This guide explains functionality that aACE provides for managing multiple business entities. It is intended for advanced users.

aACE can help you segregate people, products, and financials across different business entities, different locations, or even different brands. For an example of how this feature can help your team, read our feature highlight.

Multiple Companies

The Offices module enables you to organize one or more companies operating from one or more locations. You can set up each office record as a distinct business entity, including a separate tax ID, address, logo, etc.

Team Members

Personnel at each location will have Team Member records assigned to the corresponding office. A user's current office assignment is displayed in the footer of the Main Menu. The User Groups module helps you control whether team members can view records from other offices or even switch to a different office for the current session in aACE.

Line Item Codes (LICs)

Each of your products in aACE are associated with an office. You can manage the office-specific settings of LICs so they display for certain offices.

Orders

An order record is initially associated with the current office of the team member who generates it. However, offices are derived from departments. This means you can manually change an order's office association by specifying a different department.

Inter-Office Inventory

Sometimes product purchased at one location must be transferred to a location where the demand is greater. With aACE's data entry preferences for Accounting, you can prevent one office from being expensed for another office's use of inventory. In the Inventory section, mark the flag to 'Prevent inter-office COGS transactions' and then click Commit Updates.

In contrast, with this flag for inventory cleared, you can set up your system for inter-office accounting (see below).

Accounting

GL Accounts

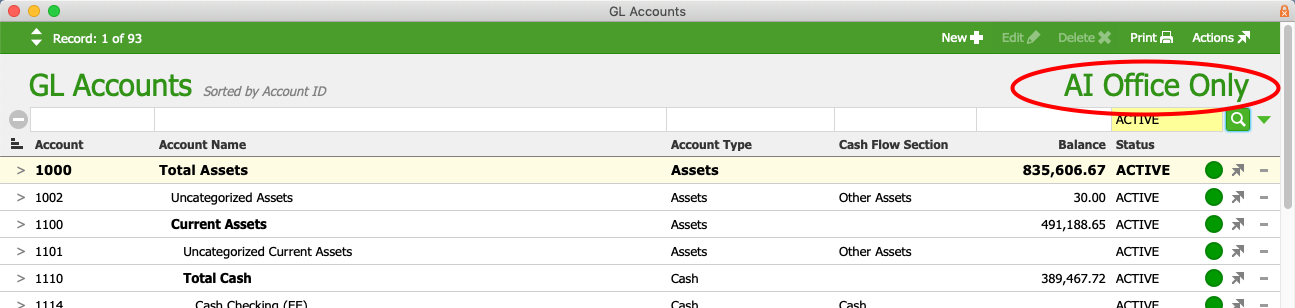

You can configure aACE to show account balances associated with all offices at once or to only show balances for a user's current office assignment.

Navigate from Main Menu > Accounting > Preferences > Data Entry > Multi-Office Preferences section. Mark the flag to 'Manage office general ledgers separately'. When this flag is marked, your system filters the general ledger to show only the transactions for the current office. aACE displays a header above the GL transactions list to remind users which office is being displayed:

Note: Users with certain User Group privileges may be able to switch between offices at the Main Menu. After switching, they can view the GL Accounts for the new office.

Inter-Office A/P and A/R Accounts

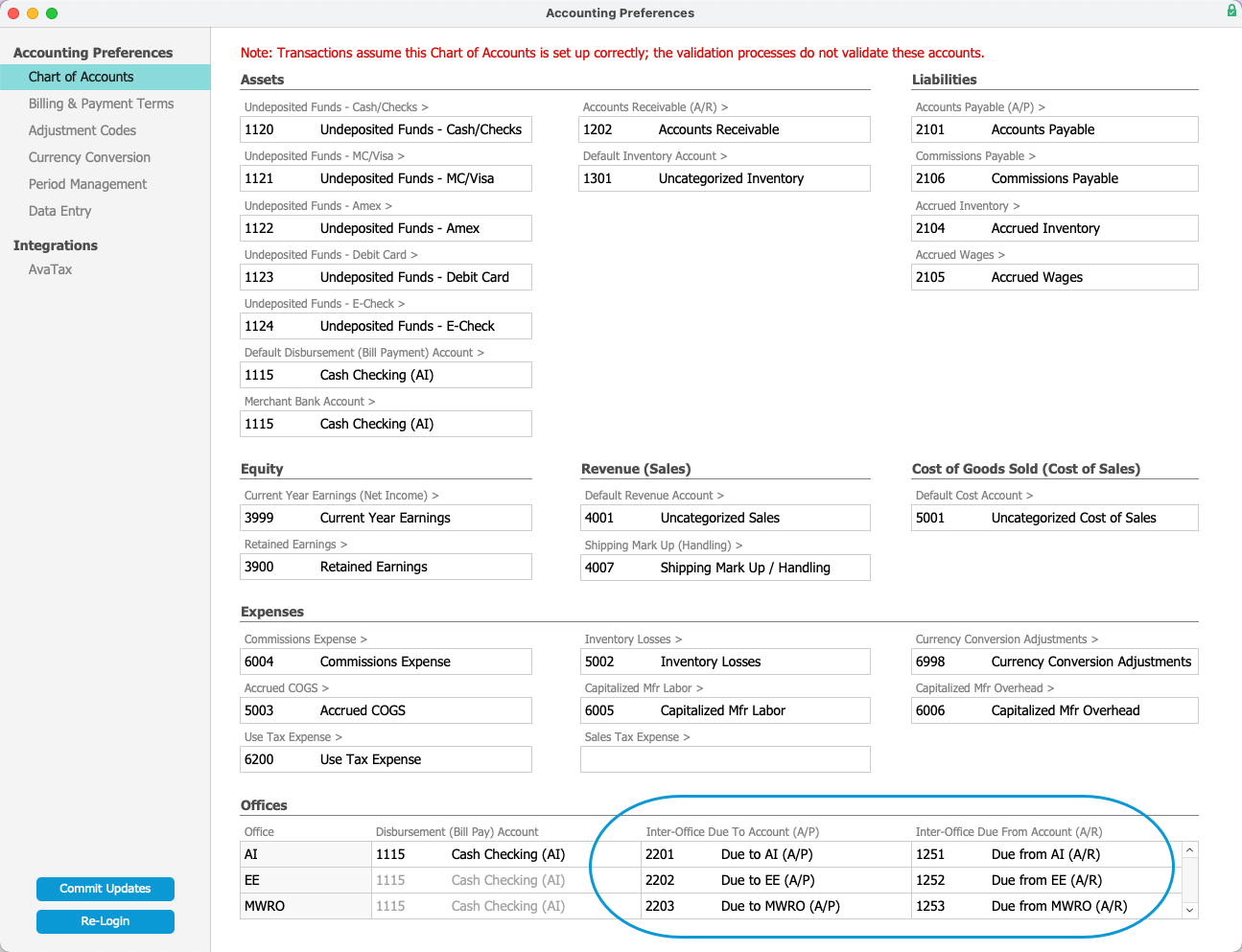

When your separate offices will be conducting internal transactions, you can set up accounting preferences to help track these exchanges.

- Navigate from Main Menu > Accounting > GL Accounts.

- For each office you have created for your organization, create an A/P account and an A/R account.

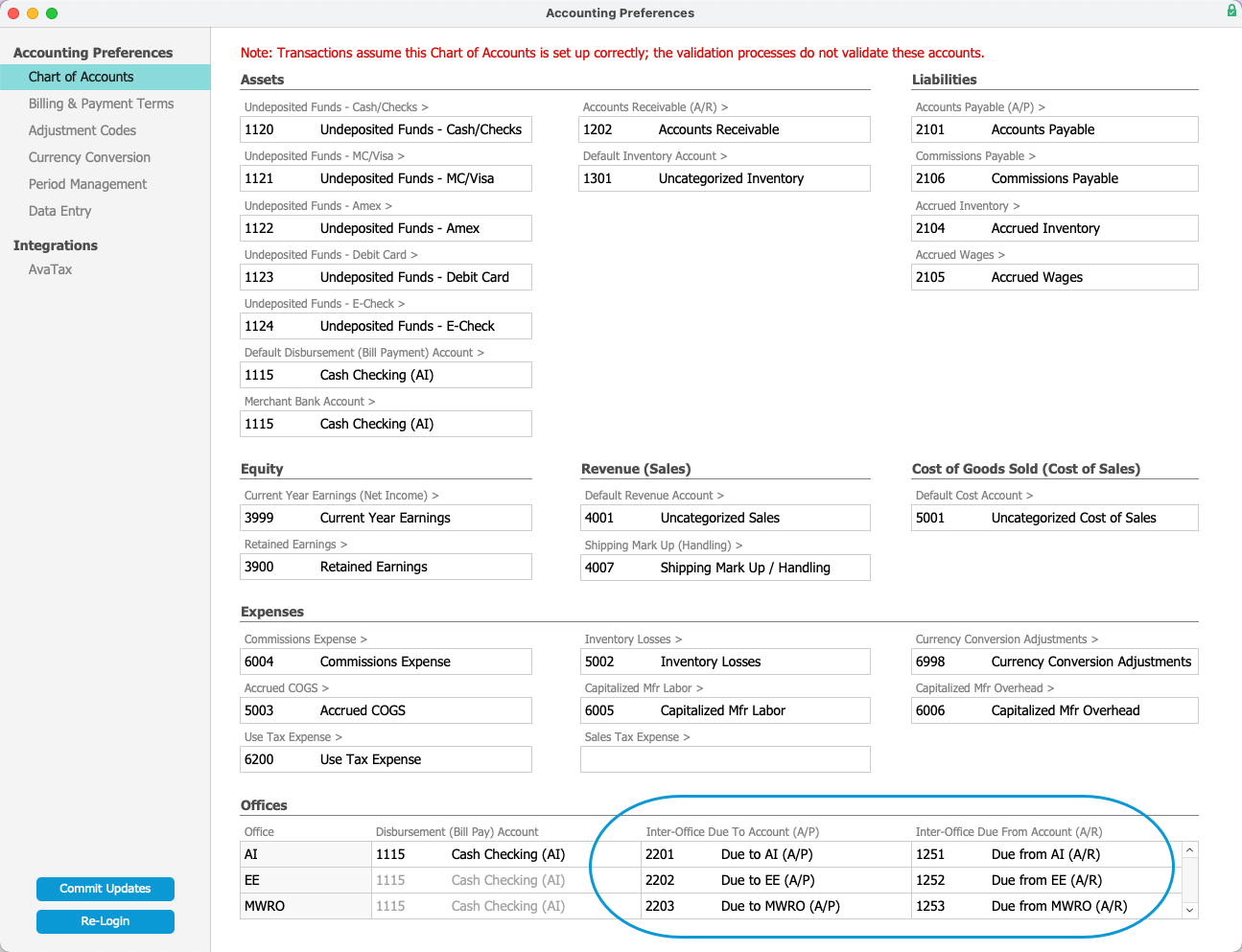

- Navigate from Main Menu > Accounting > Preferences > Chart of Accounts.

- In the Offices section, specify the inter-office A/P and A/R accounts for each office.

Note: As the screenshot above shows, the line for an office should include the due-to and due-from accounts for that office. aACE will apply those accounts appropriately as they are used by other offices. - Click Commit Updates.

Examples of Inter-Office Transactions

After you organize these accounts, aACE will track receivable and payable balances between your offices. It will automatically create an A/R balance for the office that purchased the inventory and an A/P balance for the office that used the inventory.

For example, if two offices are paying part of a purchase (e.g. rent for a shared space), you can specify each Dept field on the Purchase record. In the General Ledger, the office that originates the purchase gets the Accounts Payable balance for the overall purchase. aACE also automatically creates a receivable balance for the part of the purchase due from the second office, plus a liability on the second office's accounts for what they owe to the originating office.

As an example with receivable transactions, when one office sells a line item code which another office should receive the proceeds for (e.g. the inventory belongs to one entity, even though other entities can add it on orders), aACE creates an A/R balance for the office that should receive the sale and an A/P balance for the office that handled the sale.

Bank Accounts

For each office, you can specify a default bank account for disbursements. Navigate to the Chart of Accounts and, in the Offices section, click the field for 'Disbursement (Bill Pay) Account', then select from the list of options. (Note: After you manually assign an account in this field, it will not be affected by changes to the Default Disbursement account in the Assets section.)

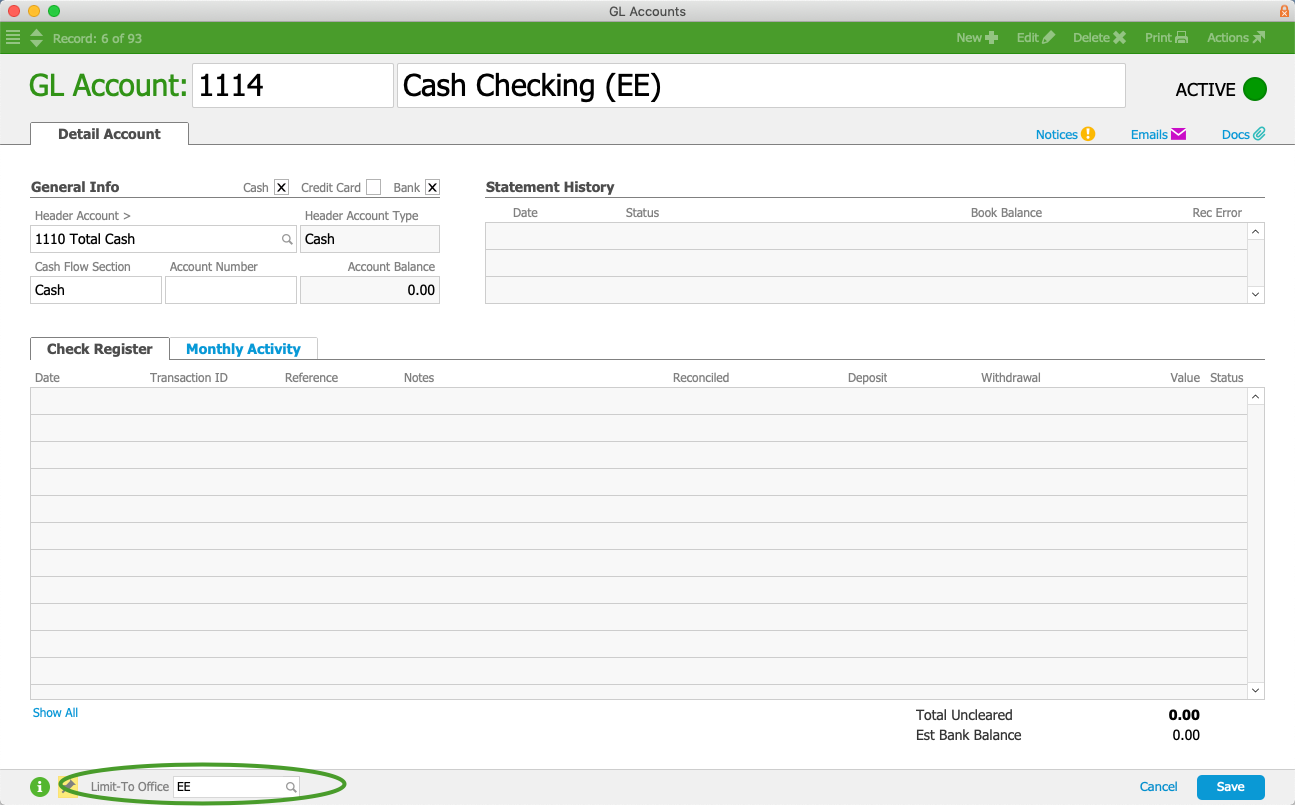

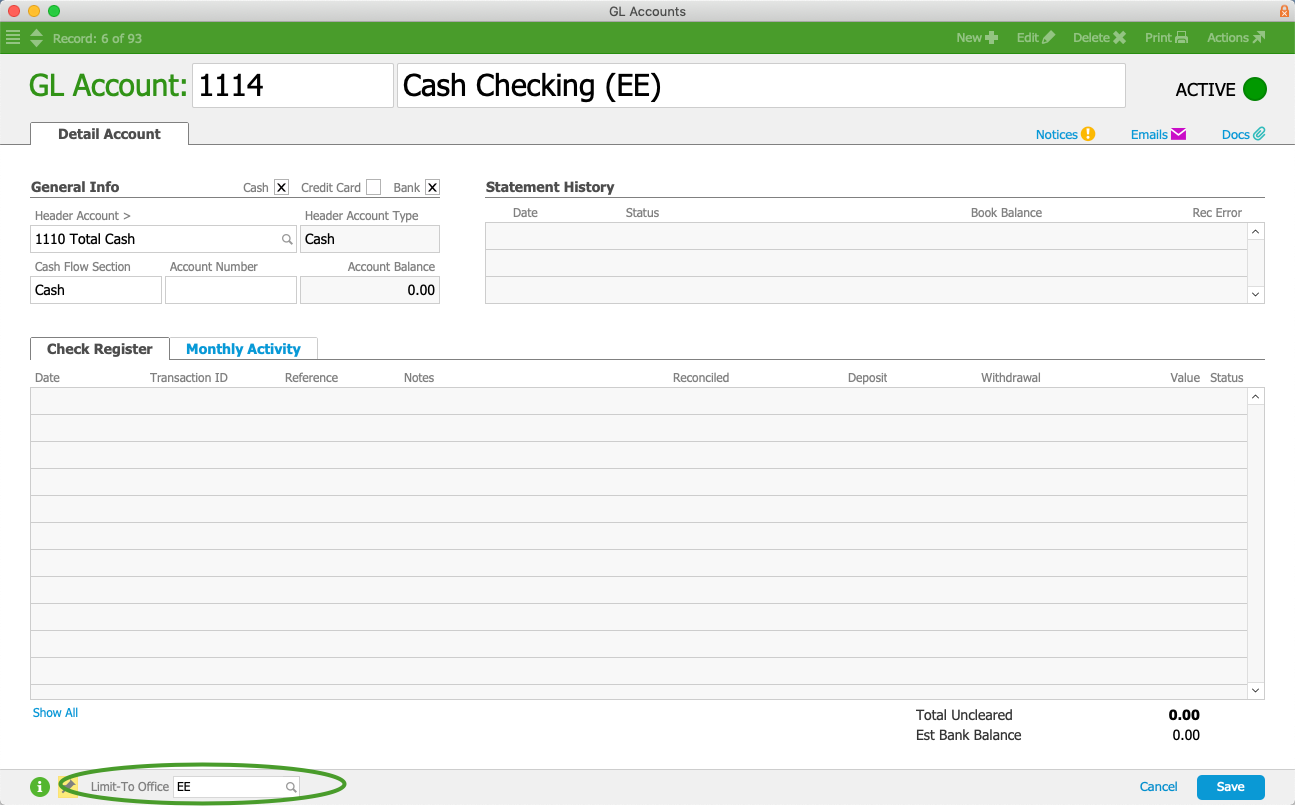

For organizations with separate legal entities, you can help avoid reconciliation problems by constraining bank accounts to a single office (e.g. Bank of America 1107):

- Navigate to the GL Accounts module and locate the desired account.

- At the detail view, click Edit.

- In the module footer, click the Limit-To Office field and select the appropriate office.

- Click Save.

Another oversight feature is the 'Prevent multi-office cash transactions' option. When you mark this flag, aACE checks to ensure cash separation between multiple legal entities, constraining receipts disbursements to be assigned only to bank accounts that are linked to the office creating the receipt or disbursement. Set this option at Accounting > Preferences > Data Entry > Multi-Office Preferences:

Financial Printouts

You can generate various financial reports, either for a single office or for all offices. At the GL Accounts module, click the Print ( ) icon, then select the desired report.

) icon, then select the desired report.

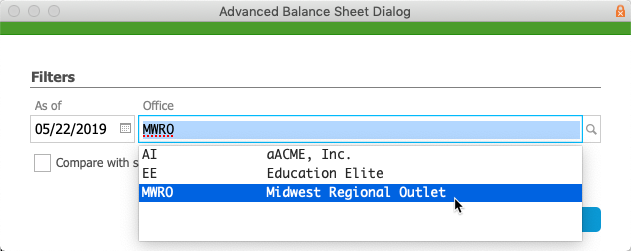

For example, to print a balance sheet for a single office, select Advanced Balance Sheet, specify the desired office, and click Print. In contrast, to print a balance sheet for all offices, leave the Office field blank for this report.