This guide defines customer credits and explains how to create a standalone credit memo. It is intended for intermediate users.

A 'customer credit' in aACE is any invoice with a negative balance. A credit might occur because of a return, an overpayment, an order cancellation, etc. The customer can apply the credit as a payment against other open invoices or they can request that it be refunded.

You can generate a customer credit in various ways:

- Create an adjustment invoice (e.g. for returned product)

- Process an overpayment

- Create a standalone credit memo (see below)

Issuing a Standalone Credit Memo

A standalone credit memo is not linked to any other transaction. It is a negative invoice created as a direct incentive for a specific customer.

Suppose that a long-time customer heard of a promotion you were offering, but they hadn't been able to participate in. When they asked about the deal, your team agreed that it was appropriate to reward them for their loyalty.

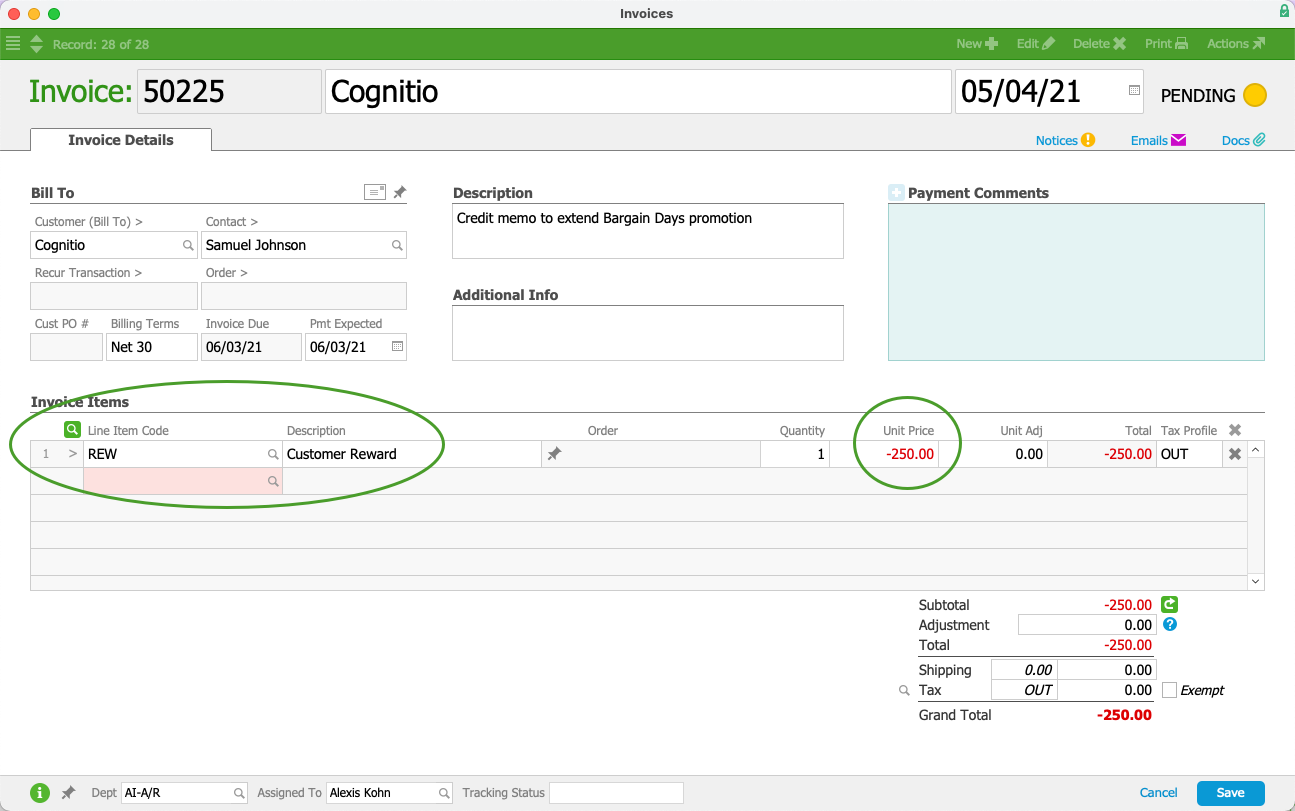

The A/R rep would go to the Invoices module and create a new invoice. She would specify the customer, note the reason for the credit, and use the appropriate line item code to enter the credit amount as a negative number:

She saves and opens the invoice. When she prints the invoice to send a copy to the customer, the negative Grand Total prompts aACE to display the record as a credit memo:

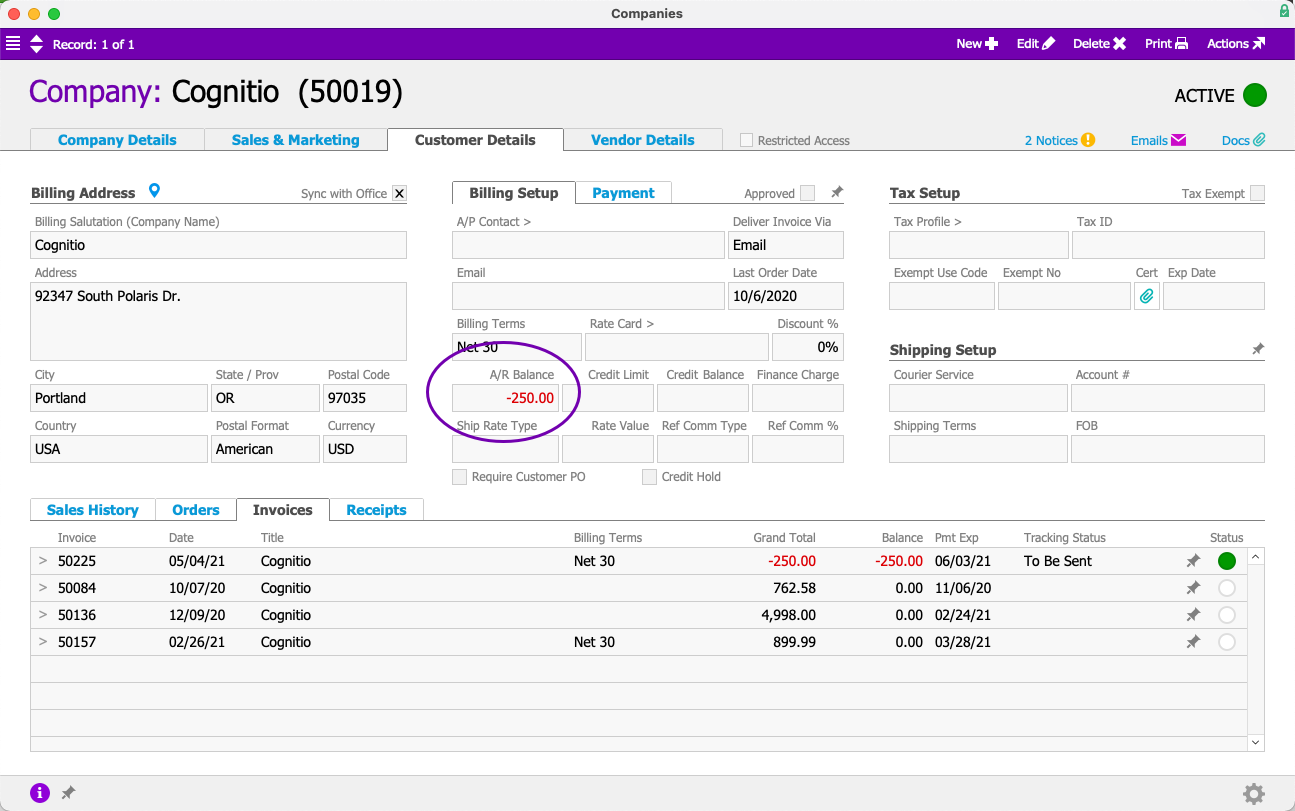

The reward credit also shows up as an A/R Balance on the customer's company record. This can help your sales staff to remind customers when they have a credit to apply on subsequent orders.

Credit Memos Isolated vs Integrated

Some business software solutions isolate credit memos from other invoices. However, we've found that presenting credits alongside other invoices and in aging reports produces better results. This integrated view gives a more complete picture to aid with decision-making. We also believe that a customer's A/R balance should tie out with the balance of their open invoices. For these reasons, aACE does not feature a separate module for credit memos.