This guide explains what the aACE COGS process does and how you can use it. It is intended for advanced users.

Note: This explanation of the cost of goods sold (COGS) process assumes that you understand the relationships between aACE inventory lot, usage, and transaction records.

The COGS process allocates inventory usage records to inventory lot records using the applicable actual cost method (e.g. FIFO, LIFO, or specific-unit logic). This enables aACE to determine the true cost of goods and to create the necessary COGS GL entries. The COGS reconciliation process requires that your aACE system is set up for inventory tracking.

COGS Process Walk-thru

Using a sample inventory product, we'll trace the three aspects of the COGS process:

- Inventory Lots

- Inventory Usage

- COGS Entries

Inventory Lots

aACE generates inventory lot records whenever inventoried LICs are procured or produced.

For this example, the Inventory Lots module shows that we have received a partial shipment of ten textbooks into current inventory. There are 90 more still on order. Each textbook is valued at $29.99. The Inventory COGS section at the bottom displays no entries.

Inventory Usage

aACE generates inventory usage records whenever inventoried items are part of out-going shipments.

Continuing our example, suppose a sales order for ten textbooks is shipped. This creates the following inventory usage record, showing that ten units have been used, but none of them have been allocated. The Inventory COGS section at the bottom displays no entries.

COGS Entries

The COGS reconciliation process allocates inventory usage records to inventory lot records in order to calculate the actual cost.

When the COGS process runs, it updates the inventory usage record so the ten used units now show as allocated. The Inventory COGS section now displays the relevant inventory lot and purchase order.

The COGS process also updates the inventory lot record. Current inventory has been depleted and the units are now noted as used. The Inventory COGS section now links to the relevant inventory usage and out-going shipment.

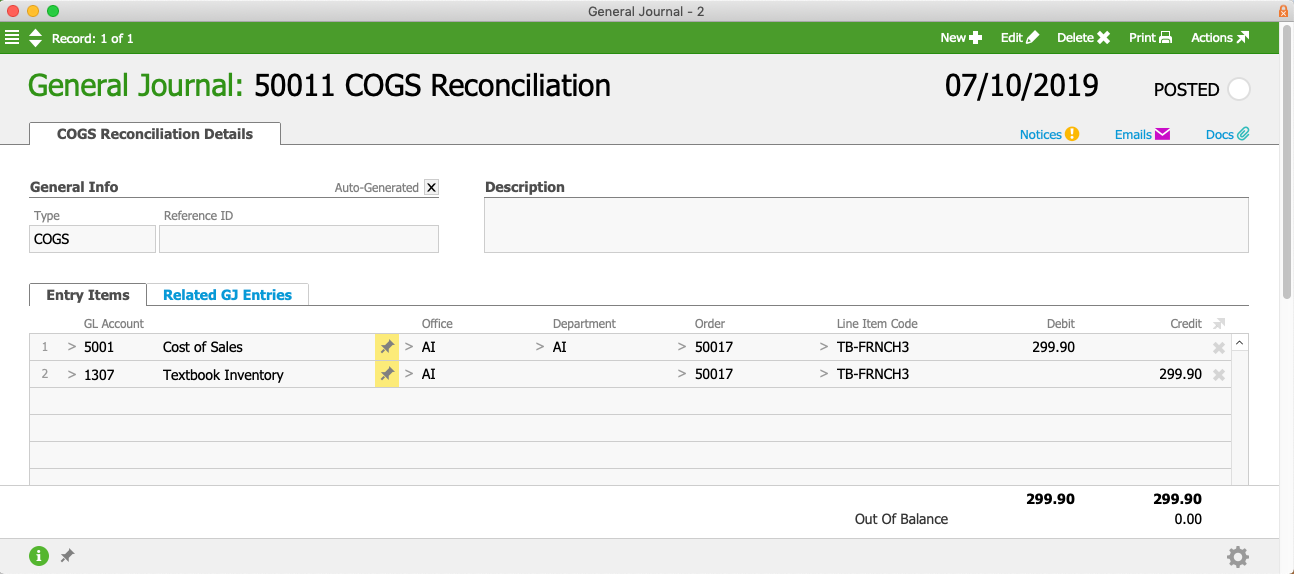

The COGS reconciliation process also makes entries in the General Journal, removing ten textbooks from inventory and expensing them to the GL account Cost of Sales:

Running the COGS Process

The COGS reconciliation process typically runs as part of the Generate COGS Reconciliation automation schedule, but it can also be run manually.

COGS Process Automation

System administrators can set up your system to run the COGS process automatically (Menu > System Admin > Preferences > Automation Schedules). There are two schedules titled Generate COGS Reconciliation. By default, one schedule runs every Sunday evening, while the other runs on the last night of every month. These automated entries always use the current date for the resulting General Journal entries.

If you customize the timing of these schedules, be aware that they can take a long time to complete. We recommend running them after work hours in order to avoid interfering with users' daily workflows.

Manually Running the COGS Process

If you execute this process manually, remember to also run the Generate Accrued COGS Reconciliation (available in the same GJ Actions list). If you run the COGS Reconciliation process without running the Accrued COGS Reconciliation process, your financials may become skewed by the sales and costs from unallocated inventory usage being accounted for in different periods. Conversely, if you run the Accrued COGS Reconciliation process without running the COGS Reconciliation process first, it may create accrued COGS entries for inventory usage records that could be allocated during the COGS reconciliation process.

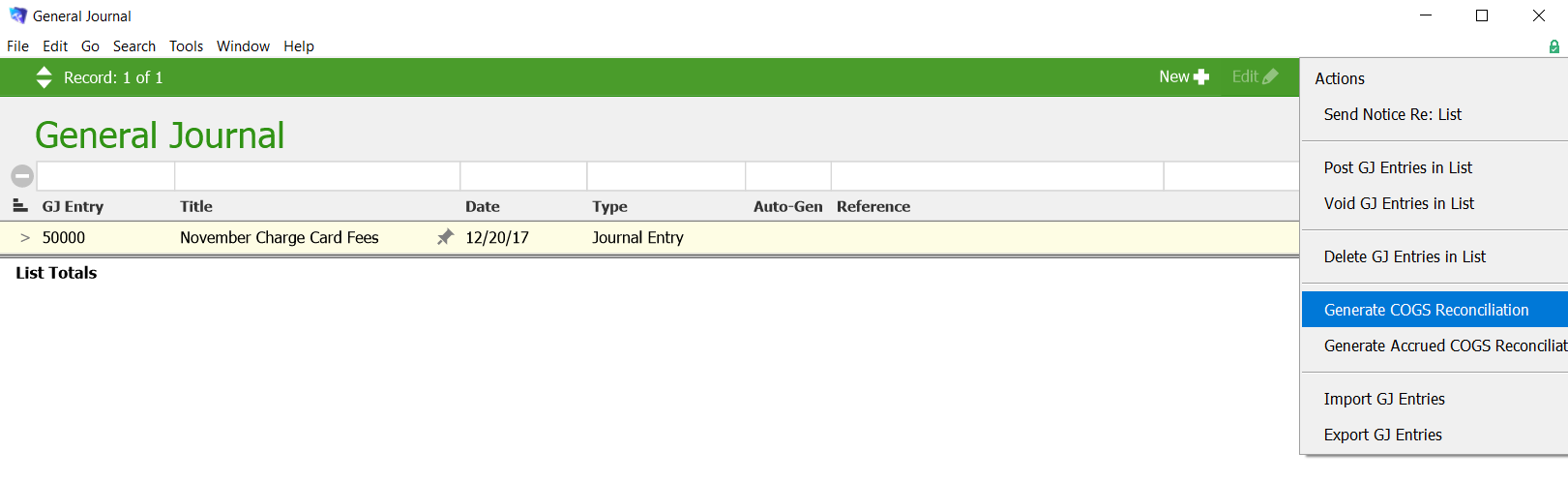

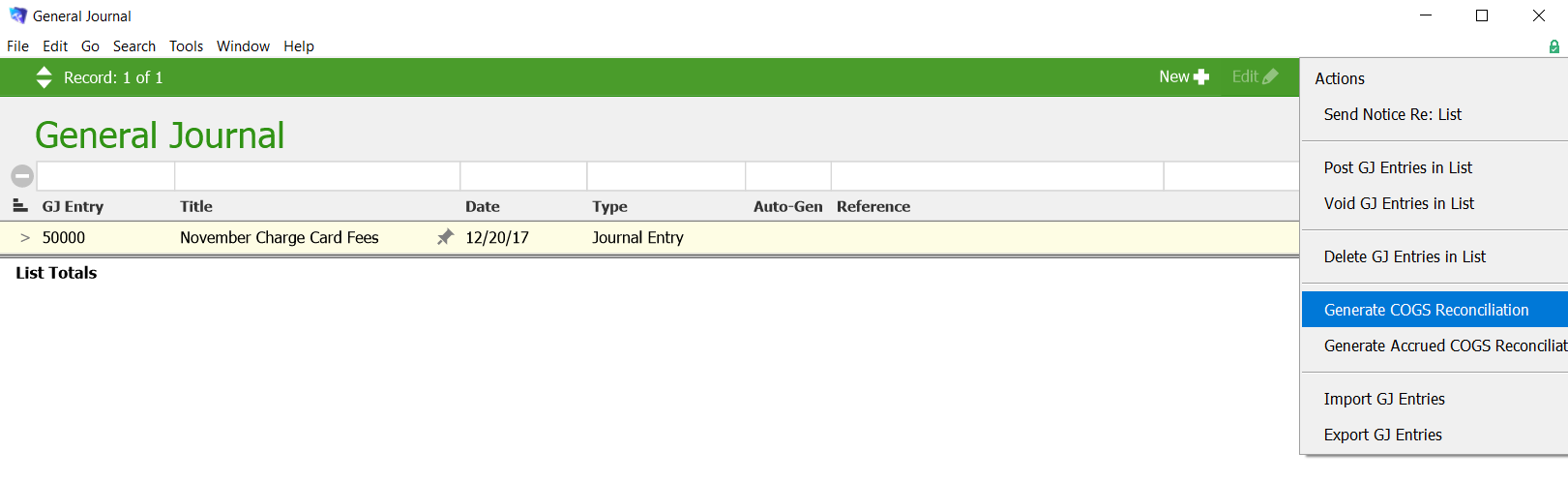

- Navigate from Main Menu > Accounting > General Journal.

- At the list view, click Actions > Generate COGS Reconciliation.

- If applicable, enter the Limit-To Date (see below for important details), then click Yes.

Limit-To Date

The Limit-To Date allows you to backdate a COGS reconciliation:

- Limit-To Date used — The process uses the specified date for the General Journal entry. It considers all inventory lot and inventory usage records dated on or before that date.

Note: Including a Limit-To Date lengthens the processing time significantly and can tie up your machine for systems with larger data sets. We recommend starting the process at the end of the day when you leave your desk. - Limit-To Date blank — The process uses the current date for the General Journal entry. It considers only inventory lot and inventory usage records that are new or have been changed since the last time the process was run.

Note: Running the process without a Limit-To Date runs much faster, but on large data sets it may still slow down your machine.