This guide explains how to handle refunds for credit card purchases from your vendors. It is intended for intermediate users.

When you return items to a vendor, receiving refunds for purchases made with credit cards (CC) must be handled different from other purchases. CC transactions with vendors are accounted for in aACE as disbursements. When you return items that were purchased on a credit card, the refund should usually be handled by creating a new, negative disbursement. If you try to handle the refund using a credit card receipt, it will instead activate integrated credit card purchasing. (For purchases made with cash or check, refunds should be handled by creating refund records.)

Be sure to follow your company's policies for returns and refunds, as well as the vendor's policies.

Note: If the refund is for a customer payment made with a credit card, the process requires different steps.

Refund a CC Disbursement with a Negative Disbursement

- Navigate from Menu > Accts Payable > Purchases and locate the desired purchase record.

Note: It may be helpful to use Advanced Search at the Disbursements module list view, searching for "Credit Card" in the Payment Method field, then locating the related purchase record. - At the purchase record's Disbursements tab, click the Plus button (

).

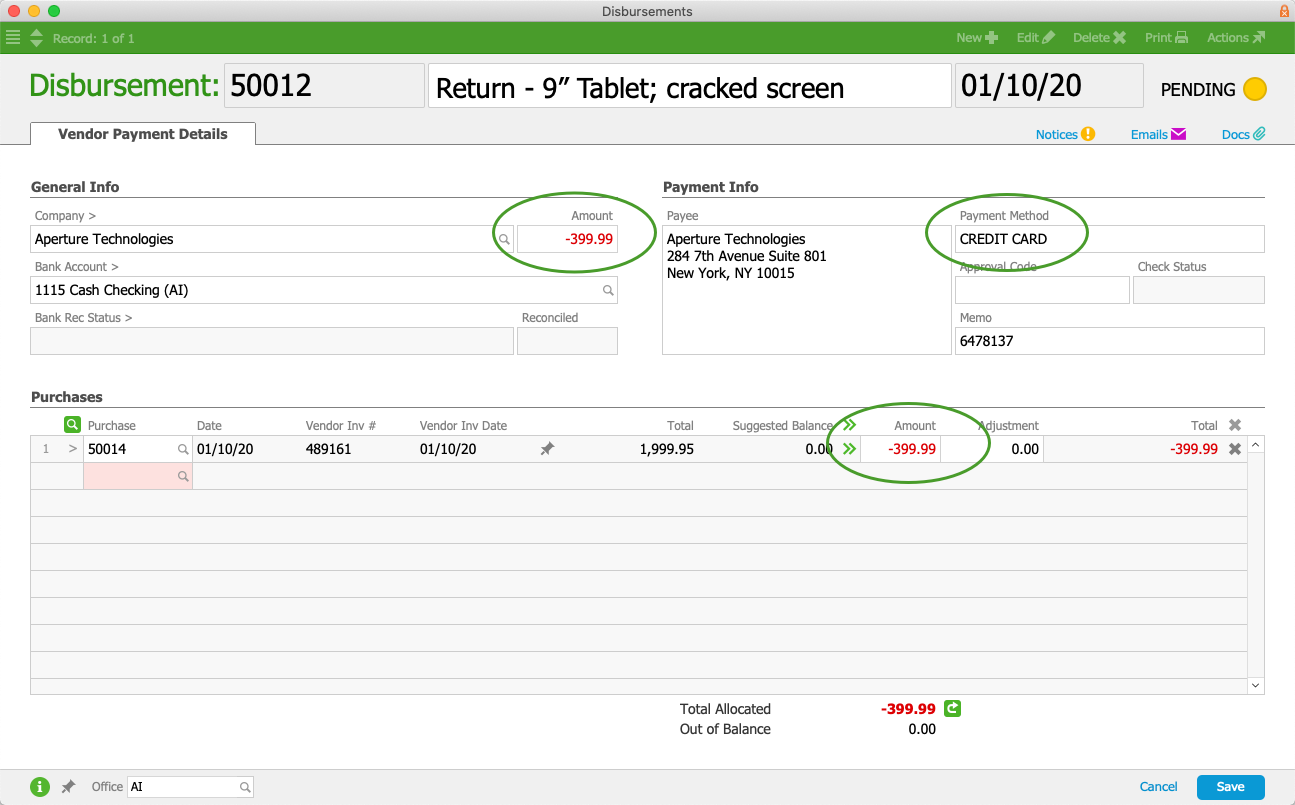

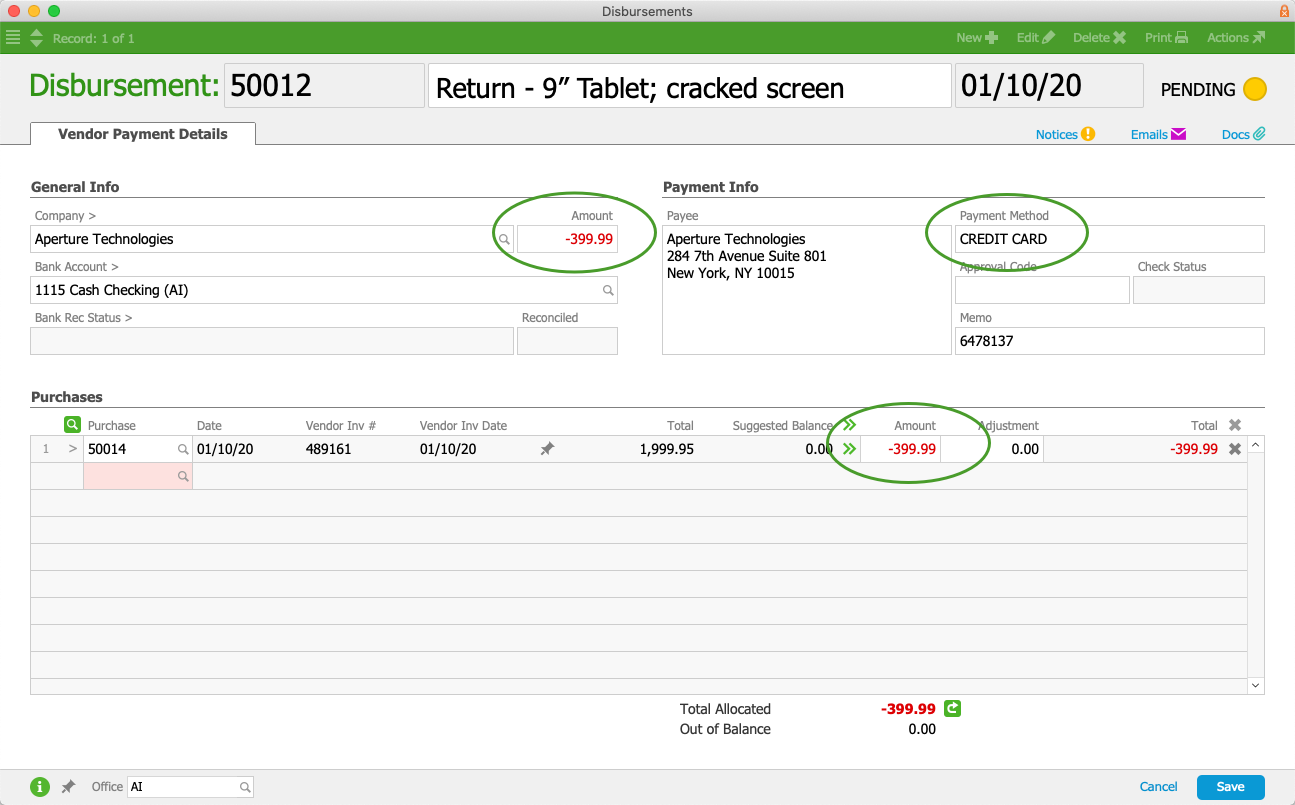

). - Enter a record title that explains the refund and specify the ˜Payment Method" as Credit Card.

- Enter the amount of the refund as a negative number in both the General Info section Amount field and the Purchases list Amount field.

- Click Save and Post.

When you post the refund, it will put a balance back on the purchase and re-open the record. You will need to adjust the purchase so it accounts for the change from the refund. This is typically handled by reversing the necessary purchase details with a credit adjustment.

).

).