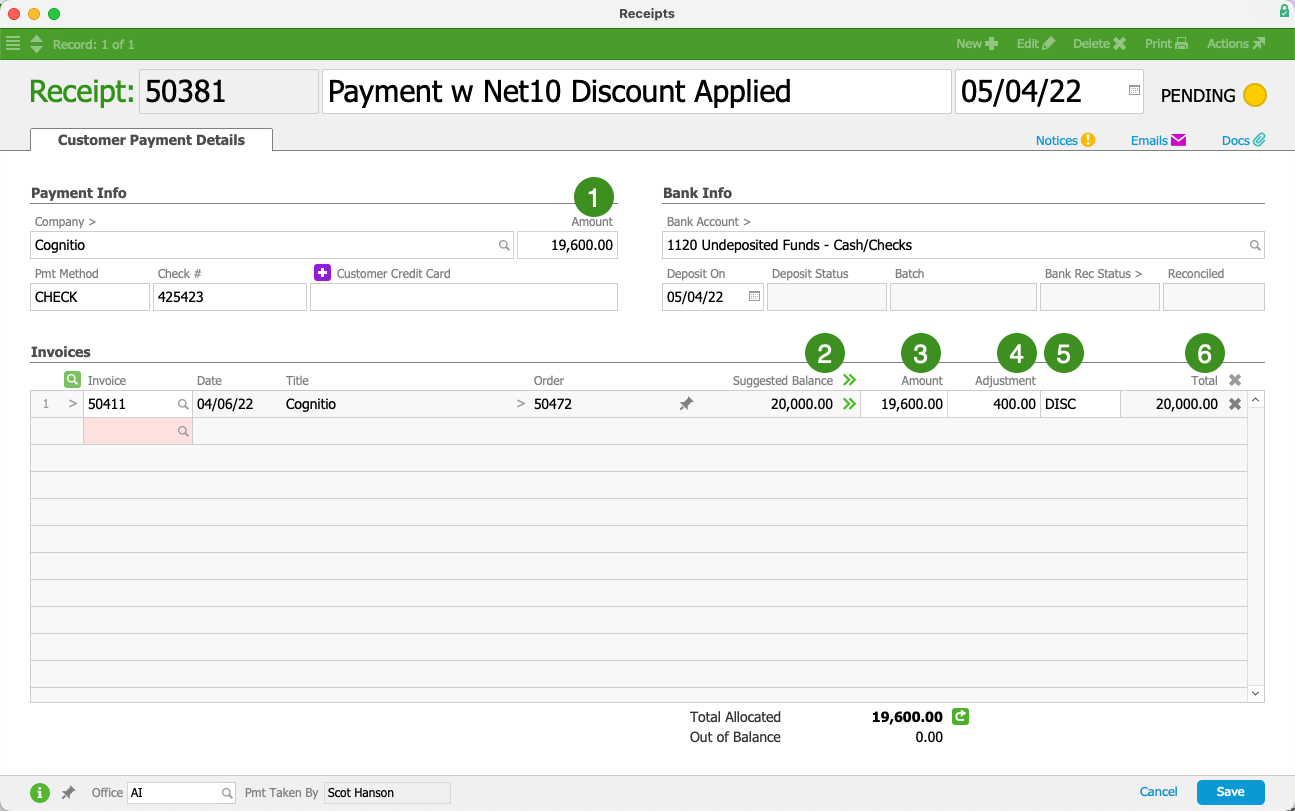

As an example, suppose you had an outstanding invoice for $20,000.00, with terms of Net 10 2%. The customer opts to take advantage of the early payment discount, sending a check for the discounted amount of $19,600.00. Your A/R rep would create a new customer payment in aACE similar to the following screenshot:

Payment Info Section

- Amount — The reduced amount that the customer is paying

Invoices Section

- Suggested Balance — The amount due on the initial invoice

- Amount — The amount you are receiving towards the invoice's balance

- Adjustment — The amount you are discounting from the invoice's balance

- Adjustment Code — A dropdown menu to specify the reason for each adjustment

Note: This field becomes active after you enter an amount in the Adjustment field. System administrators can add other adjustment codes to this value list. - Total — The total value you are applying to the invoice's balance (amount + adjustment)

Additional Examples

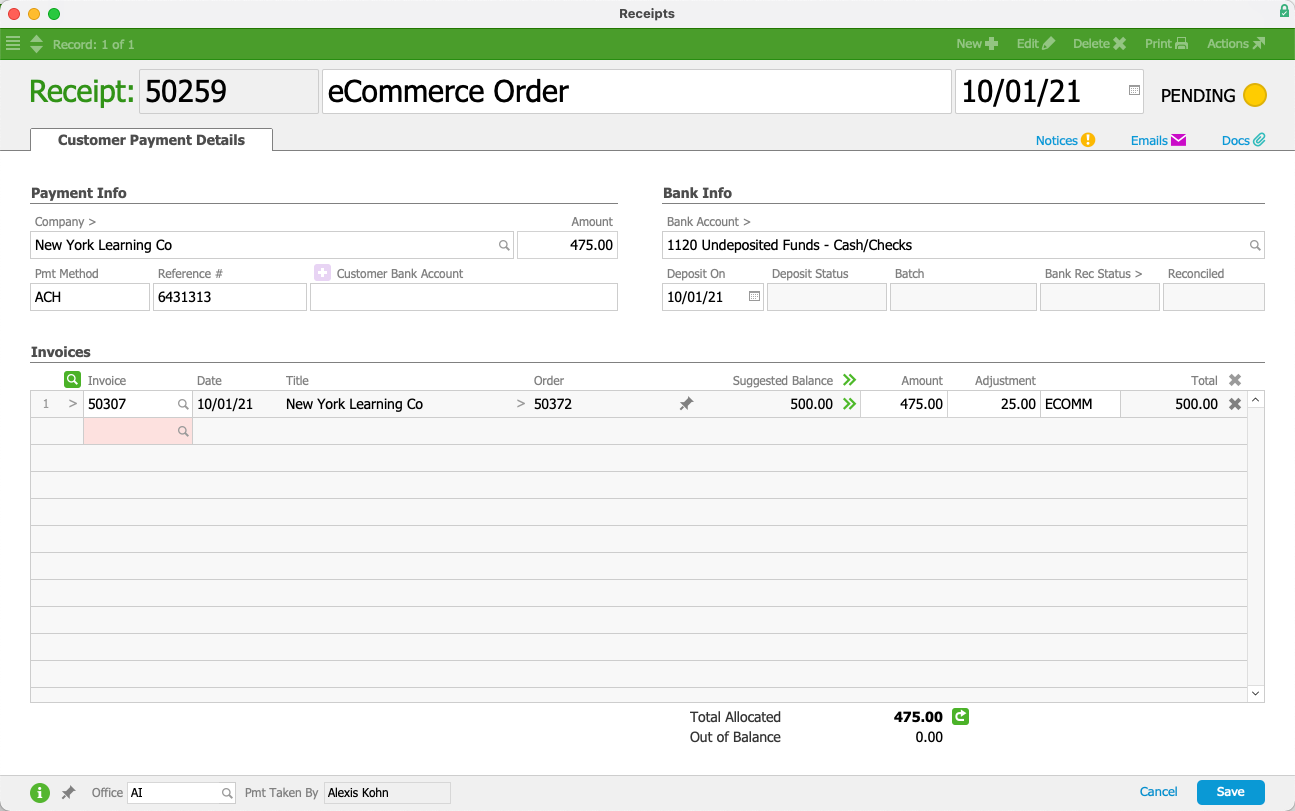

Another common scenario comes from an ecommerce provider that levies a fee on each order. If you sold $500.00 worth of product on an online order, but the ecommerce provider charged $25.00 for that order, you would only receive $475.00. The ecommerce fee should be recorded as an adjustment:

Accounting Impact of Adjusting a Receipt

When you post an adjusted receipt:

- The Total will credit the A/R Account.

- The Amount will debit the Bank Account.

- The Adjustment will debit the Receipt Adjustments (Discounts Given) Account associated with the specified adjustment code.

- The Total will be applied towards the related invoice's balance. If the invoice is fully paid, it will be automatically closed.